Q1 Rundown: TransDigm (NYSE:TDG) Vs Other Aerospace Stocks

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how aerospace stocks fared in Q1, starting with TransDigm (NYSE:TDG).

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

The 14 aerospace stocks we track reported a decent Q1; on average, revenues beat analyst consensus estimates by 2%. while next quarter's revenue guidance was 1.8% above consensus. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, but aerospace stocks have shown resilience, with share prices up 7.2% on average since the previous earnings results.

TransDigm (NYSE:TDG)

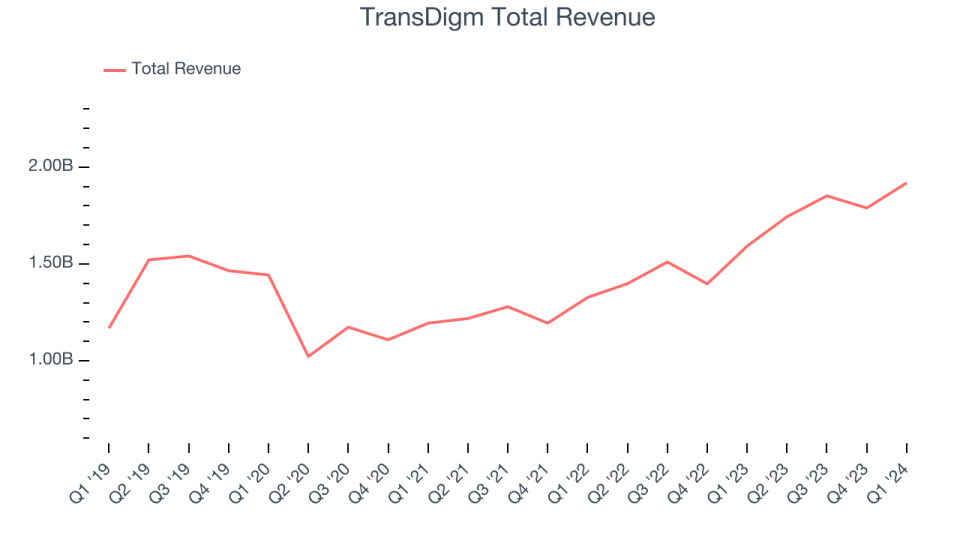

Supplying parts for nearly all aircraft currently in service, TransDigm (NYSE:TDG) develops and manufactures components and systems for military and commercial aviation.

TransDigm reported revenues of $1.92 billion, up 20.5% year on year, topping analysts' expectations by 2%. It was a solid quarter for the company, with a decent beat of analysts' earnings estimates.

"I am very pleased with the operating results for the second quarter. We continued to see strong performance as we closed out the first half of our fiscal year," stated Kevin Stein, TransDigm Group's President and Chief Executive Officer.

The stock is down 1.9% since the results and currently trades at $1,275.07.

Read why we think that TransDigm is one of the best aerospace stocks, our full report is free.

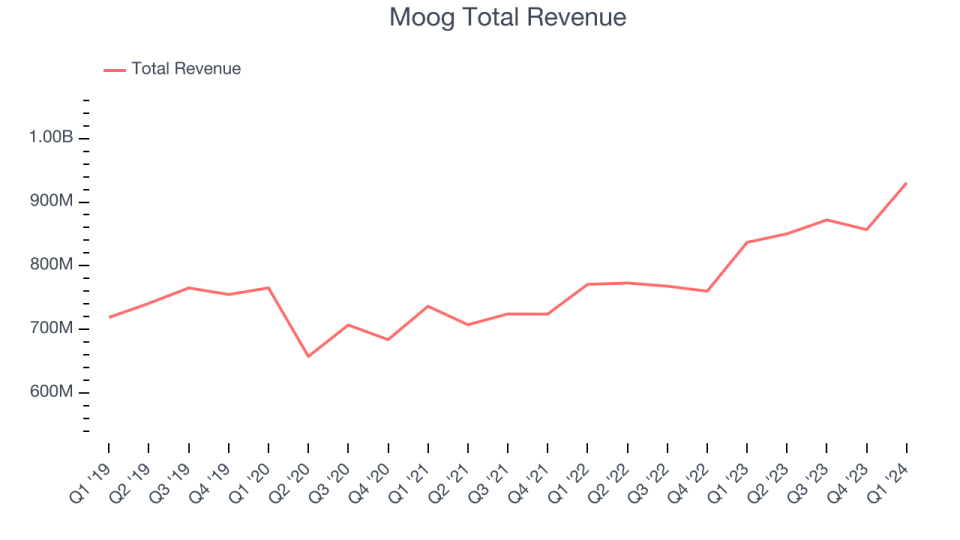

Best Q1: Moog (NYSE:MOG.A)

Responsible for the flight control actuation system integrated in the B-2 stealth bomber, Moog (NYSE:MOG.A) provides precision motion control solutions used in aerospace and defense applications.

Moog reported revenues of $930.3 million, up 11.2% year on year, outperforming analysts' expectations by 6.5%. It was an incredible quarter for the company, with a solid beat of analysts' revenue estimates.

The stock is up 7.1% since the results and currently trades at $168.4.

Is now the time to buy Moog? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Textron (NYSE:TXT)

Listed on the NYSE in 1947, Textron (NYSE:TXT) provides products and services in the aerospace, defense, industrial, and finance sectors.

Textron reported revenues of $3.14 billion, up 3.7% year on year, falling short of analysts' expectations by 4%. It was a weak quarter for the company, with a miss of analysts' organic revenue estimates.

Textron had the weakest performance against analyst estimates in the group. The stock is down 8.7% since the results and currently trades at $85.78.

Read our full analysis of Textron's results here.

Ducommun (NYSE:DCO)

Recognized as the oldest continuously operating business in California, Ducommun (NYSE:DCO) specializes in providing essential components and systems for the aerospace and defense markets.

Ducommun reported revenues of $190.8 million, up 5.3% year on year, in line with analysts' expectations. It was a very strong quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is up 4.8% since the results and currently trades at $58.24.

Read our full, actionable report on Ducommun here, it's free.

HEICO (NYSE:HEI)

Offering niche components and composite materials to multiple industries, HEICO (NYSE:HEI) manufactures aerospace components and electronic systems.

HEICO reported revenues of $955.4 million, up 38.9% year on year, in line with analysts' expectations. It was a solid quarter for the company, with a decent beat of analysts' earnings estimates.

The stock is up 1% since the results and currently trades at $224.

Read our full, actionable report on HEICO here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance