Radian (RDN) Okays Buyback to Boost Shareholder Returns

The board of directors of Radian Group RDN authorized a share buyback program to return more value to investors. With the latest authorization, the board increased the authorization by $600 million to $900 million. The program remains active through Jun 30, 2026.

Generally, companies see share repurchase as a prudent use of additional cash to buy back their own shares when the stock is undervalued, apart from hiking dividends, paying special dividends and deploying funds for growth initiatives.

Radian Group maintains a solid balance sheet with sufficient liquidity and strong cash flows. A strong capital position helps Radian Group deploy capital via share repurchases and dividend hikes that enhance shareholders’ value. Radian Group bought back 1.8 million shares worth $50 million, including commissions, in the first quarter. The remaining repurchase capacity was $117 million as of Mar 31, 2024.

Concurrently, the board also approved a 24.5 cents per share quarterly dividend. The dividend will be paid out on Jun 20, 2024, to stockholders of record as of Jun 4. Riding on continued financial strength and flexibility, Radian declared a 9% increase in its quarterly dividend in the first quarter of 2024. This is the fifth consecutive year where RDN has increased the quarterly dividend with a total increase of 96% over the past four years. Its current dividend yield of 3.1% betters the industry average of 2.5%.

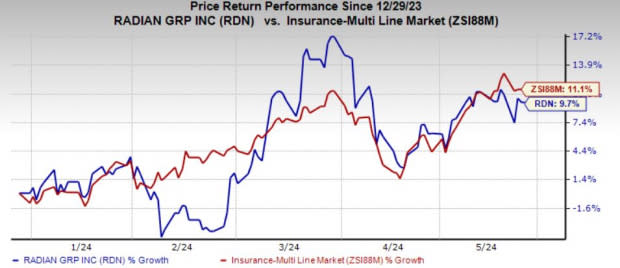

Improving mortgage insurance portfolio, declining claims, a well-performing homogenous segment, and a solid capital position should help the insurer deliver impressive results. This, in turn, should poise the company well with sufficient liquidity and aid in boosting shareholders' value. Shares of this Zacks Rank #2 (Buy) mortgage insurer have gained 9.7% year to date, outperforming the industry’s increase of 11.1%.

Image Source: Zacks Investment Research

Recently, the board of directors of AXIS Capital Holdings Limited AXS authorized a share buyback program to return more value to investors. The latest authorization will allow the company to spend up to $300 million to repurchase its common stock.

Intensified focus on specialty lines, continuous investment in growth areas, including wholesale insurance and lower middle markets, exit from the volatile catastrophe and property reinsurance space and reduction of risk exposure while concentrating on accident and health, casualty, credit and surety, and specialty reinsurance lines should help the insurer deliver impressive results. This, in turn, should poise the company well with sufficient liquidity and aid in boosting shareholders' value.

Other Stocks to Consider

Some other top-ranked stocks from the multi-line insurance industry are Old Republic International Corporation ORI and EverQuote, Inc. EVER, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Old Republic International has a solid track record of beating earnings estimates in three of the last four quarters while missing in one, the average being 6.61%. In the past year, shares of ORI have climbed 27%. The Zacks Consensus Estimate for ORI’s 2024 and 2025 earnings implies year-over-year growth of 3.8% and 4.4%, respectively.

EverQuote has a solid track record of beating earnings estimates in each of the trailing four quarters, the average being 65.16%. In the past year, shares of EVER have skyrocketed 165.9%. The Zacks Consensus Estimate for EVER’s 2024 and 2025 earnings implies year-over-year growth of 102% and 489%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

Radian Group Inc. (RDN) : Free Stock Analysis Report

EverQuote, Inc. (EVER) : Free Stock Analysis Report

Old Republic International Corporation (ORI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance