Reasons to Retain PacBio (PACB) Stock in Your Portfolio

Pacific Biosciences of California, Inc. PACB, popularly known as PacBio, has been gaining from its continued focus on research and development. The optimism, led by a decent first-quarter 2024 performance and its product development activities, is expected to contribute further. However, stiff competition and macroeconomic concerns persist.

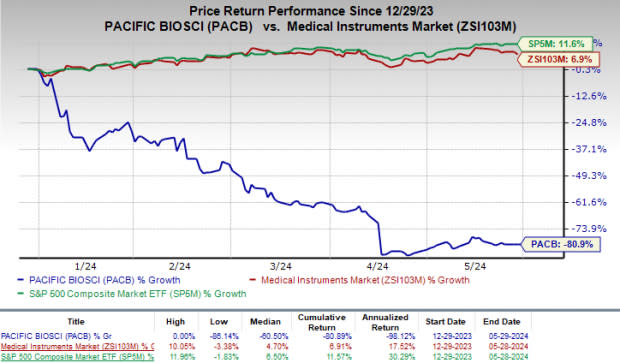

In the year-to-date period, this Zacks Rank #3 (Hold) stock has lost 80.9% against 6.9% growth of the industry. The S&P 500 Composite also gained 11.6% in the same time frame.

The renowned global provider of sequencing systems has a market capitalization of $509 million. The company projects 18% growth for 2024 and expects to maintain a strong performance in the future. PacBio’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters, with third-quarter earnings being in line, delivering an average surprise of 11.6%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Focus on R&D: We are optimistic about PacBio’s continued R&D efforts that focus on programs to develop new and existing platforms, as well as increasing throughput and decreasing costs on behalf of its customers.

PacBio is working toward improving commercial execution to drive the adoption of both the Revio and Onso platforms. With respect to Onso, in the first quarter, PacBio scaled the manufacturing of the platform, enabling it to deliver instruments based on demand much more rapidly, which aided in its ability to sell the system.

Per management, PACB is also developing a high-throughput short-read platform that is expected to enable the company to serve high-throughput labs with PACB’s leading Sequencing by Binding technology. The company believes that it will be highly competitive in terms of both throughput and cost relative to other high-throughput offerings. Per the management, the addressable market for this platform is estimated to be more than $1 billion per year.

PacBio also continues to develop its next-generation SMRT cell. This cell is expected to power a new, extremely high-throughput long-read platform, enabling throughput dramatically higher than that of the Revio system.

Product Development Activities: We are optimistic about PacBio's solid potential in the RNA-sequencing market, which has been fortifying the company’s footprint worldwide. PacBio recently announced the PureTarget repeat expansion panel, a new approach that makes it possible to thoroughly examine 20 genes linked to severe neurological conditions, including difficult-to-sequence genes with tandem repeat expansions, is now possible.

In February, the company announced two new high throughput library preparation kits and workflows, namely, HiFi Prep Kit 96 and HiFi Plex Prep Kit 96, optimized for its Revio sequencing system.

In January, the company announced PanDNA, a versatile Nanobind DNA extraction kit. With the addition of this new offering, the range of sample types appropriate for long-read sequencing is now greater and includes bacteria, cells, tissue, blood, plant nuclei, and insects.

Decent Q1 Results: PacBio exited the first quarter of 2024 with decent results where earnings aligned with the Zacks Consensus Estimate and revenues beating the same.

PACB saw an uptick in Product as well as Consumables revenues. Strong geographical performances in the Asia-Pacific region and EMEA were also encouraging. The expansion of adjusted gross margin also raises optimism. Continued strong prospects in the Revio system, with customers placing orders, looked promising for the stock.

Downsides

Macroeconomic Concerns: Macroeconomic dynamics, including rising inflation and global supply-chain constraints, have negatively impacted PacBio’s customers and lengthened customer sales cycles. These factors could affect its revenues and operations throughout 2024.

Stiff Competition: PacBio competes in a very competitive market with companies that provide supplies or equipment for nucleic acid sequencing. Since many of these businesses now possess more resources than PacBio, they could be able to react to new or evolving opportunities, standards, technologies, or consumer requirements more swiftly and successfully.

Estimate Trend

PacBio has been witnessing a positive estimate revision trend for 2024. Over the past 60 days, the Zacks Consensus Estimate for its adjusted loss per share has narrowed from $1.01 to 91 cents.

The Zacks Consensus Estimate for the company’s fiscal 2024 revenues is pegged at $176.3 million, indicating a 12.1% decrease from the year-ago reported number.

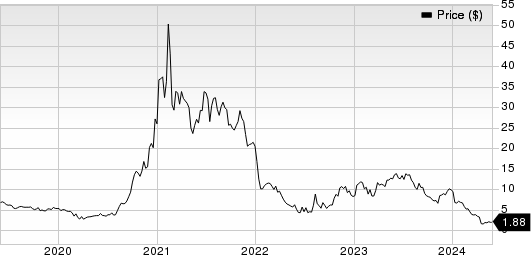

Pacific Biosciences of California, Inc. Price

Pacific Biosciences of California, Inc. price | Pacific Biosciences of California, Inc. Quote

Key Picks

Some better-ranked stocks in the broader medical space that have announced quarterly results are Align Technology, Inc. ALGN, Ecolab ECL and Boston Scientific Corporation BSX.

Align Technology, carrying a Zacks Rank of 2 (Buy), reported first-quarter 2024 adjusted earnings per share (EPS) of $2.14, beating the Zacks Consensus Estimate by 8.1%. Revenues of $997.4 million outpaced the consensus mark by 2.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Align Technology has a long-term estimated growth rate of 6.9%. ALGN’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, the average surprise being 5.9%.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 1.7%.

Ecolab’s shares have rallied 33.8% against the industry’s 9.3% decline in the past year.

Boston Scientific reported first-quarter 2024 adjusted EPS of 56 cents, beating the Zacks Consensus Estimate by 9.8%. Revenues of $3.86 billion surpassed the Zacks Consensus Estimate by 4.9%. It currently carries a Zacks Rank #2.

Boston Scientific has a long-term estimated growth rate of 12.5%. BSX’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 7.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Pacific Biosciences of California, Inc. (PACB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance