Reasons to Retain Stryker (SYK) Stock in Your Portfolio Now

Stryker Corporation SYK is well poised for growth, backed by a robust robotic arm-assisted surgery platform, Mako, and a diversified product portfolio. Meanwhile, an improvement in price also buoys optimism.

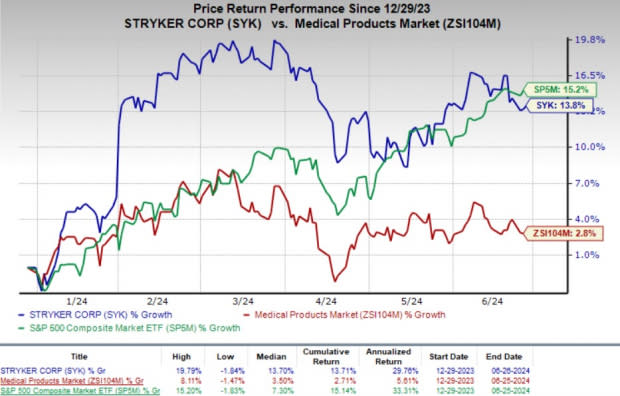

Shares of this Zacks Rank #3 (Hold) company have risen 13.8% year to date compared with the industry’s 2.8% growth. The S&P 500 Index has increased 15.2% in the same time frame.

Stryker, with a market capitalization of $129.4 billion, is one of the world’s largest medical device companies operating in the orthopedic market. It anticipates earnings to improve 10.6% in the next five years. SYK’s earnings yield of 3.5% compares favorably with the industry’s (0.3%).

Image Source: Zacks Investment Research

What’s Favoring Stryker’s Growth?

The company continues to witness strong performance across its segments in the United States. Strong International sales also buoy optimism. The momentum continued on the back of ongoing procedural recovery, a strong order book for capital equipment and an improvement in price last year. These positive trends are likely to continue in the rest of 2024 as well.

SYK is committed to the continued expansion of Mako, with launches in new countries. It remains confident about robust growth in Mako revenues in 2024, on the back of continued adoption, new launches and software upgrades.

The first-quarter results reflect Stryker’s efforts to promote the advanced surgery platform.

SYK also boasts a diversified product portfolio. Its wide range of products protects it against any significant sales shortfall during economic turmoil.

The company’s significant exposure to robotics and artificial intelligence for healthcare and Medical Mechatronics has helped it stay ahead of the curve in the MedTech space. Its portfolio includes Mako, as well as products for hip and knee surgeries.

Per management, Stryker’s constant support for customers and focus on innovation poise it for growth as the effect of the pandemic subsides. In the first quarter of 2024, the company’s adjusted research and development expenses were 7% of net sales, highlighting its strong commitment to innovation. Per management, this is likely to drive new product launches.

Earlier this month, Stryker announced the launch of its latest device in the market, offering advanced technology, the LIFEPAK 35 monitor/defibrillator. The device is likely to enable more efficient workflow and provide advanced clinical solutions to emergency responders and healthcare professionals. The company also launched the Gamma4 Hip Fracture Nailing System in Germany on Jun 4.

Apart from organic growth, Stryker is also supporting its growth through acquisitions. In June, the company entered into a definitive agreement to acquire Artelon, a privately held company that specializes in innovative soft tissue fixation products for foot and ankle and sports medicine procedures.

Moreover, Stryker is adopting several cost-cutting measures, including restructuring plans. The company’s prospects in 2024 seem promising on the back of strong customer demand for its existing products as well as new launches. The adjusted selling, general and administrative expenses during the first quarter of 2024 were 35% of net sales, contracting approximately 60 basis points year over year.

What’s Hurting the Stock?

An unfavorable currency rate fluctuation poses a persistent threat to SYK’s core businesses. Foreign currency had a 0.5% unfavorable impact on sales during the first quarter of 2024. The trend is likely to continue for the rest of 2024, though, at a slower pace. The company is also facing inflationary pressure, leading to lower margins.

Estimate Trend

The Zacks Consensus Estimate for 2024 earnings per share is pegged at $11.95, indicating year-over-year growth of 12.7%. In the past 60 days, the bottom-line estimate for 2024 has improved 0.8%. The consensus mark for revenues is pinned at $22.31 billion, implying an 8.9% improvement year over year.

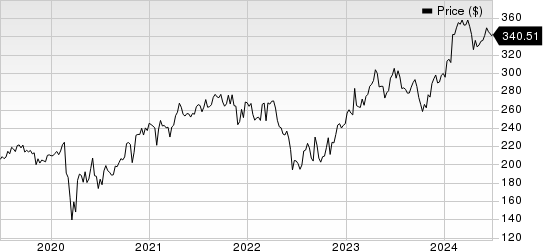

Stryker Corporation Price

Stryker Corporation price | Stryker Corporation Quote

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, ResMed RMD and Hologic HOLX.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 13.6%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 29.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita’s shares have risen 36.4% compared with the industry’s 9.3% growth year to date.

ResMed, carrying a Zacks Rank of 2 at present, has an estimated earnings growth rate of 13.2% for 2024. Its earnings surpassed estimates in three of the trailing four quarters and missed the same in one, delivering an average surprise of 2.81%.

RMD’s shares have risen 6.9% year to date compared with the industry’s 2.8% growth.

Hologic, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 7.4%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 4.94%.

Hologic’s shares have risen 0.3% year to date compared with the industry’s 4.7% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance