We Ran A Stock Scan For Earnings Growth And Lark Distilling (ASX:LRK) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Lark Distilling (ASX:LRK). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Lark Distilling with the means to add long-term value to shareholders.

See our latest analysis for Lark Distilling

How Fast Is Lark Distilling Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. Commendations have to be given in seeing that Lark Distilling grew its EPS from AU$0.00024 to AU$0.039, in one short year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

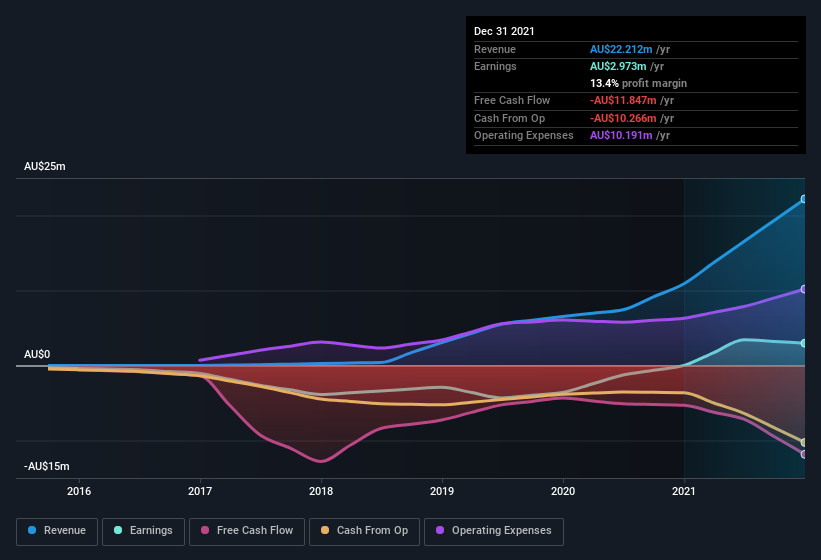

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Lark Distilling shareholders can take confidence from the fact that EBIT margins are up from 1.4% to 4.6%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Lark Distilling's forecast profits?

Are Lark Distilling Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The real kicker here is that Lark Distilling insiders spent a staggering AU$3.1m on acquiring shares in just one year, without single share being sold in the meantime. The shareholders within the general public should find themselves expectant and certainly hopeful, that this large outlay signals prescient optimism for the business. It is also worth noting that it was company insider Geoff Bainbridge who made the biggest single purchase, worth AU$2.9m, paying AU$5.00 per share.

On top of the insider buying, it's good to see that Lark Distilling insiders have a valuable investment in the business. As a matter of fact, their holding is valued at AU$62m. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 32% of the company; visible skin in the game.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because Lark Distilling's CEO, Laura McBain, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations under AU$297m, like Lark Distilling, the median CEO pay is around AU$417k.

The Lark Distilling CEO received total compensation of only AU$58k in the year to June 2021. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does Lark Distilling Deserve A Spot On Your Watchlist?

Lark Distilling's earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Lark Distilling deserves timely attention. Still, you should learn about the 3 warning signs we've spotted with Lark Distilling (including 1 which doesn't sit too well with us).

Keen growth investors love to see insider buying. Thankfully, Lark Distilling isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance