Q1 Earnings Outperformers: Vertiv (NYSE:VRT) And The Rest Of The Electrical Systems Stocks

Let's dig into the relative performance of Vertiv (NYSE:VRT) and its peers as we unravel the now-completed Q1 electrical systems earnings season.

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

The 12 electrical systems stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 0.6%. while next quarter's revenue guidance was 101% below consensus. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and electrical systems stocks have held roughly steady amidst all this, with share prices up 1% on average since the previous earnings results.

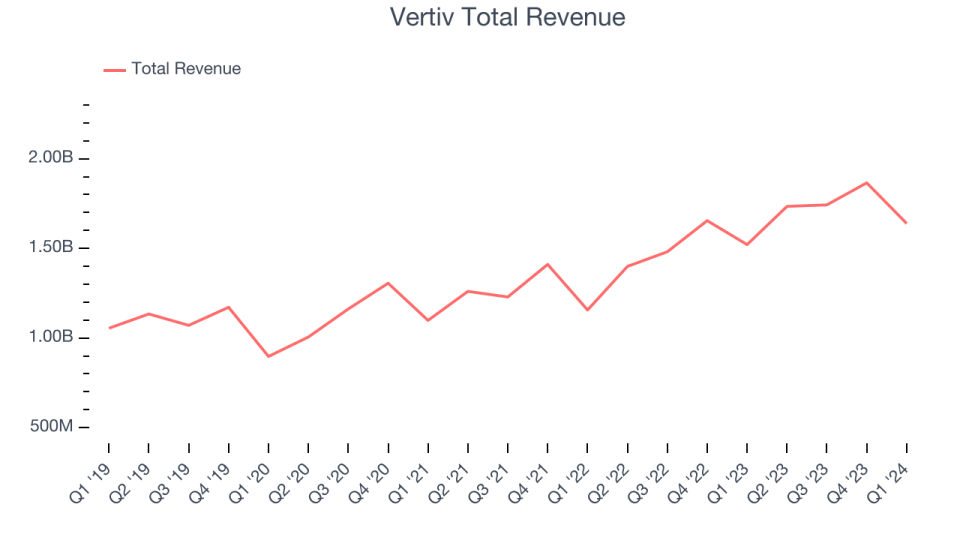

Vertiv (NYSE:VRT)

Formerly part of Emerson Electric, Vertiv (NYSE:VRT) manufactures and services infrastructure technology products for data centers and communication networks.

Vertiv reported revenues of $1.64 billion, up 7.8% year on year, in line with analysts' expectations. It was a slower quarter for the company with a miss of analysts' earnings estimates and full-year revenue guidance missing analysts' expectations.

“Vertiv’s robust momentum in 2023 continued into the first quarter of 2024, led by strength in orders, which grew 60%, exceeding our expectations and reflecting increasing pipeline velocity and acceleration of AI-driven demand,” said Giordano Albertazzi, Vertiv’s Chief Executive Officer.

Vertiv delivered the weakest full-year guidance update of the whole group. The stock is up 18.2% since reporting and currently trades at $93.59.

Is now the time to buy Vertiv? Access our full analysis of the earnings results here, it's free.

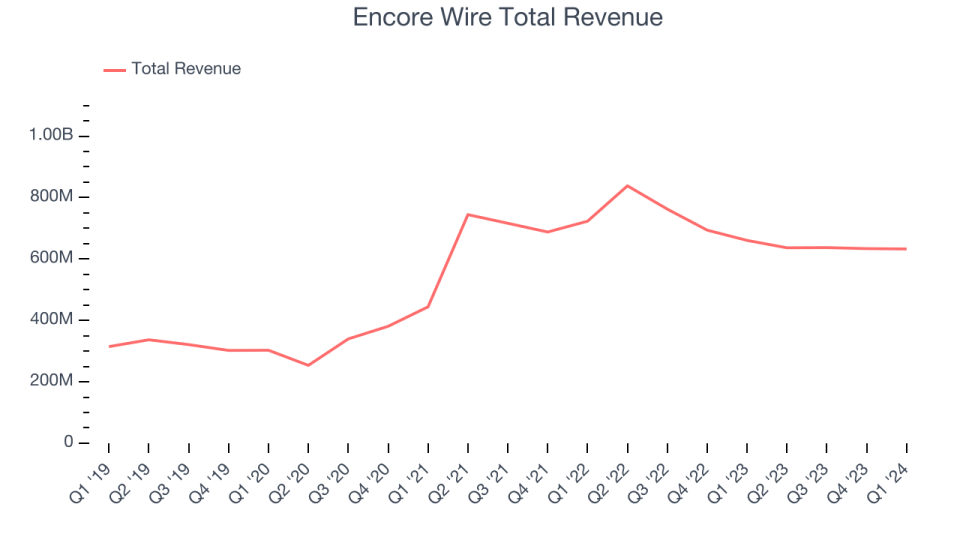

Best Q1: Encore Wire (NASDAQ:WIRE)

Started in a small warehouse in Texas in 1989, Encore Wire (NASDAQ:WIRE) manufactures a range of electrical building wire and cables.

Encore Wire reported revenues of $632.7 million, down 4.2% year on year, outperforming analysts' expectations by 7.3%. It was an impressive quarter for the company with a decent beat of analysts' earnings estimates.

Encore Wire delivered the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 2.2% since reporting. It currently trades at $289.95.

Is now the time to buy Encore Wire? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Identiv (NASDAQ:INVE)

Emerging from bankruptcy and rebranding in 2013, Identiv (NASDAQCM:INVE) provides digital identity and security solutions for various industries.

Identiv reported revenues of $22.49 million, down 13.5% year on year, falling short of analysts' expectations by 2.2%. It was a weak quarter for the company with a miss of analysts' earnings estimates.

As expected, the stock is down 21.2% since the results and currently trades at $3.98.

Read our full analysis of Identiv's results here.

Sanmina (NASDAQ:SANM)

Having partnered with NASA in its space missions, Sanmina (NASDAQ:SANM) is an electronics manufacturing services company offering end-to-end solutions for various industries.

Sanmina reported revenues of $1.83 billion, down 20.9% year on year, falling short of analysts' expectations by 2.8%. Looking more broadly, it was a weak quarter for the company with a miss of analysts' earnings estimates.

Sanmina had the slowest revenue growth among its peers. The stock is up 5.6% since reporting and currently trades at $67.69.

Read our full, actionable report on Sanmina here, it's free.

Acuity Brands (NYSE:AYI)

One of the pioneers of smart lights, Acuity (NYSE:AYI) designs and manufactures light fixtures and building management systems used in various industries.

Acuity Brands reported revenues of $968.1 million, down 3.2% year on year, falling short of analysts' expectations by 2.9%. Looking more broadly, it was a weak quarter for the company with a miss of analysts' organic revenue estimates.

Acuity Brands had the weakest performance against analyst estimates among its peers. The stock is flat since reporting and currently trades at $238.8.

Read our full, actionable report on Acuity Brands here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance