RBNZ’s Less Hawkish Stance Drags Down Kiwi, Fuels Rate-Cut Bets

(Bloomberg) -- New Zealand’s central bank kept interest rates unchanged for an eighth straight meeting but toned down its hawkish rhetoric, suggesting it could ease monetary policy sooner than previously signaled.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

The End of the Cheap Money Era Catches Up to Chelsea FC’s Owner

NYC Penthouse Sells for $135 Million in Priciest Deal Since 2022

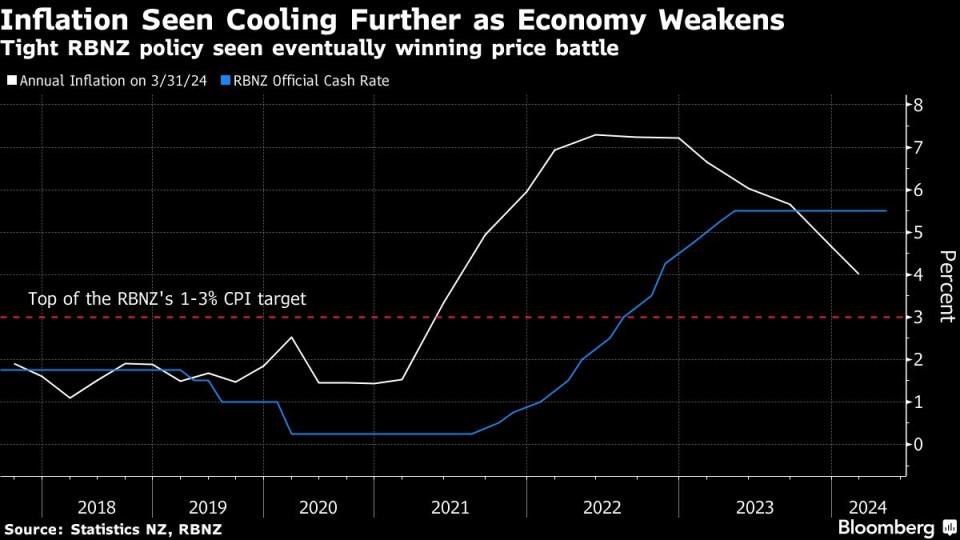

The Reserve Bank’s Monetary Policy Committee held the Official Cash Rate at 5.5% Wednesday in Wellington, as expected. It reiterated that policy needs to remain restrictive, but added that the extent of restraint will be tempered as inflation slows.

“A range of business and consumer surveys, and higher frequency spending and credit data, all point to declining activity,” the RBNZ said. Committee members “discussed the risk that this may indicate that tight monetary policy is feeding through to domestic demand more strongly than expected,” it said.

The comments are a marked departure from the RBNZ’s last meeting in May, when policymakers discussed the case to increase rates further while signaling that a cut was unlikely before the third quarter of 2025. Today’s record of meeting made no mention of a rate hike and expressed confidence that inflation will return to the bank’s 1-3% target band this year.

“The tone of today’s statement is a long way from the misplaced rate hike discussion in May,” said Sean Keane, chief Asia-Pacific strategist for JB Drax Honore. “August still feels too early for a cut, but November now feels near certain. It is quite possible that the OCR will be at 4.50% or lower by the end of March 2025.”

The New Zealand dollar slumped the most in almost a month to 60.75 cents after the decision. The yield on policy sensitive two-year bonds fell 13 basis points to 4.62%, the biggest one-day drop since February 28. Investors have now fully priced two rate cuts this year, with a better-than-even chance the easing cycle begins in August, swaps data show.

Recent data suggest the New Zealand economy may have contracted in the three months through June, which would mean gross domestic product has declined in five of the past seven quarters. The service and manufacturing sectors are in retreat and business confidence has dropped.

“There is now more evidence of excess productive capacity emerging, with measures of capacity utilization and difficulty finding labor easing materially,” the RBNZ said.

The “dovish” remarks prompted economists at Bank of New Zealand to bring forward their forecast for the RBNZ’s first rate cut to November from February, with the possibility of a 50 basis-point move to kick-start the easing cycle.

Most economists expect the RBNZ will more openly acknowledge the case for cutting rates at its next meeting on Aug. 14, when it will have seen second-quarter inflation and labor market data.

“If the overall vibe of the data is cooperative, the path to a first cut in November will be considerably smoother,” said Sharon Zollner, chief New Zealand economist at ANZ Bank in Auckland, who has retained her view for now that the first cut will be delivered in February.

Economists at Goldman Sachs Group Inc. see risks skewed “to a deeper easing cycle” in New Zealand than priced by markets.

Central banks globally are focused on how quickly inflation is slowing and when they can begin easing. The US Federal Reserve is expected to start cutting before year-end. Australia’s central bank, on the other hand, continues to signal a possible rate hike, with inflation proving stickier than anticipated.

The Australian dollar today rose to its highest level against the Kiwi since 2022 on the diverging monetary policy outlooks.

The RBNZ’s latest forecasts in May show inflation falling below 3% in the final quarter of this year but not returning to its 2% goal until mid-2026. Price growth slowed to 4% in the first quarter, the weakest reading in almost three years, but a gauge of domestically generated inflation barely slowed to 5.8%.

The RBNZ on Wednesday acknowledged that domestic price pressures still remain strong, but said there are signs “inflation persistence will ease in line with the fall in capacity pressures and business pricing intentions.”

All economists surveyed by Bloomberg think the RBNZ’s next move will be a cut, though there is a wide range of views on the timing — from as soon as August this year to as late as the first quarter of next year.

“Although the RBNZ still sees the need for monetary policy to remain restrictive, it is making the duration a lot more conditional on data,” said Nick Tuffley, chief economist at ASB Bank in Auckland. “We continue to expect the RBNZ will cut the OCR by 25 basis points in November. However, the risks are for a sooner cut or a bigger cut.”

--With assistance from Matthew Burgess.

(Adds comments from economists, updates markets.)

Most Read from Bloomberg Businessweek

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

Family Offices of the Ultra-Rich Shed Privacy With Activist Bets

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance