Q1 Earnings Highs And Lows: Sensata Technologies (NYSE:ST) Vs The Rest Of The Analog Semiconductors Stocks

As the Q1 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers in the analog semiconductors industry, including Sensata Technologies (NYSE:ST) and its peers.

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 15 analog semiconductors stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 1.9%. while next quarter's revenue guidance was in line with consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, but analog semiconductors stocks have performed well, with the share prices up 18.8% on average since the previous earnings results.

Sensata Technologies (NYSE:ST)

Originally a temperature sensor control maker and a subsidiary of Texas Instruments for 60 years, Sensata Technology Holdings (NYSE: ST) is a leading supplier of analog sensors used in industrial and transportation applications, best known for its dominant position in the tire pressure monitoring systems in cars.

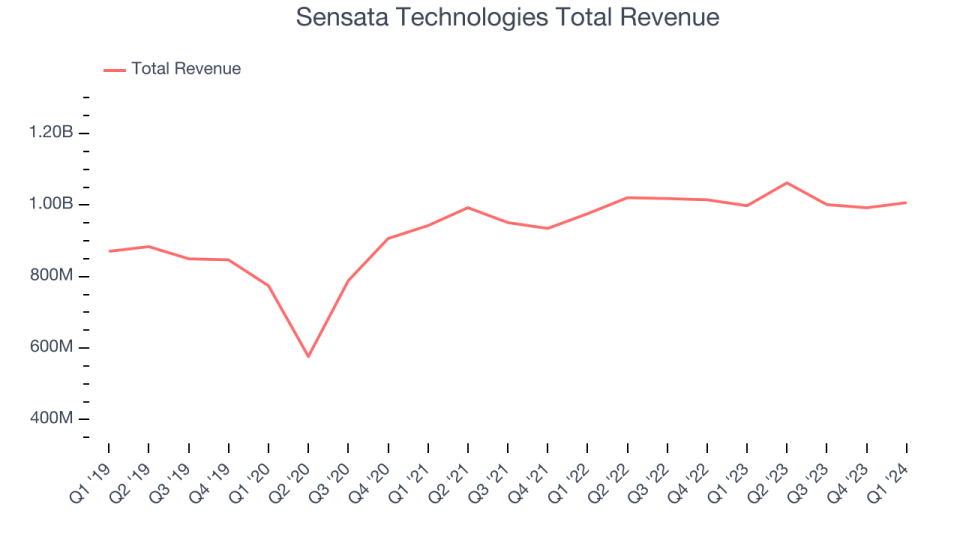

Sensata Technologies reported revenues of $1.01 billion, flat year on year, exceeding analysts' expectations by 2.1%. Overall, it was a decent quarter for the company with a solid beat of analysts' EPS estimates but a decline in its gross margin.

“We are pleased to report a solid start to 2024, with first quarter revenue and adjusted operating margins towards the high end of our guidance range,” said Jeff Cote, CEO and President of Sensata.

The stock is up 14% since reporting and currently trades at $40.70.

Is now the time to buy Sensata Technologies? Access our full analysis of the earnings results here, it's free.

Best Q1: Impinj (NASDAQ:PI)

Founded by Caltech professor Carver Mead and one of his students Chris Diorio, Impinj (NASDAQ:PI) is a maker of radio-frequency identification (RFID) hardware and software.

Impinj reported revenues of $76.83 million, down 10.6% year on year, outperforming analysts' expectations by 4.4%. It was a very strong quarter for the company with a significant improvement in its inventory levels and an impressive beat of analysts' EPS estimates.

The market seems happy with the results as the stock is up 39% since reporting. It currently trades at $167.91.

Is now the time to buy Impinj? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Microchip Technology (NASDAQ:MCHP)

Spun out from General Instrument in 1987, Microchip Technology (NASDAQ: MCHP) is a leading provider of microcontrollers and integrated circuits used mainly in the automotive world, especially in electric vehicles and their charging devices.

Microchip Technology reported revenues of $1.33 billion, down 40.6% year on year, falling short of analysts' expectations by 1.2%. It was a weak quarter for the company with underwhelming revenue guidance for the next quarter and a decline in its operating margin.

Microchip Technology posted the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is flat since the results and currently trades at $92.92.

Read our full analysis of Microchip Technology's results here.

Universal Display (NASDAQ:OLED)

Serving major consumer electronics manufacturers, Universal Display (NASDAQ:OLED) is a provider of organic light emitting diode (OLED) technologies used in display and lighting applications.

Universal Display reported revenues of $165.3 million, up 26.7% year on year, surpassing analysts' expectations by 9.9%. Revenue aside, it was a very strong quarter for the company with an impressive beat of analysts' EPS estimates and a significant improvement in its gross margin.

Universal Display delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is up 44.2% since reporting and currently trades at $225.37.

Read our full, actionable report on Universal Display here, it's free.

Monolithic Power Systems (NASDAQ:MPWR)

Founded in 1997 by its longtime CEO Michael Hsing, Monolithic Power Systems (NASDAQ:MPWR) is an analog and mixed signal chipmaker that specializes in power management chips meant to minimize total energy consumption.

Monolithic Power Systems reported revenues of $457.9 million, up 1.5% year on year, surpassing analysts' expectations by 2.9%. Taking a step back, it was a solid quarter for the company with an impressive beat of analysts' EPS estimates and optimistic revenue guidance for the next quarter.

The stock is up 32.4% since reporting and currently trades at $861.45.

Read our full, actionable report on Monolithic Power Systems here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance