Radius Recycling Inc (RDUS) Misses Earnings Predictions with Q2 Fiscal 2024 Results

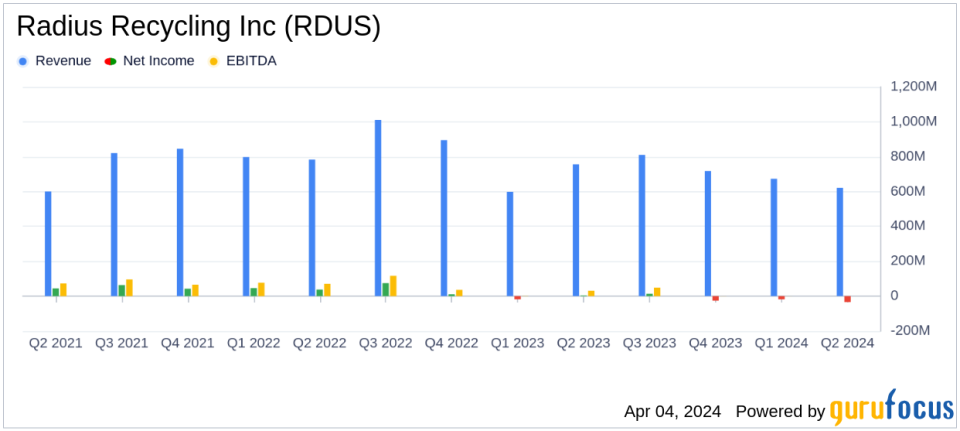

Revenue: Reported $621 million in revenues, down from $673 million in Q1 and below analyst estimates of $672.25 million.

Net Loss: Posted a net loss of $34 million, a significant decline from a net income of $4 million in the same quarter last year.

Earnings Per Share (EPS): Recorded a loss per share of $1.19, underperforming analyst expectations of a loss per share of $0.64.

Adjusted EBITDA: Achieved $3 million, compared to $32 million in the prior year's quarter.

Dividend: Declared a quarterly dividend of $0.1875 per share, maintaining a consistent return to shareholders.

Radius Recycling Inc (NASDAQ:RDUS), a North American leader in the recycling of ferrous and nonferrous metal and a manufacturer of finished steel products, released its 8-K filing on April 4, 2024, detailing the financial results for the second quarter of fiscal year 2024. With a network that includes 50 retail self-service auto parts stores, 54 metals recycling facilities, and an electric arc furnace steel mill, RDUS provides a comprehensive suite of products and services globally.

Despite a year-over-year increase in nonferrous and finished steel sales volumes, RDUS faced a challenging quarter marked by tight supply flows for recycled metals and adverse weather conditions. These factors, along with a subdued U.S. manufacturing activity, led to a contraction in scrap generation and a decrease in ferrous sales volumes by 15% sequentially.

Financial Performance and Strategic Initiatives

RDUS reported a net loss of $34 million for the quarter, a stark contrast to the $4 million net income from the same period last year. The loss per share from continuing operations was $(1.19), significantly missing the analyst estimate of $(0.64). Adjusted EBITDA stood at $3 million, a substantial drop from $32 million year-over-year. The company's gross margin also saw a decline, coming in at $40 million compared to $73 million in the second quarter of the previous year.

CEO Tamara Lundgren highlighted the company's strategic initiatives amid cyclical headwinds, including a significant expansion of the fiscal 2024 cost savings and productivity improvement program. RDUS aims to achieve $40 million in annual benefits by reducing SG&A expenses by 10% and enhancing production cost efficiencies. These measures are expected to bolster the company's position for future market improvements and benefit from structural demand tailwinds.

Challenges and Outlook

The company's performance reflects the impact of external challenges such as tight supply flows, weather conditions, and lower global demand for recycled metals. Despite these headwinds, RDUS is implementing cost reduction strategies and investing in advanced metal recovery technologies. Lundgren expressed optimism that scrap supply flows would benefit from declining U.S. interest rates and a recovery in global manufacturing activity.

RDUS's commitment to shareholder returns was evident with the declaration of its 120th consecutive quarterly dividend. The company's capital expenditure plans remain focused on completing nonferrous technology initiatives and supporting recycling services expansion.

Financial Health and Capital Allocation

RDUS ended the quarter with total debt of $374 million and net debt of $360 million. Operating cash outflow was $55 million, primarily due to an increase in net working capital. Capital expenditures for the quarter were $15 million, with an expected total of $80 million for fiscal 2024.

The effective tax rate for the quarter was an expense of 4% on GAAP results and 8% on adjusted non-GAAP results. The company continues to navigate the complex market environment with a focus on cost management and operational efficiency.

As RDUS progresses through fiscal 2024, the company's efforts to streamline operations and capitalize on strategic growth opportunities will be crucial in mitigating the challenges faced in the second quarter. Investors and stakeholders will be closely monitoring the company's ability to execute its cost-saving initiatives and adapt to market dynamics.

For more detailed financial information and future updates on Radius Recycling Inc (NASDAQ:RDUS), stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Radius Recycling Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance