Quest Diagnostics Grows on New Tests Amid Coronavirus Crisis

On Apr 24, we issued an updated research report on Quest Diagnostics, Inc. DGX. As part of its two-point strategy, Quest Diagnostics has been focusing on areas with high potential. However, the ongoing COVID-19 led economic crisis remains a major cause of concern for this Zacks Rank #3 (Hold) company.

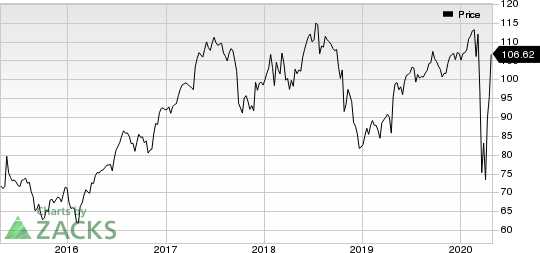

Shares of Quest Diagnostics have outperformed its industry in the past year. The stock has gained 5.1% as against a 0.2% decline of the industry.

Quest Diagnostics reported better-than-expected first-quarter 2020 figures. The company noted that it was off to a strong start in January and February, the period when coronavirus impact was not significant in the United States.

Quest Diagnostics Incorporated Price

Quest Diagnostics Incorporated price | Quest Diagnostics Incorporated Quote

In the first two months of the year, total revenues grew more than 6%. After adjusting for the calendar benefit and favorable weather in the first two months of the year, organic volume grew more than 4%. Although the overall year-over-year decline in adjusted earnings and revenues was concerning, this was totally induced by the coronavirus-led market debacle.

Meanwhile, the company newly launched COVID-19 tests have already started to significantly add to its Diagnostic information Services business. In this regard, the company noted that it has performed nearly one million molecular tests, which is approximately a quarter of all testing done in the United States. It has also begun to perform blood-based antibody testing.

Quest Diagnostics is currently refocusing on diagnostic information services wing and disciplined capital deployment. Its acquisitions and collaborations with hospitals and integrated delivery networks consistently act as major catalysts. Recently, the company announced the acquisition of Boston Clinical Laboratories, a small regional laboratory in Massachusetts. Two other recently announced acquisitions are Blueprint Genetics (to strengthen position in advanced diagnostics) and a multifaceted long-term collaboration with the Memorial Hermann Health System. Quest Diagnostics has also signed a professional laboratory services agreement with an eight-hospital health system in Tennessee.

On the flip side, the year-over-year decline in adjusted earnings as well as revenues is concerning. In March, the company experienced a significant decline in testing volumes since the COVID-19 took the shape of pandemic and social distancing and shelter-in-place measures were instituted to combat the outbreak. During the last two weeks of March, volumes declined over 40%, including COVID-19 testing. In fact, in April, volume declines continued to intensify, bottoming out at around 50% to 60%.

This apart, Quest Diagnostics is apprehensive about dealing with massive reimbursement pressure, which may get partially offset by steady execution of the Invigorate program.

Stocks to Consider

Some better-ranked stocks from the broader medical space include ResMed Inc. RMD, Merit AngioDynamics, Inc. ANGO and DexCom, Inc. DXCM, each currently carrying a Zacks Rank #2 (Buy). You can seethe complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ResMed has an estimated long-term earnings growth rate of 14.4%.

AngioDynamics has a long-term historical earnings growth rate of 10.4%.

DexCom has a projected long-term earnings growth rate of 36.7%.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.1% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AngioDynamics, Inc. (ANGO) : Free Stock Analysis Report

Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance