Realty Income Remains Strong With High Dividends

Realty Income Corp. (NYSE:O) is among the 10 largest real estate investment trusts by market cap and stands out for a number of reasons, such as its interesting multiples, allowing for a dividend yield of almost 6% per year, and its monthly distribution.

On a year-to-date basis, the asset has performed poorly, down around 9% at the time of writing, impacted by the macroeconomic scenario - with high interest rates impacting real estate and operational assets and inflation impacting its main segment, which is retail - and with this, lower growth projections.

Although there are other options on the market that may be just as good, with similar indicators, Realty Income stands out with an exceptional track record and a robust business model that should benefit from the turn of the macroeconomic cycle, continuing to present an interesting compound annual growth rate over the next few years.

Business model and history

Realty Income is a REIT that has properties mainly in the retail segment. But not just any type, its focus is on non-discretionary businesses, along with low price point and service-oriented businesses. All of its top 20 clients are in these categories, with Dollar General (NYSE:DG), Walgreens (NASDAQ:WBA) and Dollar Tree (NASDAQ:DLTR), the three largest, accounting for just over 3% of annualized contractual rent each. Apart from the core business, the company also has efforts aimed at other segments, such as Industrial and Gaming, which are already starting to appear more prominently in the portfolio, as well as international expansion, with the U.K. already accounting for 11% of annualized contractual rent.

Its business model is based on finding these opportunities and carrying out rigorous due diligence based on a series of factors, such as long-term industry trends, portfolio fit, investment spreads, internal rate of return and more. As a result, they are in a sustainable and conservative model, focused mainly on industry-leading clients with sustainable cash flow. To illustrate this, in the first quarter around $9 billion was found for acquisition opportunities, of which only $598 million was realized.

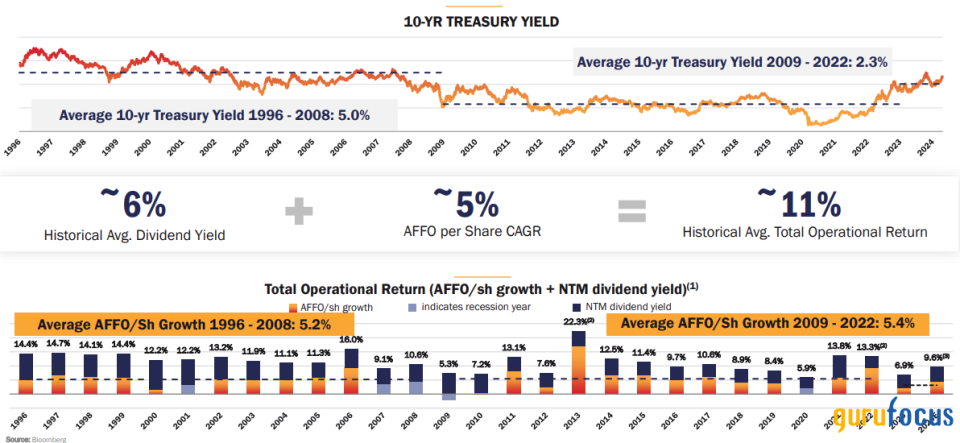

The power of this strategy can be seen in the company's track record. Not surprisingly, Realty Income is also known as "The Monthly Dividend Company." Historically, its average dividend yield has been 6%, along with a CAGR of funds from operations of 5%, since 1994. Even in more difficult times, such as 2008 or the pandemic, its FFO continued to increase and the distribution of dividends was maintained.

Source: Realty Income presentation

Complementing this track record, several indicators reinforce the quality of the operations, including its compound since its initial public offering in 1994 of 13.60% and the dividend compound of 4.30% over the same period. Further, the adjusted Ebitda margin improved from 92.40% in 2000 to 95% in the first quarter of 2024.

Even with the latent trend of technology, e-commerce and the like, it is hard to imagine a scenario where Realty Income's clients and properties are disrupted. Looking at the materials available to investors, there is an emphasis on the sustainability of this model and this growth, with exposure to new sectors and asset types (ranging from data centers to vineyards) to achieve interesting growth, but without losing conservatism and attractive returns.

In other words, it seems very plausible to me the company will be able to continue growing at a similar rate in the long term.

One point of caution in the thesis, however, is the company is dependent on raising funds on the market, mainly debt, which means it has a large amount of debt. Although its capital structure is still very robust and its credit ratings are good, some monitoring is necessary in this regard, both in terms of operations and valuation. If interest rates continue to be high for longer, this could hinder the raising of new debt at more attractive rates and more interesting acquisitions, perhaps leading the company to resort to new capital increases (issuing new shares).

As for valuation, it's enough to note that Realty Income's market cap is $46 billion, while its enterprise value is $71.6 billion, which can lead to a misunderstanding when we do not consider debt in this figure.

Good time to accumulate shares

One common saying with regard to the right time to buy a stock is "buy on the sound of cannons and sell on the sound of trumpets," which, adapted for today's context, means the best time to buy a particular asset is when nobody wants it. As noted in the previous section, Realty Income is a company of impressive quality, but in recent months it has not received as much credit for this.

Among the reasons is the aforementioned macroeconomic scenario, with concerns about inflation and the global economy, as well as high interest rates that hinder acquisitions of new properties, in addition to "sucking up" the capital available for risky assets.

There seems to be a dynamic opportunity cost at the moment. On the one hand, the U.S. 10-year Treasury is paying 4.25% per year, below Realty Income's dividend yield, but still a high rate for a risk-free bond. On the other hand, for the bolder investors, there are tech stocks like Nvidia (NVDA), which have advanced more than 150% year to date and still maintain very optimistic prospects.

Another catalyst for this REIT's poor performance were the lower-than-expected results, such as in the fourth quarter of 2023, where the company missed the adjusted funds from operations, with the market expecting something close to $1.05 and the reported figure being $1.01, justified by a period where the increase in rental rates was overshadowed by higher management costs that reduced profitability.

The company provided some guidance for 2024, including $4.17 to $4.29 in normalized FFO per share. If at least the bottom is reached, it would have a price-to-FFO ratio of 12.70. The market consensus points to something closer to $4.22, which is close to the bottom and indicates a similar price-to-FFO ratio.

The projected dividend for the next 12 months is $3.16, or almost 6% if we take the current price into account. This level does not seem like a huge bargain, but it is certainly a considerable value for investors who like the thesis and this defensive model with monthly payments. The average dividend yield over the last 10 years has been 4.80%, and with the current yield at around 5.8%, it seems like a considerable discount.

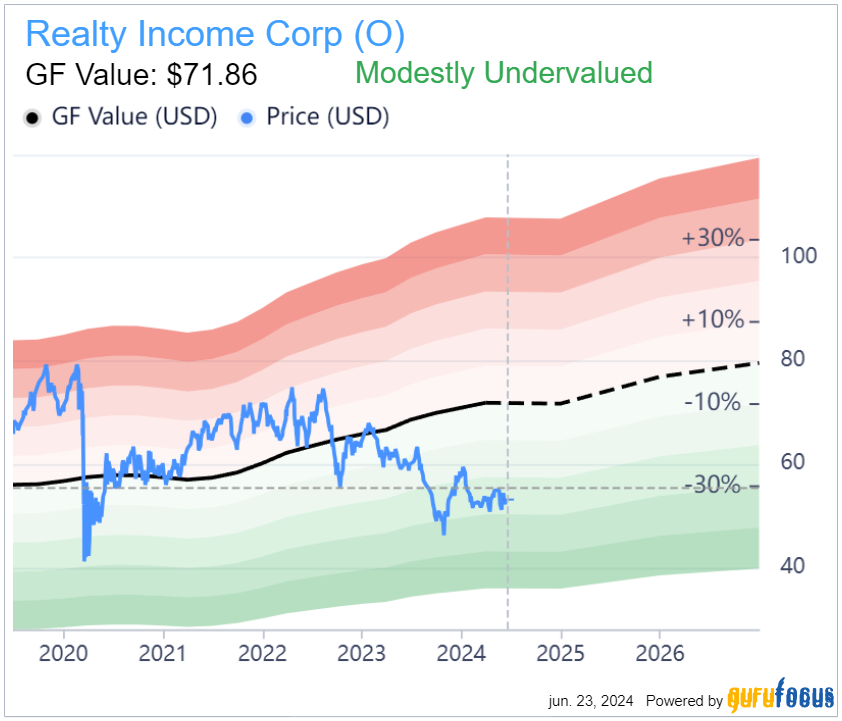

The GF Value also suggests the REIT is modestly undervalued at the time of writing, with a fair price of $71.8 against the current price of $53, indicating a potential upside of 35%.

Final thoughts

Realty Income is a very defensive position, especially at these prices. It seems likely the company will be able to maintain a CAGR similar to that seen in the past, both through its core businesses when the global economy eases, and through its new avenues of expansion.

This, coupled with a dividend yield of almost 6% per year, distributed monthly, leads me to believe this REIT makes a lot of sense for income-focused investors looking for a high-quality asset with prospects of maintaining conservative but still interesting growth and distributing most of this growth via dividends.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance