Rayonier (RYN) Earnings Beat Estimates in Q4, Revenues Lag

Rayonier Inc. RYN reported fourth-quarter 2019 earnings per share of 12 cents, surpassing the Zacks Consensus Estimate of 10 cents. This also compares favorably with the prior-year quarter earnings of 2 cents per share.

The quarterly performance reflects improved operating income in Southern Timber aided by higher non-timber income and increase in harvest volumes. Also, the Real Estate segment’s results highlight an increase in the number of non-strategic/timberland and unimproved development acres sold.

Revenues were up 7.6% year over year to $178.8 million but missed the Zacks Consensus Estimate of $190 million.

For 2019, the company reported earnings per share of 46 cents, down from 79 cents earned in the prior year. Revenues of $711.6 million also declined 12.8% year over year.

Segmental Performance

During the reported quarter, operating income at the company’s Southern Timber segment came in at $12 million, up from $7.2 million in the prior-year quarter. This upside resulted from higher non-timber income, increased volumes, lower lease related expenses and reduced depletion rates. However, the positives were partially offset by a drop in net stumpage prices.

The Pacific Northwest Timber segment reported an operating loss of $1.3 million, narrower than the operating loss of $4.1 million recorded in fourth-quarter 2018. This was mainly due to higher net stumpage prices, lower road maintenance and other costs and reduced depletion rates, partially offset by an increase in other variable costs.

The New Zealand Timber segment recorded operating income of $9.4 million, down from the year-earlier tally of $12.6 million. Results indicate lower net stumpage prices and higher roading costs, partly offset by higher volumes, increased non-timber income and favorable foreign exchange impacts.

Real Estate’s operating income of $12.7 million was significantly up from the year-ago $4.6 million. This was chiefly due to a higher number of acres sold, partially muted by a drop in weighted-average prices.

The Trading segment reported operating loss of $0.3 million in the quarter against operating income of $0.3 million in the year-earlier quarter. This suggests lower margins due to port congestion and reduced availability of third-party export volume resulting from overall market price declines.

Liquidity

Rayonier ended the fourth quarter with $68.7 million in cash and cash equivalents, down from $148.4 million recorded as of Dec 31, 2018. Total long-term debt was $973.1 million, marginally up from $972.6 million as on Dec 31, 2018.

Outlook

Management expects to achieve 2020 net income attributable to Rayonier of $47-$57 million and adjusted EBITDA of $245-$270 million. This is excluding the impact of the company’s expected mid-year acquisition of Pope Resources.

In the Southern Timber segment, the company expects to achieve full-year harvest volumes of 6.3 to 6.5 million tons, while in the Pacific Northwest Timber segment, the company projects harvest volumes of 1.4-1.5 million tons. In the New Zealand Timber segment, harvest volumes are expected at 2.6-2.7 million tons. Further, the company expects a notable increase in adjusted EBITDA in its Real Estate segment, based on current pipeline of transactions. However, the company anticipates that real estate activity will be greatly weighted to the second half of this year.

Currently, Rayonier carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

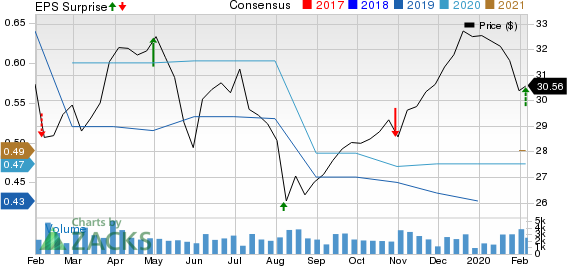

Rayonier Inc. Price, Consensus and EPS Surprise

Rayonier Inc. price-consensus-eps-surprise-chart | Rayonier Inc. Quote

We, now, look forward to earnings releases from other REITs like Federal Realty Investment Trust FRT, Healthpeak Properties, Inc. PEAK and Welltower Inc. WELL. All three companies are scheduled to release their quarterly numbers next week.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Rayonier Inc. (RYN) : Free Stock Analysis Report

Federal Realty Investment Trust (FRT) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report

Healthpeak Properties, Inc. (PEAK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance