Q1 Vertical Software Earnings Review: First Prize Goes to Manhattan Associates (NASDAQ:MANH)

Looking back on vertical software stocks' Q1 earnings, we examine this quarter's best and worst performers, including Manhattan Associates (NASDAQ:MANH) and its peers.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 4 vertical software stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 2.4%. while next quarter's revenue guidance was 0.8% below consensus. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and vertical software stocks have held roughly steady amidst all this, with share prices up 4.8% on average since the previous earnings results.

Best Q1: Manhattan Associates (NASDAQ:MANH)

Boasting major consumer staples and pharmaceutical companies as clients, Manhattan Associates (NASDAQ:MANH) offers a software-as-service platform that helps customers manage their supply chains.

Manhattan Associates reported revenues of $254.6 million, up 15.2% year on year, topping analysts' expectations by 4.6%. It was a decent quarter for the company, with full-year revenue guidance topping analysts' expectations but a decline in its gross margin.

“We are very pleased with our solid start to 2024 and better than expected first quarter results. Manhattan’s fundamentals are strong, as demand continues to drive favorable pipeline and revenue momentum,” said Manhattan Associates president and CEO Eddie Capel.

Manhattan Associates scored the biggest analyst estimates beat and highest full-year guidance raise of the whole group. The stock is up 6.6% since the results and currently trades at $245.74.

Is now the time to buy Manhattan Associates? Access our full analysis of the earnings results here, it's free.

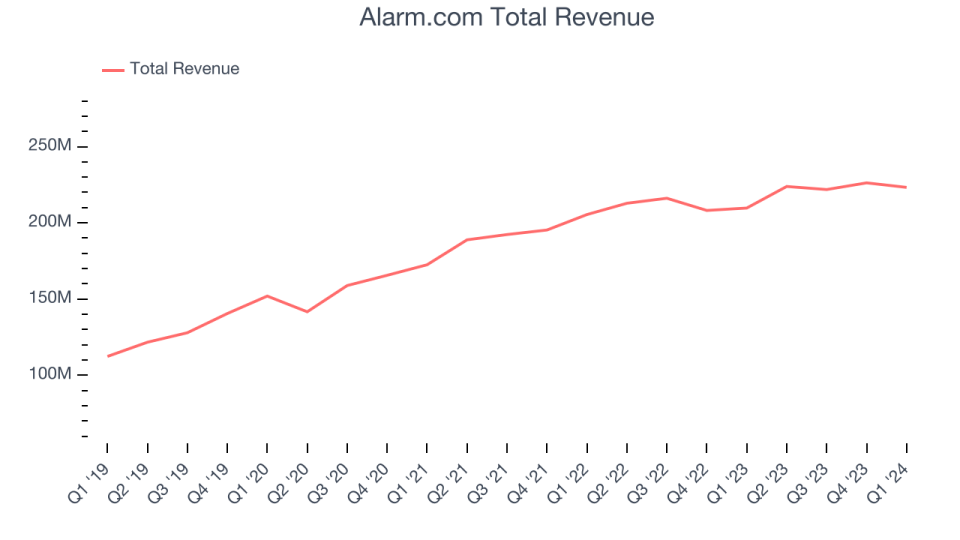

Alarm.com (NASDAQ:ALRM)

Founded in 2000 as a business unit within MicroStrategy, Alarm.com (NASDAQ:ALRM) is a software-as-a-service platform that enables users to control their security systems and smart home appliances from a single app.

Alarm.com reported revenues of $223.3 million, up 6.5% year on year, outperforming analysts' expectations by 1.6%. It was a mixed quarter for the company, with a decent beat of analysts' billings estimates but full-year revenue guidance missing analysts' expectations.

Alarm.com had the slowest revenue growth and weakest full-year guidance update among its peers. The stock is down 7.7% since the results and currently trades at $63.36.

Is now the time to buy Alarm.com? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Bentley (NASDAQ:BSY)

Founded by brothers Keith and Barry Bentley, Bentley Systems (NASDAQ:BSY) offers a software-as-a-service platform that addresses the lifecycle of infrastructure projects such as road networks, tunnel systems, and wastewater facilities.

Bentley reported revenues of $337.8 million, up 7.4% year on year, falling short of analysts' expectations by 0.7%. It was a weak quarter for the company, with a miss of analysts' billings estimates.

Bentley had the weakest performance against analyst estimates in the group. The stock is down 7.9% since the results and currently trades at $49.25.

Read our full analysis of Bentley's results here.

Guidewire (NYSE:GWRE)

Founded by two individuals involved in the development of leading procurement software Ariba, Guidewire (NYSE:GWRE) offers insurance companies a software-as-a-service platform to help sell their products and manage their workflows.

Guidewire reported revenues of $240.7 million, up 16% year on year, surpassing analysts' expectations by 4%. It was an ok quarter for the company, with a decent beat of analysts' billings estimates but a decline in its gross margin.

Guidewire scored the fastest revenue growth among its peers. The stock is up 28.4% since the results and currently trades at $138.8.

Read our full, actionable report on Guidewire here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance