Real Estate Services Stocks Q1 Recap: Benchmarking Cushman & Wakefield (NYSE:CWK)

Let's dig into the relative performance of Cushman & Wakefield (NYSE:CWK) and its peers as we unravel the now-completed Q1 real estate services earnings season.

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

The 14 real estate services stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 4.2%. while next quarter's revenue guidance was 4% below consensus. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, but real estate services stocks have performed well, with the share prices up 16.6% on average since the previous earnings results.

Cushman & Wakefield (NYSE:CWK)

With expertise in the commercial real estate sector, Cushman & Wakefield (NYSE:CWK) is a global Chicago-based real estate firm offering a comprehensive range of services to clients.

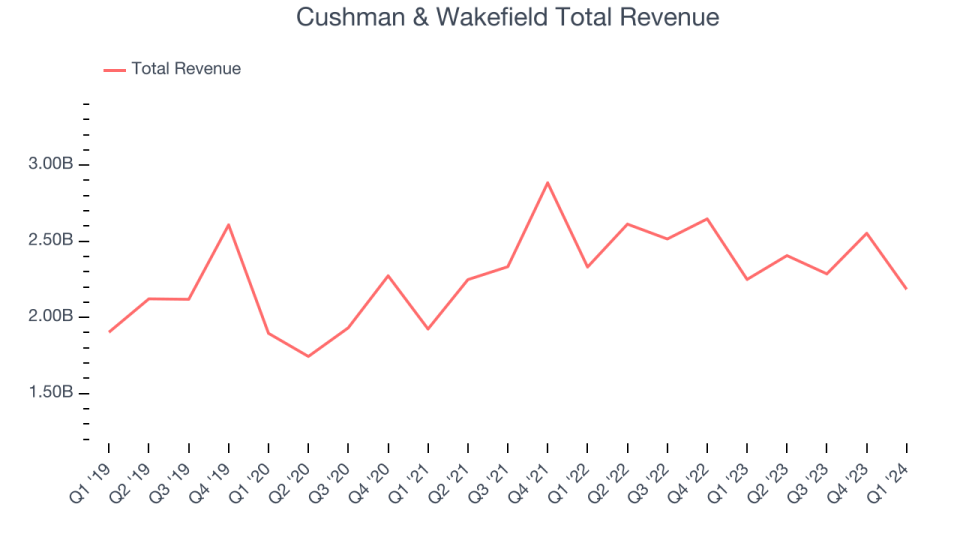

Cushman & Wakefield reported revenues of $2.18 billion, down 2.9% year on year, in line with analysts' expectations. Overall, it was a very strong quarter for the company with an impressive beat of analysts' earnings estimates.

“We reported strong first quarter results that demonstrate the breadth and strength of our service offerings as well as our commitment to executing consistently on our strategic priorities,” said Michelle MacKay, Cushman & Wakefield Chief Executive Officer.

The stock is up 21.6% since reporting and currently trades at $12.06.

Is now the time to buy Cushman & Wakefield? Access our full analysis of the earnings results here, it's free.

Best Q1: JLL (NYSE:JLL)

Founded in 1999 through the merger of Jones Lang Wootton and LaSalle Partners, JLL (NYSE:JLL) is a company specializing in real estate advisory and investment management services.

JLL reported revenues of $5.12 billion, up 8.7% year on year, outperforming analysts' expectations by 6.4%. It was a stunning quarter for the company with an impressive beat of analysts' earnings estimates and a decent beat of analysts' Capital Markets revenue estimates.

The market seems happy with the results as the stock is up 22.3% since reporting. It currently trades at $226.65.

Is now the time to buy JLL? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Anywhere Real Estate (NYSE:HOUS)

Formerly known as Realogy Holdings, Anywhere Real Estate (NYSE:HOUS) is a residential real estate company with a network of brokerages, franchises, and settlement services.

Anywhere Real Estate reported revenues of $1.13 billion, flat year on year, falling short of analysts' expectations by 1.8%. It was a weak quarter for the company with a miss of analysts' earnings estimates.

Anywhere Real Estate had the weakest performance against analyst estimates in the group. As expected, the stock is down 18.1% since the results and currently trades at $4.44.

Read our full analysis of Anywhere Real Estate's results here.

Compass (NYSE:COMP)

Fueled by its mission to replace the "paper-driven, antiquated workflow" of buying a house, Compass (NYSE:COMP) is a digital-first company operating a residential real estate brokerage in the United States.

Compass reported revenues of $1.05 billion, up 10.1% year on year, surpassing analysts' expectations by 2.2%. Taking a step back, it was a mixed quarter for the company with revenue guidance for next quarter beating analysts' expectations but a miss of analysts' earnings estimates.

The stock is up 35.4% since reporting and currently trades at $4.44.

Read our full, actionable report on Compass here, it's free.

eXp World (NASDAQ:EXPI)

Founded in 2009, eXp World (NASDAQ:EXPI) is a real estate company known for its virtual, cloud-based approach to real estate brokerage.

eXp World reported revenues of $943.1 million, up 10.9% year on year, surpassing analysts' expectations by 5.6%. Taking a step back, it was a weaker quarter for the company with a miss of analysts' earnings estimates.

The stock is up 30.3% since reporting and currently trades at $12.95.

Read our full, actionable report on eXp World here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance