Q1 Earnings Recap: Commvault Systems (NASDAQ:CVLT) Tops Data and Analytics Software Stocks

As the Q1 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers in the data and analytics software industry, including Commvault Systems (NASDAQ:CVLT) and its peers.

Data is the lifeblood of the internet and software, and its importance to businesses continues to accelerate. Tracking sensors, ubiquitous mobile devices, and every action in every app are producing an explosion of analyzable data which increasingly gets stored in public cloud environments. This drives demand for a variety of software solutions, from databases to analytics software, which help companies derive actionable insights from the data to better understand customer preferences, supply chains, and forecast at ever more granular levels to improve their competitive advantage.

The 9 data and analytics software stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 2%. while next quarter's revenue guidance was in line with consensus. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and while some of the data and analytics software stocks have fared somewhat better than others, they collectively declined, with share prices falling 0.3% on average since the previous earnings results.

Best Q1: Commvault Systems (NASDAQ:CVLT)

Originally formed in 1988 as part of Bell Labs, Commvault (NASDAQ: CVLT) provides enterprise software used for data backup and recovery, cloud and infrastructure management, retention, and compliance.

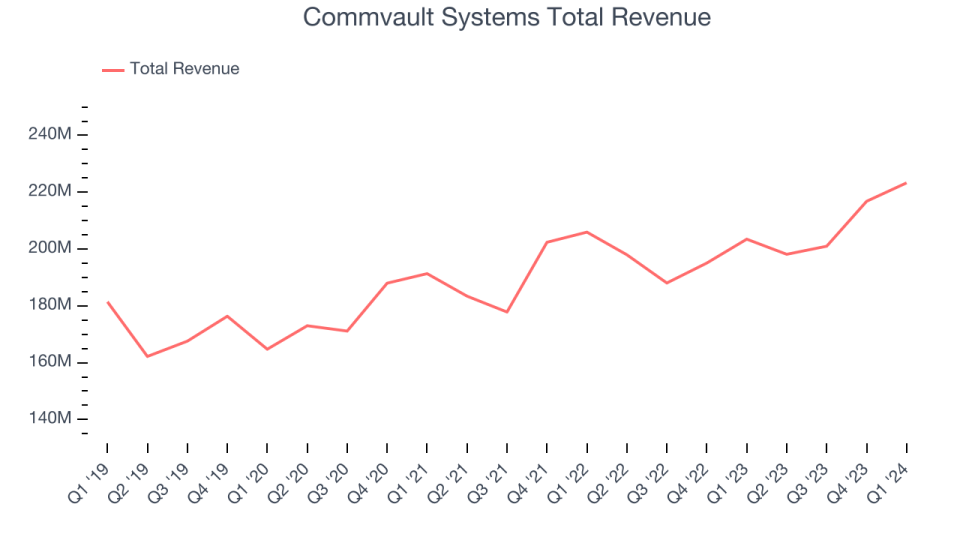

Commvault Systems reported revenues of $223.3 million, up 9.7% year on year, topping analysts' expectations by 5.1%. It was a very strong quarter for the company, with management forecasting accelerating growth and a solid beat of analysts' billings estimates.

"We had an outstanding quarter and a breakout year, highlighted by 10% total revenue growth and 15% total ARR growth in the fourth quarter," said Sanjay Mirchandani, President and CEO.

Commvault Systems achieved the highest full-year guidance raise of the whole group. The stock is up 11.6% since the results and currently trades at $111.

Is now the time to buy Commvault Systems? Access our full analysis of the earnings results here, it's free.

DigitalOcean (NYSE:DOCN)

Started by brothers Ben and Moisey Uretsky, DigitalOcean (NYSE: DOCN) provides a simple, low-cost platform that allows developers and small and medium-sized businesses to host applications and data in the cloud.

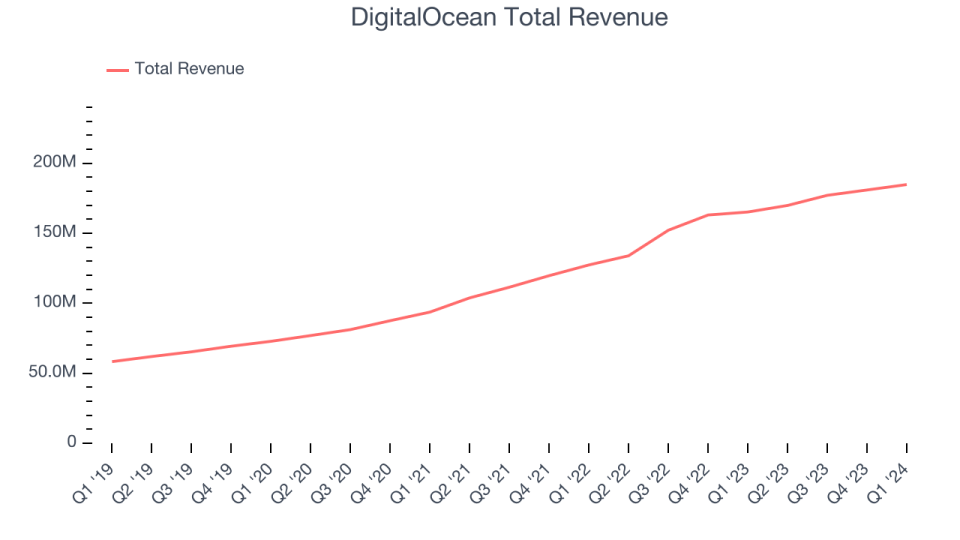

DigitalOcean reported revenues of $184.7 million, up 11.9% year on year, outperforming analysts' expectations by 1.2%. It was a decent quarter for the company, with a significant improvement in its gross margin.

The stock is up 11.5% since the results and currently trades at $36.32.

Is now the time to buy DigitalOcean? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Teradata (NYSE:TDC)

Part of point-of-sale and ATM company NCR from 1991 to 2007, Teradata (NYSE:TDC) offers a software-as-service platform that helps organizations manage their data across multiple storages and analyze it.

Teradata reported revenues of $465 million, down 2.3% year on year, in line with analysts' expectations. It was a weak quarter for the company, with a miss of analysts' billings estimates.

Teradata had the slowest revenue growth in the group. The stock is down 16.1% since the results and currently trades at $31.85.

Read our full analysis of Teradata's results here.

Health Catalyst (NASDAQ:HCAT)

Founded by healthcare professionals Tom Burton and Steve Barlow in 2008, Health Catalyst (NASDAQ:HCAT) provides data and analytics technology to healthcare organizations, enabling them to improve care and lower costs.

Health Catalyst reported revenues of $74.72 million, up 1.2% year on year, falling short of analysts' expectations by 0.1%. It was a weaker quarter for the company, with underwhelming revenue guidance for the next quarter and full-year revenue guidance missing analysts' expectations.

Health Catalyst had the weakest performance against analyst estimates and weakest full-year guidance update among its peers. The stock is down 2.4% since the results and currently trades at $6.51.

Read our full, actionable report on Health Catalyst here, it's free.

Palantir (NYSE:PLTR)

Started by Peter Thiel after seeing US defence agencies struggle in the aftermath of the 2001 terrorist attacks, Palantir (NYSE:PLTR) offers software as a service platform that helps government agencies and large enterprises use data to make better decisions.

Palantir reported revenues of $634.3 million, up 20.8% year on year, surpassing analysts' expectations by 2.7%. It was a slower quarter for the company, with a miss of analysts' billings estimates.

The stock is down 16.5% since the results and currently trades at $21.04.

Read our full, actionable report on Palantir here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance