Raymond James (RJF) Hikes Dividend, Announces Buyback Plan

Raymond James Financial, Inc. RJF has rewarded shareholders with enhanced capital deployment plans, including a dividend hike and a new share buyback program. RJF's board of directors has announced a quarterly cash dividend of 34 cents per share. This reflects a sequential hike of 31% from 26 cents paid out on Oct 15, 2021. The new divined will be paid out on Jan 18, 2022, to shareholders of record as of Jan 4, 2022.

Based on the increased rate, the annual dividend came to $1.36 a share, resulting in an annualized yield of 1.4%, considering Raymond James' closing price of $98.07 as of Dec 2.The yield is attractive for income investors and offers a steady source of income.

Raymond James has a track record of regularly raising dividends over the last decade. Prior to the recent hike, the company had announced a 5.4% increase in its quarterly dividend in December 2020.

Dividend payouts apart, Raymond James' board has authorized the repurchase of its shares of common stock, aggregating to $1 billion, with no expiration date. The authorization is higher and replaces the previous buyback authorization of $750 million announced on Dec 3, 2020. Under the previous authorization, around $632 million remained as of Dec 2, 2021.

Given a robust capital position and lower dividend payout ratio compared with peers, the company is expected to sustain efficient capital deployment activities. Such moves are likely to drive shareholder confidence in the stock.

RJF remains focused on inorganic growth moves, supported by its strong liquidity position. Particularly, in late October, the company announced a deal to acquire TriState Capital Holdings, Inc. TSC.

With a branchless bank model, TriState Capital had $9.9 billion in total loans and $10.8 billion in total deposits as of Sep 30, 2021. In addition, TriState Capital's asset management division — Chartwell Investment Partners — had $11.5 billion in assets under management (AUM) largely invested in equity and fixed-income strategies. Hence, the buyout is expected to strengthen Raymond James' Private Client Group ("PCG") and Asset Management segments.

Also, most of Raymond James' businesses are performing relatively well, with the PCG segment remaining one of the best performers. Hence, ongoing inorganic moves are poised to further strengthen the company's operations and enhance its cash-generation capabilities.

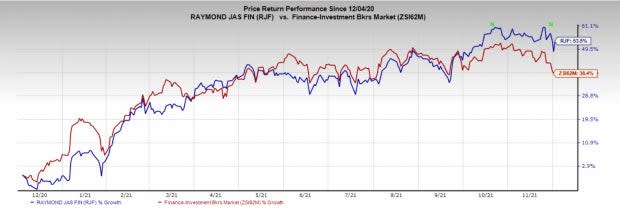

Over the past year, shares of Raymond James have rallied 53.5%, outperforming 38.4% growth of its industry.

Image Source: Zacks Investment Research

Currently, Raymond James carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Other Companies Undertaking Enhanced Capital Deployment Actions

Over the past few months, several banks have rewarded shareholders with new share-repurchase programs or dividend hikes. Some of these are Farmers National Banc Corp. FMNB and United Community Banks, Inc. UCBI.

Farmers National announced a sequential hike in the quarterly dividend of 27.3% to 14 cents per share. The dividend will be paid out on Dec 31 to shareholders of record as of Dec 10, 2021. This marks the 6th consecutive quarter of an increase by Farmers National.

Farmers National's management noted, "since 2015, our annual cash dividend has increased at an impressive 26% compound annual growth rate, reflecting our strong financial results and commitment to returning capital to shareholders."

United Community Banks announced a new share repurchase plan, under which it is authorized to buy back up to $50 million outstanding shares. The plan will expire on Dec 31, 2022.

The new repurchase plan replaces the previous one, which authorized United Community Banks to buy back up to $50 million shares by Dec 31, 2021. As of Sep 30, 2021, UCBI had the authorization to repurchase shares worth $34.9 million remaining under the earlier plan.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Raymond James Financial, Inc. (RJF) : Free Stock Analysis Report

United Community Banks, Inc. (UCBI) : Free Stock Analysis Report

TriState Capital Holdings, Inc. (TSC) : Free Stock Analysis Report

Farmers National Banc Corp. (FMNB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance