We Ran A Stock Scan For Earnings Growth And BT Group (LON:BT.A) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like BT Group (LON:BT.A), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for BT Group

BT Group's Improving Profits

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So EPS growth can certainly encourage an investor to take note of a stock. To the delight of shareholders, BT Group's EPS soared from UK£0.13 to UK£0.19, over the last year. That's a fantastic gain of 49%.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It was a year of stability for BT Group as both revenue and EBIT margins remained have been flat over the past year. While this doesn't ring alarm bells, it may not meet the expectations of growth-minded investors.

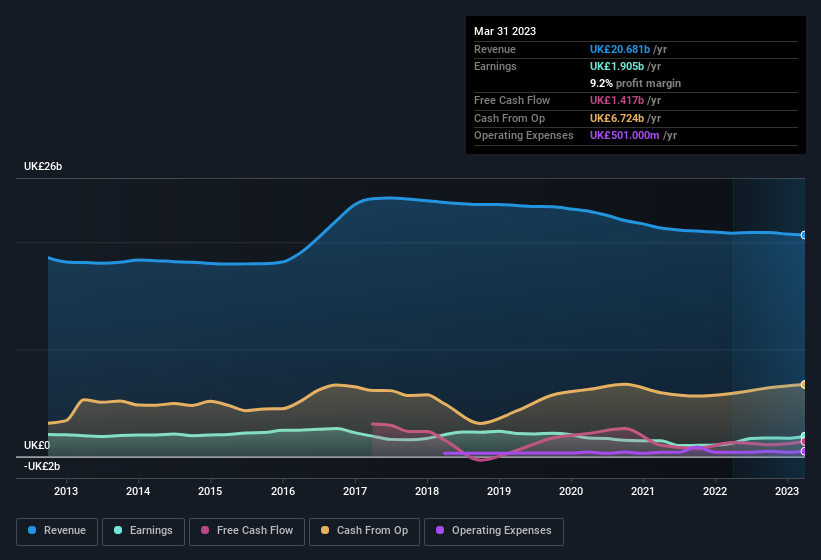

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of BT Group's forecast profits?

Are BT Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling BT Group shares, in the last year. With that in mind, it's heartening that Sara Weller, the Independent Non-Executive Director of the company, paid UK£7.3k for shares at around UK£1.46 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

Along with the insider buying, another encouraging sign for BT Group is that insiders, as a group, have a considerable shareholding. Notably, they have an enviable stake in the company, worth UK£3.0b. That equates to 25% of the company, making insiders powerful and aligned with other shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. The cherry on top is that the CEO, Philip Eric Jansen is paid comparatively modestly to CEOs at similar sized companies. The median total compensation for CEOs of companies similar in size to BT Group, with market caps over UK£6.2b, is around UK£4.1m.

BT Group's CEO took home a total compensation package worth UK£3.1m in the year leading up to March 2023. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add BT Group To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into BT Group's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say that this stock may well deserve a spot on your watchlist. We don't want to rain on the parade too much, but we did also find 4 warning signs for BT Group (1 is a bit unpleasant!) that you need to be mindful of.

Keen growth investors love to see insider buying. Thankfully, BT Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance