Q1 Rundown: International Paper (NYSE:IP) Vs Other Industrial Packaging Stocks

As the Q1 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers in the industrial packaging industry, including International Paper (NYSE:IP) and its peers.

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

The 9 industrial packaging stocks we track reported a mixed Q1; on average, revenues missed analyst consensus estimates by 1.6%. while next quarter's revenue guidance was 2.1% below consensus. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and while some of the industrial packaging stocks have fared somewhat better than others, they collectively declined, with share prices falling 0.2% on average since the previous earnings results.

International Paper (NYSE:IP)

Established in 1898, International Paper (NYSE:IP) produces containerboard, pulp, paper, and materials used in packaging and printing applications.

International Paper reported revenues of $4.62 billion, down 8% year on year, exceeding analysts' expectations by 2.7%. Overall, it was a good quarter for the company with a solid beat of analysts' Cellulose Fibers revenue estimates.

"International Paper made progress executing our strategic initiatives in the first quarter,'' said Mark Sutton, Chairman and Chief Executive Officer. "We saw commercial benefits from our business strategies, as well as cost benefits from mill system optimization.

The stock is up 24.1% since reporting and currently trades at $42.7.

Is now the time to buy International Paper? Access our full analysis of the earnings results here, it's free.

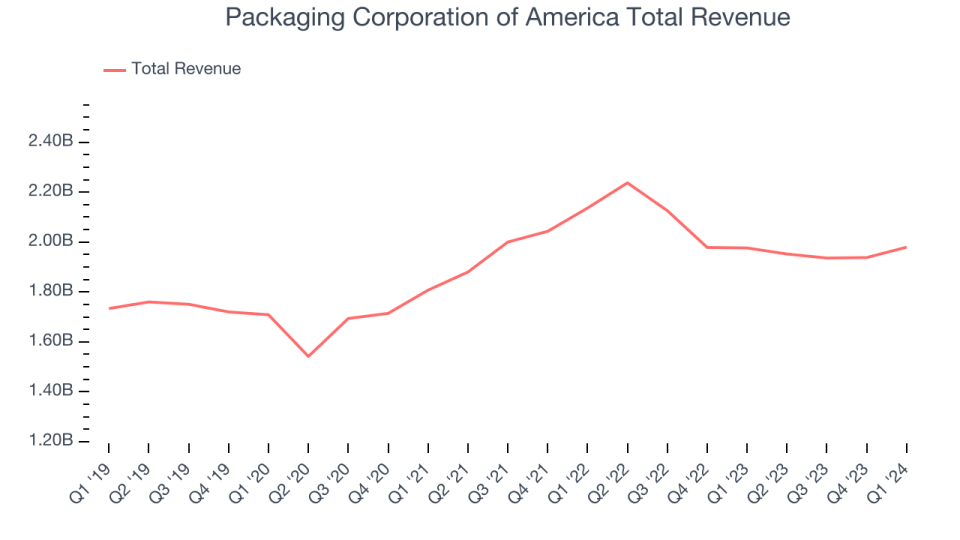

Best Q1: Packaging Corporation of America (NYSE:PKG)

Founded in 1959, Packaging Corporation of America (NYSE: PKG) produces containerboard and corrugated packaging products, also offering displays and protective packaging solutions.

Packaging Corporation of America reported revenues of $1.98 billion, flat year on year, outperforming analysts' expectations by 3.7%. It was an exceptional quarter for the company with an impressive beat of analysts' volume estimates and a narrow beat of analysts' earnings estimates.

The stock is flat since reporting and currently trades at $179.67.

Is now the time to buy Packaging Corporation of America? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Silgan Holdings (NYSE:SLGN)

Established in 1987, Silgan Holdings (NYSE:SLGN) is a supplier of rigid packaging for consumer goods products, specializing in metal containers, closures, and plastic packaging.

Silgan Holdings reported revenues of $1.32 billion, down 7.1% year on year, falling short of analysts' expectations by 4.1%. It was a weak quarter for the company with a miss of analysts' organic revenue estimates.

As expected, the stock is down 8.8% since the results and currently trades at $42.56.

Read our full analysis of Silgan Holdings's results here.

Sealed Air (NYSE:SEE)

Founded in 1960, Sealed Air Corporation (NYSE: SEE) specializes in the development and production of protective and food packaging solutions, serving a variety of industries.

Sealed Air reported revenues of $1.33 billion, down 1.4% year on year, surpassing analysts' expectations by 3.8%. Looking more broadly, it was a very strong quarter for the company with an impressive beat of analysts' earnings estimates.

Sealed Air pulled off the biggest analyst estimates beat among its peers. The stock is up 7.9% since reporting and currently trades at $34.63.

Read our full, actionable report on Sealed Air here, it's free.

Ball (NYSE:BALL)

Started with a $200 loan in 1880, Ball (NYSE:BLL) manufactures aluminum packaging for beverages, personal care, and household products as well as aerospace systems and other technologies.

Ball reported revenues of $2.87 billion, down 17.6% year on year, falling short of analysts' expectations by 8.8%. Looking more broadly, it was a strong quarter for the company with an impressive beat of analysts' earnings estimates and a solid beat of analysts' organic revenue estimates.

Ball had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is down 8.8% since reporting and currently trades at $59.7.

Read our full, actionable report on Ball here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance