Raymond James' (RJF) Q2 Earnings Miss, Revenues Rise Y/Y

Raymond James’ RJF second-quarter fiscal 2024 (ended Mar 31) adjusted earnings of $2.31 per share missed the Zacks Consensus Estimate by a penny. The bottom line, however, was up 14% from the prior-year quarter.

Results were adversely impacted by higher non-interest expenses. Also, RJF recorded bank loan provision for credit losses during the quarter on the tough macroeconomic outlook.

However, robust investment banking and brokerage performance aided the Capital Markets segment’s results. The performance of the Private Client Group and the Asset Management segments was also decent. The acquisitions over the past years supported the company’s financials to some extent.

Net income available to common shareholders (GAAP basis) was $474 million or $2.22 per share, up from $425 million or $1.93 per share in the prior-year quarter.

Revenues Improve, Costs Rise

Net revenues were $3.12 billion, up 9% year over year. The top line matched the Zacks Consensus Estimate.

Segment-wise, in the reported quarter, the Private Client Group recorded 9% growth in net revenues, Asset Management’s net revenues rose 17%, and Capital Markets’ top line increased 6%. Further, Others witnessed a 70% jump in revenues. Bank registered a fall of 21% from the prior year in net revenues.

Non-interest expenses rose 8% year over year to $2.51 billion. The increase was largely due to higher compensation, commissions and benefits costs and investment sub-advisory fees. Our estimate for non-interest expenses was also $2.44 billion. Also, RJF recorded a bank loan provision for credit losses of $21 million.

As of Mar 31, 2024, client assets under administration were $1.45 trillion, up 18% from the end of the prior-year quarter. Financial assets under management of $226.8 billion grew 17%. Our estimates for client assets under administration and financial assets under management were $1.32 trillion and $206.2 billion, respectively.

Balance Sheet & Capital Ratios Strong

As of Mar 31, 2024, Raymond James has total assets of $81.23 billion, up 1% from the prior quarter. Total equity rose 2% sequentially to $10.91 billion.

Book value per share was $52.60, up from $46.67 as of Mar 31, 2023.

As of Mar 31, 2024, the total capital ratio was 23.3% compared with 21.4% as of Mar 31, 2023. The Tier 1 capital ratio was 21.9% compared with 20.1% as of March 2023-end.

Return on common equity (annualized basis) was 17.5% at the end of the reported quarter compared with 17.3% a year ago.

Share Repurchase Update

In the reported quarter, RJF repurchased 1.7 million shares for $207 million.

As of Apr 23, 2024, $1.14 billion remained under the buyback authorization.

Our View

Raymond James’ global diversification efforts, strategic acquisitions and higher rates are expected to support top-line growth. However, elevated operating expenses and the volatile nature of capital markets businesses are concerns.

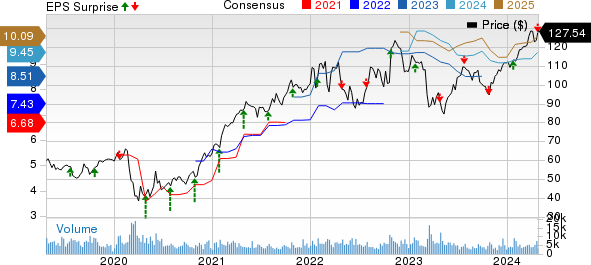

Raymond James Financial, Inc. Price, Consensus and EPS Surprise

Raymond James Financial, Inc. price-consensus-eps-surprise-chart | Raymond James Financial, Inc. Quote

Currently, Raymond James carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Investment Banks

Jefferies Financial Group’s JEF first-quarter fiscal 2024 (ended Feb 29) adjusted earnings (excluding Weiss losses) of 87 cents per share surpassed the Zacks Consensus Estimate of 76 cents. In the prior-year quarter, the company recorded earnings of 54 cents.

Results were primarily aided by an improvement in net revenues. The performance of the reportable segments was also strong. However, higher expenses hurt JEF’s results to some extent.

Moelis & Company’s MC first-quarter 2024 adjusted earnings per share of 22 cents handily surpassed the Zacks Consensus Estimate of 11 cents. The bottom line also compared favorably with 5 cents earned in the prior-year quarter.

Results benefited from a rise in revenues and other income. Also, MC had a solid liquidity position in the quarter. However, an increase in expenses acted as an undermining factor.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jefferies Financial Group Inc. (JEF) : Free Stock Analysis Report

Raymond James Financial, Inc. (RJF) : Free Stock Analysis Report

Moelis & Company (MC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance