I Ran A Stock Scan For Earnings Growth And Par Pacific Holdings (NYSE:PARR) Passed With Ease

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Par Pacific Holdings (NYSE:PARR). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Par Pacific Holdings

How Fast Is Par Pacific Holdings Growing Its Earnings Per Share?

Over the last three years, Par Pacific Holdings has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a wedge-tailed eagle on the wind, Par Pacific Holdings's EPS soared from US$1.30 to US$1.81, in just one year. That's a commendable gain of 39%.

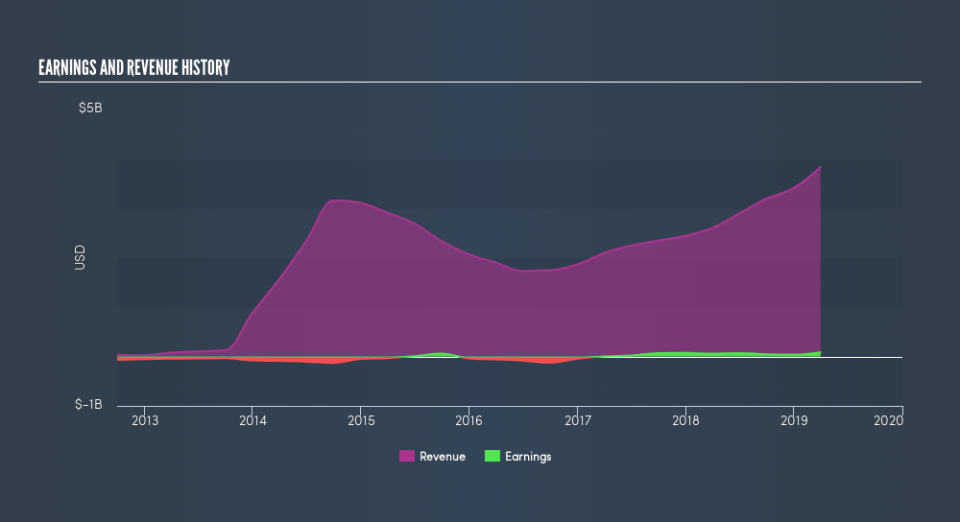

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Par Pacific Holdings's EBIT margins were flat over the last year, revenue grew by a solid 47% to US$3.8b. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Par Pacific Holdings EPS 100% free.

Are Par Pacific Holdings Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Par Pacific Holdings insiders have a significant amount of capital invested in the stock. To be specific, they have US$17m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 1.5% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Par Pacific Holdings Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Par Pacific Holdings's strong EPS growth. Further, the high level of insider buying impresses me, and suggests that I'm not the only one who appreciates the EPS growth. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. Now, you could try to make up your mind on Par Pacific Holdings by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Although Par Pacific Holdings certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance