Reasons to Add FirstEnergy (FE) to Your Portfolio Right Now

FirstEnergy Corporation’s FE continuous capital investments to maintain and increase resiliency enhance its performance. The modernization of the grid will help withstand severe weather conditions and ensure a constant supply of electricity even during challenging conditions.

The company currently carries a Zacks Rank #2 (Buy). Let’s look at the factors that are driving the stock.

Growth Projections

The Zacks Consensus Estimate for FE’s 2024 and 2025 earnings has increased 0.75% and 0.35%, respectively, in the last 60 days.

The company’s long-term (three to five years) earnings growth is pinned at 5.87%.

Surprise History & Dividend Details

FirstEnergy has a positive earnings surprise history. Its trailing four-quarter earnings surprise is 3.2%, on average.

The company’s board of directors approved a new dividend policy that increased the target payout ratio to 60-70% from 55-65% previously. Its current dividend yield is 4.4%, better than the industry average yield of 3.7%.

Return on Equity & Return on Asset

FirstEnergy’s current return on equity (ROE) is pinned at 12.5%, which is more than the industry average of 9.7%. ROE, a profitable measure, reflects how effectively a company is utilizing its shareholders’ funds in its operations to generate income.

FE’s current return on assets (ROA) is pinned at 3%, which is more than the industry average of 2.6%. ROA, another profitable measure, reflects how effectively a company is utilizing its assets in its operations to generate income.

Investments

FirstEnergy’s strategic investment will help serve its 6 million customers more efficiently. The company’s "Energize365" is a multi-year grid evolution platform that is focused on enhancing the customer experience while maintaining affordability.

With planned investments of $26 billion between 2024 and 2028, FE plans to install advanced equipment and technologies that will strengthen and modernize its transmission and distribution infrastructure. It also expects investments worth $4.3 billion in 2024. Strengthening the transmission and renewable generation assets will allow it to transmit electricity even during adverse weather conditions.

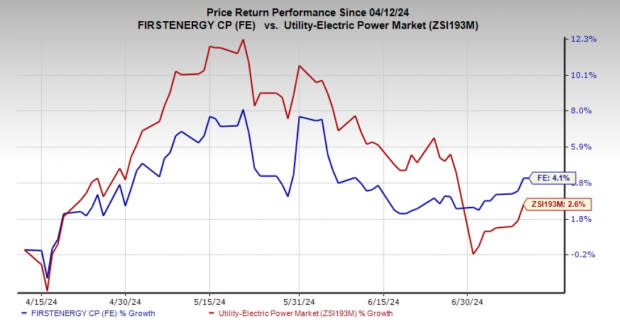

Price Performance

Shares of FirstEnergy have gained 4.1% in the past three months compared with the industry’s 2.6% growth.

Image Source: Zacks Investment Research

Other Stocks to Consider

Other top-ranked stocks in the industry are Consolidated Edison, Inc. ED, CenterPoint Energy CNP, and Fortis Inc. FTS. Each of these stocks currently carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Consolidated Edison has delivered an average earnings surprise of 5.9% in the last four quarters. The Zacks Consensus Estimate for earnings for 2024 and 2025 indicates year-over-year growth of 5.13% and 5.15% respectively.

CenterPoint Energy has delivered an average earnings surprise of 3.13% in the last four quarters. The company’s long-term (three to five years) earnings growth is pinned at 7%.

Fortis has delivered an average earnings surprise of 4.17% in the last four quarters. The Zacks Consensus Estimate for earnings for 2024 and 2025 indicates year-over-year growth of 2.19% and 2.66% respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

Consolidated Edison Inc (ED) : Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report

Fortis (FTS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance