There Is A Reason Qudian Inc.'s (NYSE:QD) Price Is Undemanding

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

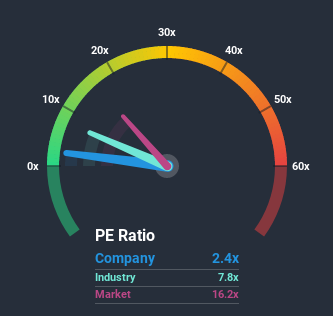

Qudian Inc.'s (NYSE:QD) price-to-earnings (or "P/E") ratio of 2.4x might make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 17x and even P/E's above 33x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

While the market has experienced earnings growth lately, Qudian's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Qudian

How Does Qudian's P/E Ratio Compare To Its Industry Peers?

An inspection of average P/E's throughout Qudian's industry may help to explain its particularly low P/E ratio. The image below shows that the Consumer Finance industry as a whole also has a P/E ratio significantly lower than the market. So this certainly goes a fair way towards explaining the company's ratio right now. Some industry P/E's don't move around a lot and right now most companies within the Consumer Finance industry should be getting stifled strongly. Nevertheless, the company's P/E should be primarily influenced by its own financial performance.

Want the full picture on analyst estimates for the company? Then our free report on Qudian will help you uncover what's on the horizon.

Is There Any Growth For Qudian?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Qudian's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 32% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 47% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should bring plunging returns, with earnings decreasing 148% as estimated by the six analysts watching the company. The market is also set to see earnings decline 12% but the stock is shaping up to perform materially worse.

In light of this, it's understandable that Qudian's P/E sits below the majority of other companies. However, when earnings shrink rapidly the P/E often shrinks too, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult achieve as the weak outlook is already weighing down the shares heavily.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Qudian maintains its low P/E on the weakness of its earnings forecast being even worse than the struggling market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. However, we're still cautious about the company's ability to resist even greater pain to its business from the broader market turmoil. In the meantime, unless the company's prospects improve they will continue to form a barrier for the share price around these levels.

Having said that, be aware Qudian is showing 3 warning signs in our investment analysis, you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance