Q1 Earnings Roundup: DXP (NASDAQ:DXPE) And The Rest Of The Maintenance and Repair Distributors Segment

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the maintenance and repair distributors stocks, including DXP (NASDAQ:DXPE) and its peers.

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Maintenance and repair distributors that boast reliable selection and quickly deliver products to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to serve customers everywhere. Additionally, maintenance and repair distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

The 7 maintenance and repair distributors stocks we track reported a slower Q1; on average, revenues were in line with analyst consensus estimates. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, and maintenance and repair distributors stocks have had a rough stretch, with share prices down 11.5% on average since the previous earnings results.

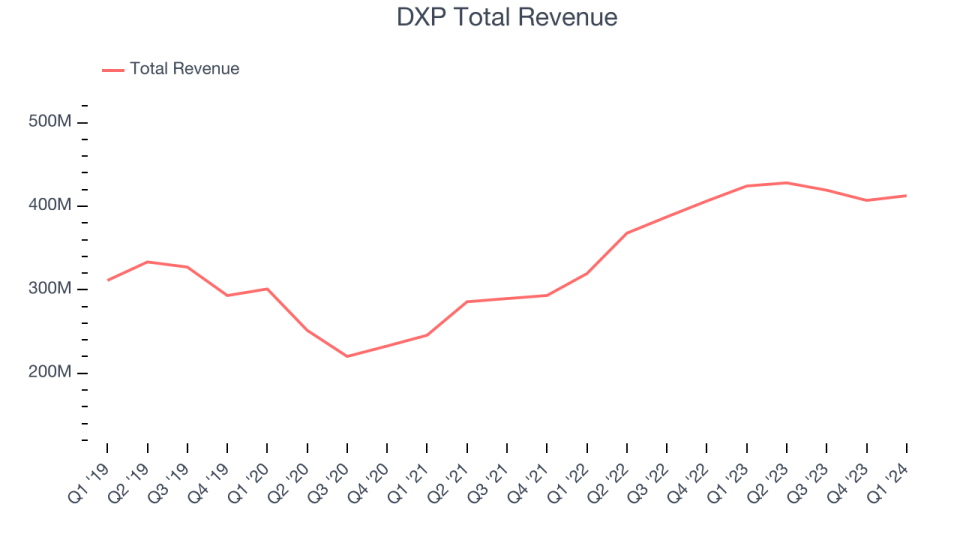

DXP (NASDAQ:DXPE)

Founded as Southern Engine and Pump Company, DXP Enterprises (NASDAQ:DXPE) is an industrial distributor that sells pumps, motors, metal milling and threading tools, and safety equipment like goggles, among other products and services.

DXP reported revenues of $412.6 million, down 2.7% year on year, in line with analysts' expectations. It was a weak quarter for the company, with a miss of analysts' operating margin and earnings estimates.

David R. Little, Chairman and Chief Executive Officer commented, “Our first quarter results reflect sequential sales growth driven by acquisitions, strong free cash flow, and continued efforts to expand and grow our business. We are encouraged by the sequential increases and the start to the year. As we look ahead to the rest of 2024, we remain optimistic around market conditions, our ability to execute our growth initiatives and the diversity of our end markets to deliver growth in 2024. DXP’s first quarter 2024 sales were $412.6 million. In terms of our business segments for the first quarter of 2024, sales were $288.4 million for Service Centers, $62.2 million for Innovative Pumping Solutions, and $62.0 million for Supply Chain Services. We believe we are well positioned to outgrow the market and to generate improved operating margins and returns for the benefit of our shareholders as we move further into 2024.”

The stock is down 17.4% since the results and currently trades at $46.03.

Is now the time to buy DXP? Access our full analysis of the earnings results here, it's free.

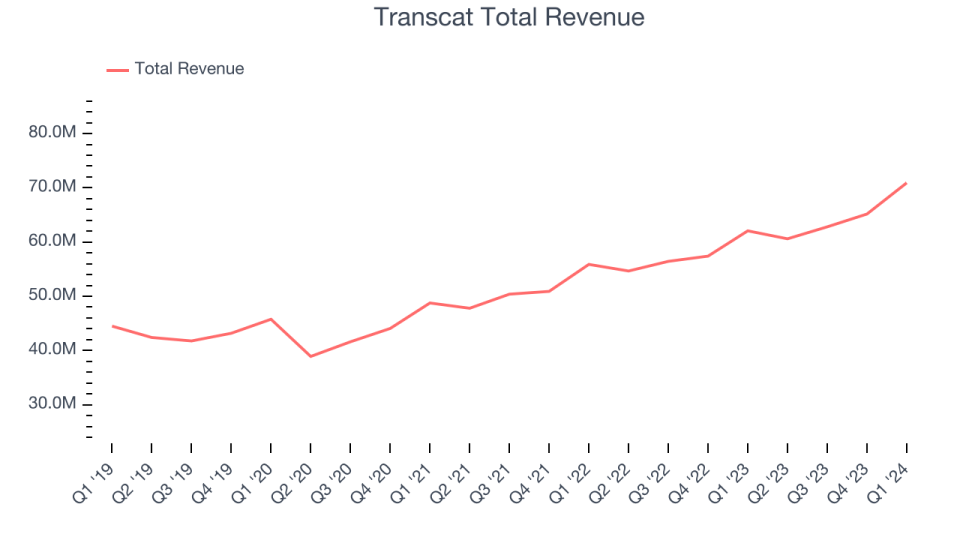

Best Q1: Transcat (NASDAQ:TRNS)

Serving the pharmaceutical, industrial manufacturing, energy, and chemical process industries, Transcat (NASDAQ:TRNS) provides measurement instruments and supplies.

Transcat reported revenues of $70.91 million, up 14.3% year on year, outperforming analysts' expectations by 3.4%. It was an incredible quarter for the company, with an impressive beat of analysts' earnings estimates.

Transcat delivered the biggest analyst estimates beat among its peers. The stock is down 4.8% since the results and currently trades at $117.84.

Is now the time to buy Transcat? Access our full analysis of the earnings results here, it's free.

Weakest Q1: MSC Industrial (NYSE:MSM)

Founded in NYC’s Little Italy, MSC Industrial Direct (NYSE:MSM) provides industrial supplies and equipment, offering vast and reliable selection for customers such as contractors

MSC Industrial reported revenues of $935.3 million, down 2.7% year on year, falling short of analysts' expectations by 1.6%. It was a weak quarter for the company, with a miss of analysts' operating margin and organic revenue estimates.

MSC Industrial had the weakest performance against analyst estimates in the group. The stock is down 20.7% since the results and currently trades at $78.87.

Read our full analysis of MSC Industrial's results here.

W.W. Grainger (NYSE:GWW)

Founded as a supplier of motors, W.W. Grainger (NYSE:GWW) provides maintenance, repair, and operating (MRO) supplies and services to businesses and institutions.

W.W. Grainger reported revenues of $4.24 billion, up 3.5% year on year, falling short of analysts' expectations by 0.5%. It was a mixed quarter for the company, with a miss of analysts' operating margin estimates.

The stock is down 5.2% since the results and currently trades at $908.79.

Read our full, actionable report on W.W. Grainger here, it's free.

Fastenal (NASDAQ:FAST)

Founded in 1967, Fastenal (NASDAQ:FAST) provides industrial and construction supplies, including fasteners, tools, safety products, and many other product categories to businesses globally.

Fastenal reported revenues of $1.90 billion, up 1.9% year on year, falling short of analysts' expectations by 1%. It was a weak quarter for the company, with a miss of analysts' revenue and earnings estimates.

The stock is down 15% since the results and currently trades at $63.5.

Read our full, actionable report on Fastenal here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance