Reasons to Retain FLEETCOR (FLT) Stock in Your Portfolio

FLEETCOR Technologies, Inc. FLT is currently benefiting from strong organic growth and strategic acquisitions.

The company has an expected long-term (three to five years) earnings per share growth rate of 16.3%. Its earnings are expected to register growth of 20.8% in 2022 and 7.4% in 2023.

Factors That Bode Well

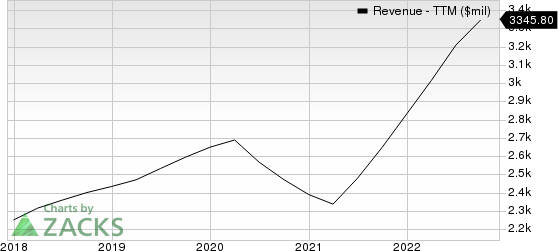

FLEETCOR’s top line continues to grow organically, driven by continued strong sales, robust retention levels and healthy same-store sales. The company’s organic revenue growth was 13% in the third quarter of 2022.

FleetCor Technologies, Inc. Revenue (TTM)

FleetCor Technologies, Inc. revenue-ttm | FleetCor Technologies, Inc. Quote

Acquisitions have helped the company to expand its customer base, headcount and operations over time. The recent acquisition of Plugsurfing is expected to helpFLEETCOR to expand into new customer segments with original equipment manufacturers and charge point operators. The acquisition of Accrualify is expected to strengthen the company’s portfolio of payment solutions and its corporate payments platform capabilities.

FLEETCOR has a track record of returning value through share repurchases. In 2021, 2020 and 2019, it repurchased shares worth $1.4 billion, $849.9 million and $694.9 million, respectively.

Some Risks

FLEETCOR’s current ratio (a measure of liquidity) at the end of third-quarter 2022 was pegged at 0.99, lower than the 1.06 reported in the prior quarter. A decline in the current ratio is not a favorable development. Moreover, a current ratio of less than 1 is not desirable as it implies that the company doesn't have enough liquid assets to cover its short-term liabilities.

Zacks Rank and Stocks to Consider

FLEETCOR currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are Booz Allen Hamilton Holding Corporation BAH and Cross Country Healthcare, Inc. CCRN.

Booz Allencarries a Zacks Rank #2 (Buy) at present. BAH has a long-term earnings growth expectation of 8.9%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Booz Allen delivered a trailing four-quarter earnings surprise of 8.8% on average.

Cross Country Healthcare is currently a Zacks #2 Ranked stock. CCRN has a long-term earnings growth expectation of 6%.

CCRN delivered a trailing four-quarter earnings surprise of 10.1% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FleetCor Technologies, Inc. (FLT) : Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report

Cross Country Healthcare, Inc. (CCRN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance