Quest Resource Holding (NASDAQ:QRHC) shareholders have earned a 36% CAGR over the last five years

We think all investors should try to buy and hold high quality multi-year winners. While the best companies are hard to find, but they can generate massive returns over long periods. Just think about the savvy investors who held Quest Resource Holding Corporation (NASDAQ:QRHC) shares for the last five years, while they gained 368%. And this is just one example of the epic gains achieved by some long term investors. It's also up 17% in about a month. We note that Quest Resource Holding reported its financial results recently; luckily, you can catch up on the latest revenue and profit numbers in our company report.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for Quest Resource Holding

Quest Resource Holding wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Quest Resource Holding saw its revenue grow at 28% per year. That's well above most pre-profit companies. Arguably, this is well and truly reflected in the strong share price gain of 36%(per year) over the same period. It's never too late to start following a top notch stock like Quest Resource Holding, since some long term winners go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

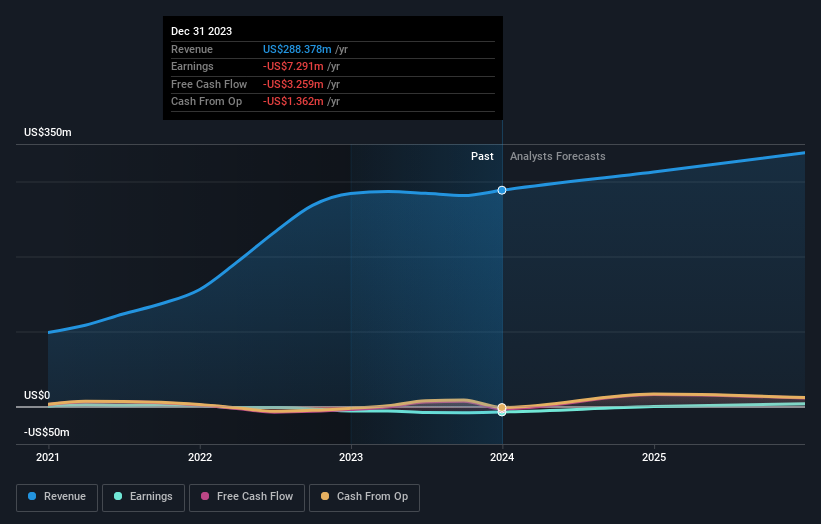

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Quest Resource Holding will earn in the future (free profit forecasts).

A Different Perspective

It's nice to see that Quest Resource Holding shareholders have received a total shareholder return of 34% over the last year. However, the TSR over five years, coming in at 36% per year, is even more impressive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Quest Resource Holding that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance