Reasons to Retain The Cooper Companies (COO) in Your Portfolio Now

The Cooper Companies, Inc. COO is well-poised for growth, backed by strong prospects in its CooperVision (CVI) and CooperSurgical (CSI) business segments. Acquisitions boost the company’s portfolio and buoy optimism. However, unfavorable currency movements and rising costs continue to hurt revenues and margins, respectively.

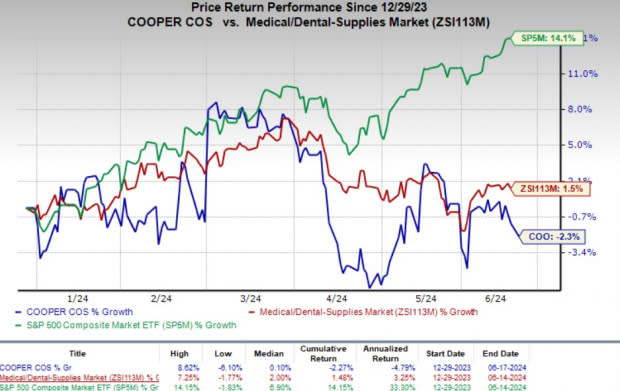

Shares of this Zacks Rank #3 (Hold) company have lost 2.3% year to date against the industry's 1.5% growth. The S&P 500 Index has gained 14.1% in the same time frame.

The Cooper Companies, with a market capitalization of $18.61 billion, is a global specialty medical device company.

The company’s bottom line is estimated to improve 11.3% over the next five years. Its earnings beat estimates in two of the trailing four quarters and met the mark in the other two, delivering an average surprise of 2.50%.

Image Source: Zacks Investment Research

What's Driving COO’s Performance?

The Cooper Companies has been leading the specialty lenses market, owing to innovative product portfolios, market-leading flexibility and strength in key accounts. Its flagship silicone hydrogel lenses, including MyDay and clarity, are expected to drive strong sales in the upcoming quarters. Moreover, its silicone hydrogel FRP lenses, Biofinity and Avaira, should boost top-line growth.

In the second quarter, the company continued to witness substantial growth across CVI’s Toric, Multifocal and single-use sphere subunits. It also experienced an organic improvement in sales on a geographical basis, with EMEA, the Americas and the Asia-Pacific markets exhibiting strength. Moreover, the robust performance of COO’s myopia management portfolio, primarily driven by strong demand for MiSight, is also encouraging.

The CVI segment displayed solid performance in the same period, with its revenues rising 10% at a constant exchange rate to $635.9 million. Per management, strong demand for silicone hydrogel lenses contributed to the segmental uptick.

CVI revenues are likely to be in the $2.591-$2.613 billion range (organic growth of 8.5-9.5%) in fiscal 2024.

The Cooper Companies is also well-positioned to benefit from the expanding CSI product portfolio. In the fiscal second quarter, CSI witnessed constant-currency revenue growth in two focus areas, which were fertility and office, and surgical products.

Revenues from fertility increased 2% year over year to $123.8 million, indicating sustained solid performance. Sales of office and surgical products improved 12% to $182.9 million.

For fiscal 2024, CSI revenues are expected to be in the $1.272-$1.293 billion range, implying organic growth of 5-7%.

What's Weighing on the Stock?

The Cooper Companies generates a significant portion of its revenues in foreign currencies. Fluctuations in foreign exchange rates may significantly affect its overseas revenues.

Moreover, an increase in the cost of sales and selling, general and administrative expenses is concerning. The contraction in the operating margin during the first quarter is disappointing.

Estimates Trend

The Zacks Consensus Estimate for the company's fiscal 2024 revenues is pegged at $3.88 billion, implying growth of 8% from the 2023 reported figure. The same for adjusted earnings per share is pinned at $3.56, indicating an improvement of 11.3% from the previous year’s recorded level.

In the past 30 days, COO’s earnings estimates for fiscal 2024 have improved 1.7% to $3.56 per share.

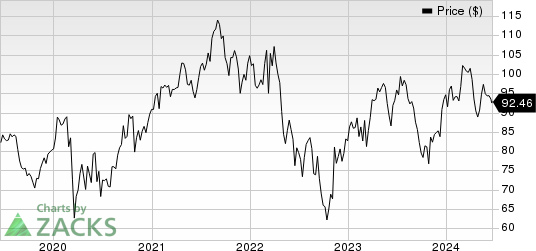

The Cooper Companies, Inc. Price

The Cooper Companies, Inc. price | The Cooper Companies, Inc. Quote

Stocks to Consider

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Boston Scientific BSX and Hologic HOLX.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 13.6%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 29.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita’s shares have risen 34.7% compared with the industry’s 7.9% growth year to date.

Boston Scientific, carrying a Zacks Rank of 2 at present, has an estimated earnings growth rate of 12.5% in 2024. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 7.49%.

BSX’s shares have risen 32.8% year to date compared with the industry’s 3.1% growth.

Hologic, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 7.4%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 4.94%.

Hologic’s shares have risen 0.5% year to date compared with the industry’s 6.2% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

The Cooper Companies, Inc. (COO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance