Q1 Rundown: Evolv (NASDAQ:EVLV) Vs Other Electrical Systems Stocks

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Evolv (NASDAQ:EVLV) and the best and worst performers in the electrical systems industry.

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

The 11 electrical systems stocks we track reported a weaker Q1; on average, revenues were in line with analyst consensus estimates. while next quarter's revenue guidance was below consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, and while some of the electrical systems stocks have fared somewhat better than others, they collectively declined, with share prices falling 4.8% on average since the previous earnings results.

Evolv (NASDAQ:EVLV)

Incorporating the use of AI algorithms to adapt to new threats, Evolv (NASDAQCM:EVLV) offers physical security screening systems and related software to the transportation, entertainment, government, education, and healthcare sectors.

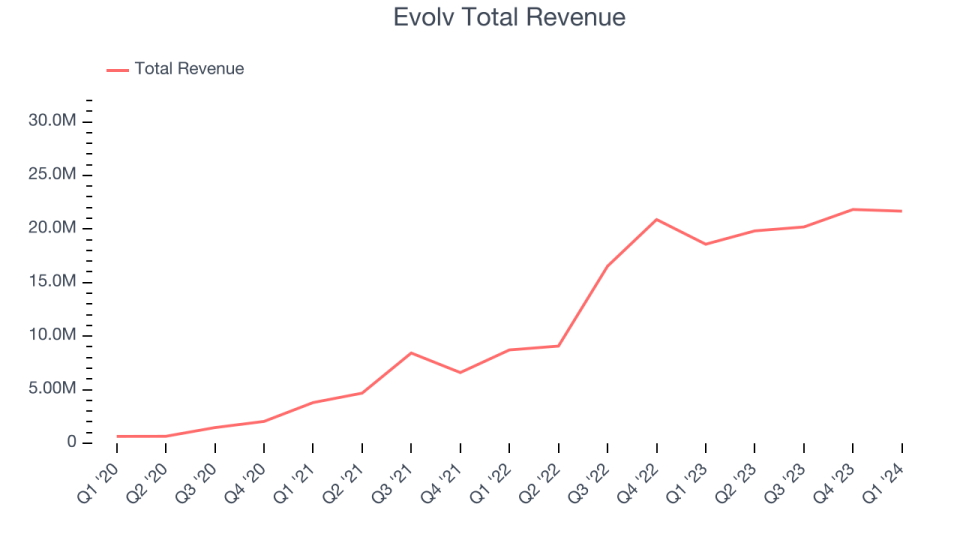

Evolv reported revenues of $21.67 million, up 16.6% year on year, falling short of analysts' expectations by 6%. It was a weak quarter for the company, with a miss of analysts' revenue and gross margin estimates.

Evolv scored the fastest revenue growth but had the weakest performance against analyst estimates of the whole group. The stock is down 38.1% since the results and currently trades at $2.38.

Is now the time to buy Evolv? Access our full analysis of the earnings results here, it's free.

Best Q1: Encore Wire (NASDAQ:WIRE)

Started in a small warehouse in Texas in 1989, Encore Wire (NASDAQ:WIRE) manufactures a range of electrical building wire and cables.

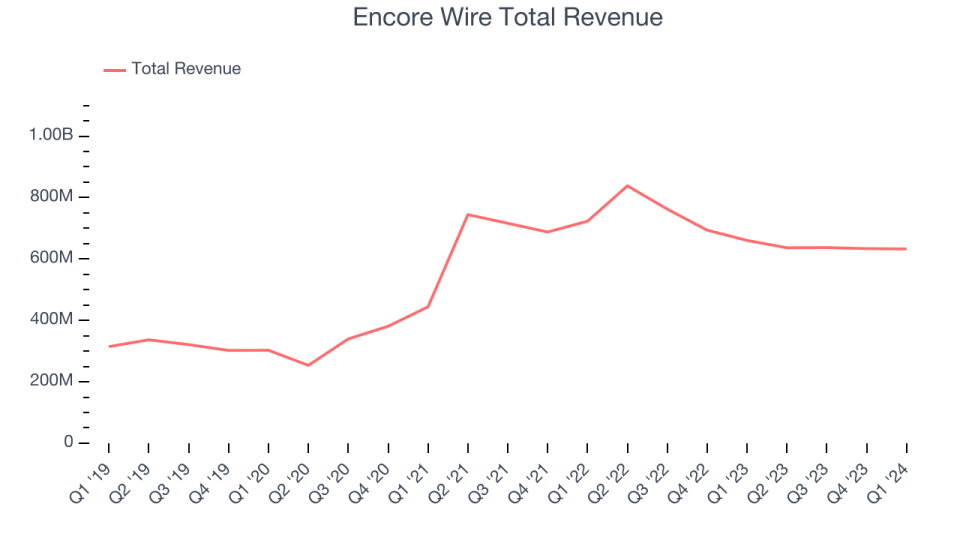

Encore Wire reported revenues of $632.7 million, down 4.2% year on year, outperforming analysts' expectations by 7.3%. It was an impressive quarter for the company, with a solid beat of analysts' revenue and EPS estimates.

Encore Wire achieved the biggest analyst estimates beat among its peers. The stock is up 2.2% since the results and currently trades at $289.95.

Is now the time to buy Encore Wire? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Identiv (NASDAQ:INVE)

Emerging from bankruptcy and rebranding in 2013, Identiv (NASDAQCM:INVE) provides digital identity and security solutions for various industries.

Identiv reported revenues of $22.49 million, down 13.5% year on year, falling short of analysts' expectations by 2.2%. It was a weak quarter for the company, with a miss of analysts' revenue and EPS estimates.

The stock is down 18.6% since the results and currently trades at $4.11.

Read our full analysis of Identiv's results here.

Whirlpool (NYSE:WHR)

Credited with introducing the first automatic washing machine, Whirlpool (NYSE:WHR) is a manufacturer of a variety of home appliances.

Whirlpool reported revenues of $4.49 billion, down 3.4% year on year, surpassing analysts' expectations by 1.7%. It was a very strong quarter for the company, with an impressive beat of analysts' volume estimates and a decent beat of analysts' earnings estimates.

Whirlpool achieved the highest full-year guidance raise among its peers. The stock is down 4.5% since the results and currently trades at $100.94.

Read our full, actionable report on Whirlpool here, it's free.

Napco (NASDAQ:NSSC)

The first company to introduce digital alarm communication over telephone lines, Napco (NASDAQGS:NSSC) offers intrusion and fire alarm systems, access control systems, and video surveillance solutions.

Napco reported revenues of $49.27 million, up 13.2% year on year, surpassing analysts' expectations by 1.3%. It was a strong quarter for the company, with a decent beat of analysts' revenue estimates.

The stock is up 25.8% since the results and currently trades at $53.52.

Read our full, actionable report on Napco here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance