Q1 Earnings Roundup: The Real Brokerage (NASDAQ:REAX) And The Rest Of The Real Estate Services Segment

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how real estate services stocks fared in Q1, starting with The Real Brokerage (NASDAQ:REAX).

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

The 14 real estate services stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 4.2%. while next quarter's revenue guidance was 4% below consensus. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and real estate services stocks have held roughly steady amidst all this, with share prices up 0.1% on average since the previous earnings results.

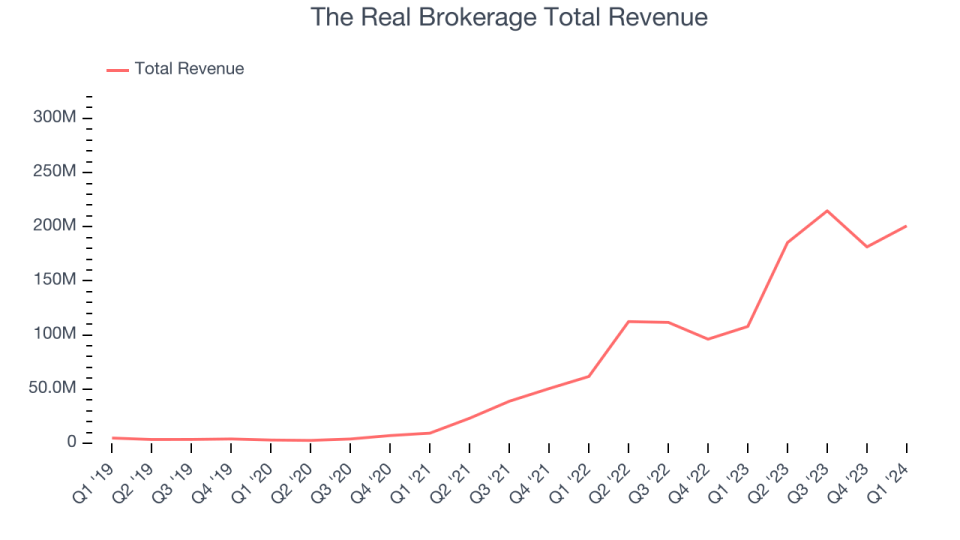

The Real Brokerage (NASDAQ:REAX)

Founded in Toronto, Canada in 2014, The Real Brokerage (NASDAQ:REAX) is a technology-driven real estate brokerage firm combining a tech-centric model with an agent-centric philosophy.

The Real Brokerage reported revenues of $200.7 million, up 86.1% year on year, exceeding analysts' expectations by 17.6%. Overall, it was a mixed quarter for the company. The Real Brokerage blew past analysts' revenue expectations this quarter as its completed real estate transactions grew 88% year on year to $7.5 billion. On the other hand, its operating margin missed and its EPS fell short of Wall Street's estimates.

"Real delivered exceptional results in what is traditionally the lowest revenue quarter of the year, while setting a new quarterly record for net agent additions, which surpassed 3,000. This performance clearly demonstrates the strong appeal of our agent value proposition in the marketplace," said Tamir Poleg, Real’s Chairman and Chief Executive Officer.

The Real Brokerage achieved the biggest analyst estimates beat and fastest revenue growth of the whole group. The stock is up 18.2% since reporting and currently trades at $4.94.

Is now the time to buy The Real Brokerage? Access our full analysis of the earnings results here, it's free.

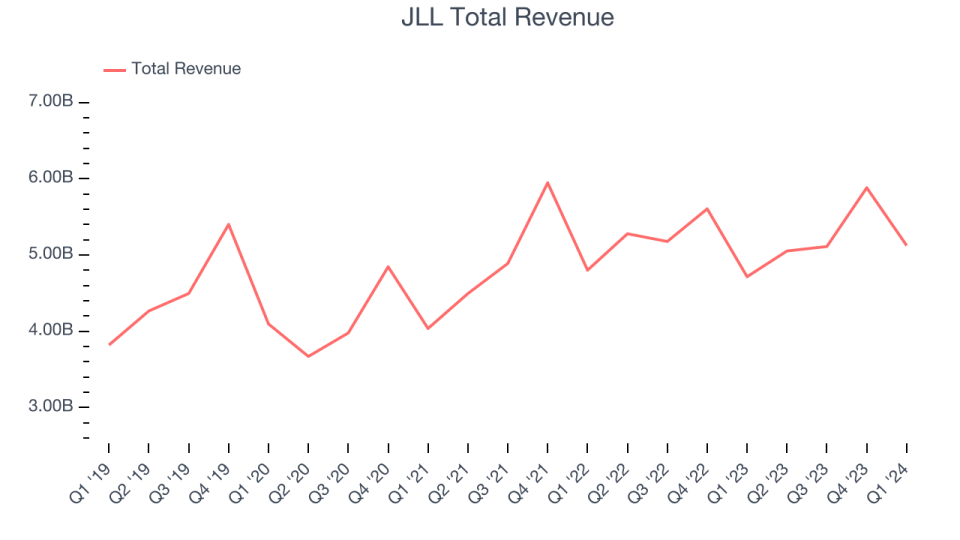

Best Q1: JLL (NYSE:JLL)

Founded in 1999 through the merger of Jones Lang Wootton and LaSalle Partners, JLL (NYSE:JLL) is a company specializing in real estate advisory and investment management services.

JLL reported revenues of $5.12 billion, up 8.7% year on year, outperforming analysts' expectations by 6.4%. It was a stunning quarter for the company with an impressive beat of analysts' earnings estimates and a decent beat of analysts' Capital Markets revenue estimates.

The market seems happy with the results as the stock is up 11.2% since reporting. It currently trades at $206.04.

Is now the time to buy JLL? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Anywhere Real Estate (NYSE:HOUS)

Formerly known as Realogy Holdings, Anywhere Real Estate (NYSE:HOUS) is a residential real estate company with a network of brokerages, franchises, and settlement services.

Anywhere Real Estate reported revenues of $1.13 billion, flat year on year, falling short of analysts' expectations by 1.8%. It was a weak quarter for the company with a miss of analysts' earnings estimates.

Anywhere Real Estate posted the weakest performance against analyst estimates in the group. As expected, the stock is down 40% since the results and currently trades at $3.25.

Read our full analysis of Anywhere Real Estate's results here.

Marcus & Millichap (NYSE:MMI)

Founded in 1971, Marcus & Millichap (NYSE:MMI) specializes in commercial real estate investment sales, financing, research, and advisory services.

Marcus & Millichap reported revenues of $129.1 million, down 16.6% year on year, surpassing analysts' expectations by 1.3%. Looking more broadly, it was an ok quarter for the company with a decent beat of analysts' earnings estimates.

The stock is down 4.9% since reporting and currently trades at $31.74.

Read our full, actionable report on Marcus & Millichap here, it's free.

Cushman & Wakefield (NYSE:CWK)

With expertise in the commercial real estate sector, Cushman & Wakefield (NYSE:CWK) is a global Chicago-based real estate firm offering a comprehensive range of services to clients.

Cushman & Wakefield reported revenues of $2.18 billion, down 2.9% year on year, in line with analysts' expectations. Looking more broadly, it was a very strong quarter for the company with an impressive beat of analysts' earnings estimates.

The stock is up 10% since reporting and currently trades at $10.91.

Read our full, actionable report on Cushman & Wakefield here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance