Q1 Rundown: Bandwidth (NASDAQ:BAND) Vs Other Software Development Stocks

Earnings results often indicate what direction a company will take in the months ahead. With Q1 now behind us, let’s have a look at Bandwidth (NASDAQ:BAND) and its peers.

As legendary VC investor Marc Andreessen says, "Software is eating the world", and it touches virtually every industry. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming.

The 8 software development stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 1.5%. while next quarter's revenue guidance was in line with consensus. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and software development stocks have had a rough stretch, with share prices down 8.8% on average since the previous earnings results.

Bandwidth (NASDAQ:BAND)

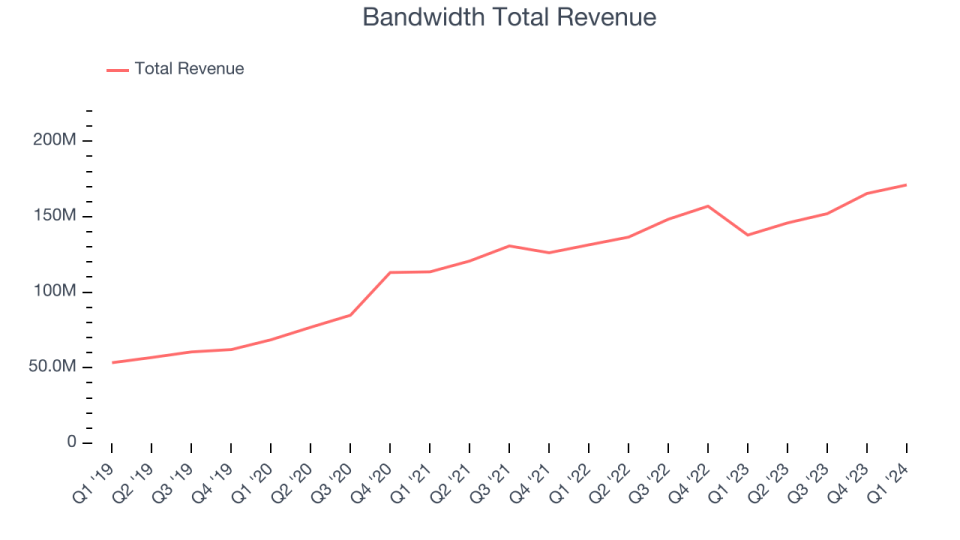

Started in 1999 by David Morken who was later joined by Henry Kaestner as co-founder in 2001, Bandwidth (NASDAQ:BAND) provides thousands of customers with a software platform that uses its own global network to provide phone numbers, voice, and text connectivity.

Bandwidth reported revenues of $171 million, up 24.1% year on year, topping analysts' expectations by 3.6%. It was a solid quarter for the company, with optimistic revenue guidance for the next quarter and a decent beat of analysts' revenue estimates.

"We've had an impressive start to 2024, exceeding our initial forecasts and raising our projections for the remainder of the year. Our direct-to-enterprise business has shown robust growth, marking a 20 percent increase in the first quarter," said David Morken, CEO of Bandwidth.

Bandwidth pulled off the biggest analyst estimates beat and highest full-year guidance raise of the whole group. The stock is up 0.7% since the results and currently trades at $20.69.

Is now the time to buy Bandwidth? Access our full analysis of the earnings results here, it's free.

Best Q1: Datadog (NASDAQ:DDOG)

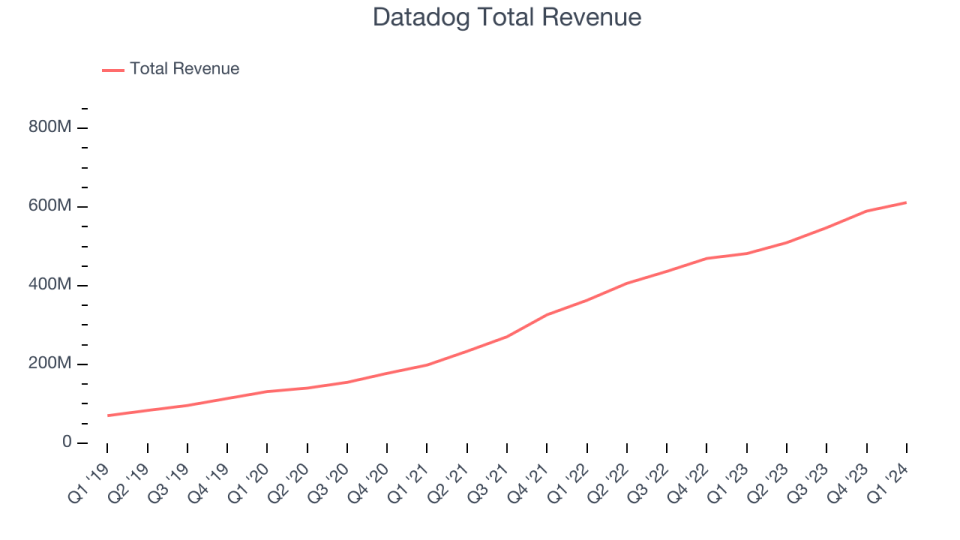

Named after a database the founders had to painstakingly look after at their previous company, Datadog (NASDAQ:DDOG) is a software-as-a-service platform that makes it easier to monitor cloud infrastructure and applications.

Datadog reported revenues of $611.3 million, up 26.9% year on year, outperforming analysts' expectations by 3.3%. It was a strong quarter for the company, with an impressive beat of analysts' ARR (annual recurring revenue) estimates and accelerating growth in large customers.

The stock is down 2.5% since the results and currently trades at $123.76.

Is now the time to buy Datadog? Access our full analysis of the earnings results here, it's free.

Weakest Q1: F5 (NASDAQ:FFIV)

Initially started as a hardware appliances company in the late 1990s, F5 (NASDAQ:FFIV) makes software that helps large enterprises ensure their web applications are always available by distributing network traffic and protecting them from cyberattacks.

F5 reported revenues of $681.4 million, down 3.1% year on year, falling short of analysts' expectations by 0.4%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of analysts' billings estimates.

F5 had the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is down 6.7% since the results and currently trades at $169.9.

Read our full analysis of F5's results here.

Twilio (NYSE:TWLO)

Founded in 2008 by Jeff Lawson, a former engineer at Amazon, Twilio (NYSE:TWLO) is a software as a service platform that makes it really easy for software developers to use text messaging, voice calls and other forms of communication in their apps.

Twilio reported revenues of $1.05 billion, up 4% year on year, surpassing analysts' expectations by 1.4%. It was a mixed quarter for the company, with accelerating customer growth but underwhelming revenue guidance for the next quarter.

The company added 8,000 customers to reach a total of 313,000. The stock is down 6.6% since the results and currently trades at $59.15.

Read our full, actionable report on Twilio here, it's free.

Dynatrace (NYSE:DT)

Founded in Austria in 2005, Dynatrace (NYSE:DT) provides companies with software that allows them to monitor the performance of their full technology stack, from software applications to the infrastructure they run on.

Dynatrace reported revenues of $380.8 million, up 21.1% year on year, surpassing analysts' expectations by 1.4%. It was a weaker quarter for the company, with full-year revenue guidance missing analysts' expectations and management forecasting growth to slow.

The stock is up 1% since the results and currently trades at $46.86.

Read our full, actionable report on Dynatrace here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance