Q1 Earnings Highs And Lows: Marvell Technology (NASDAQ:MRVL) Vs The Rest Of The Semiconductor Manufacturing Stocks

Earnings results often indicate what direction a company will take in the months ahead. With Q1 now behind us, let’s have a look at Marvell Technology (NASDAQ:MRVL) and its peers.

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

The 14 semiconductor manufacturing stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 1.3%. while next quarter's revenue guidance was in line with consensus. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, but semiconductor manufacturing stocks have exhibited impressive performance, with the share prices up 10.8% on average since the previous earnings results.

Marvell Technology (NASDAQ:MRVL)

Moving away from a low margin storage device management chips in one of the biggest semiconductor business model pivots of the past decade, Marvell Technology (NASDAQ: MRVL) is a fabless designer of special purpose data processing and networking chips used by data centers, communications carriers, enterprises, and autos.

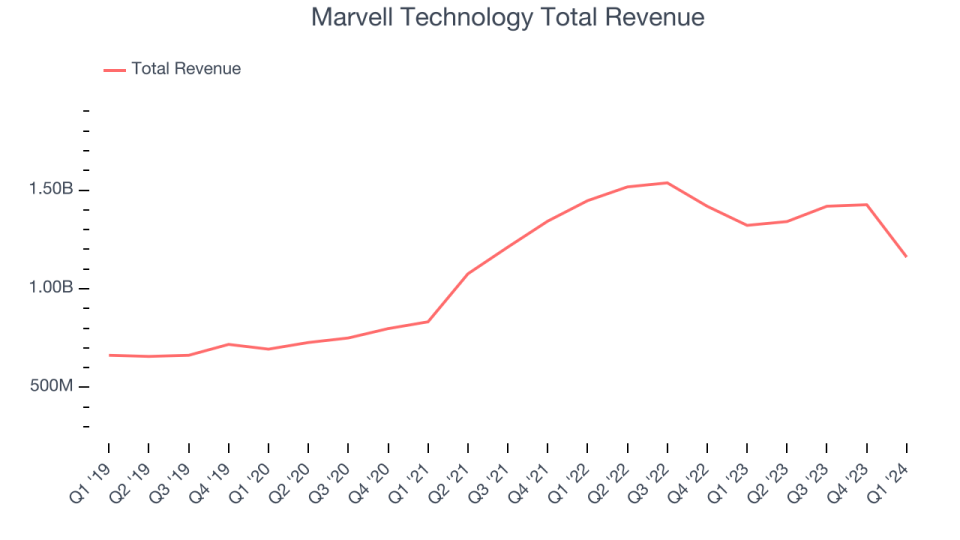

Marvell Technology reported revenues of $1.16 billion, down 12.2% year on year, falling short of analysts' expectations by 0.1%. It was a mixed quarter for the company, with a significant improvement in its gross margin but an increase in its inventory levels.

"Marvell delivered first quarter fiscal 2025 revenue of $1.161 billion, above the mid-point of guidance, driven by stronger than forecasted demand from AI. Our data center revenue grew 87% year over year, with the start of a ramp in our custom AI programs complementing our substantial base of electro-optics revenue," said Matt Murphy, Marvell's Chairman and CEO.

The stock is down 11.9% since the results and currently trades at $67.68.

Read our full report on Marvell Technology here, it's free.

Best Q1: Lam Research (NASDAQ:LRCX)

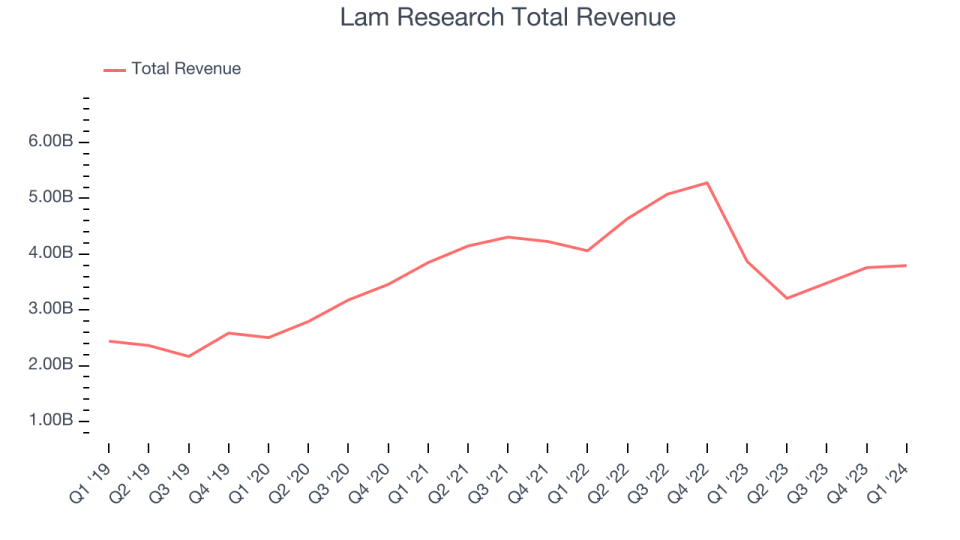

Founded in 1980 by David Lam, who pioneered semiconductor etching technology, Lam Research (NASDAQ:LCRX) is one of the leading providers of the wafer fabrication equipment used to make semiconductors.

Lam Research reported revenues of $3.79 billion, down 2% year on year, outperforming analysts' expectations by 1.7%. It was a strong quarter for the company, with a significant improvement in its gross margin and an impressive beat of analysts' EPS estimates.

The stock is up 21.2% since the results and currently trades at $1,072.

Is now the time to buy Lam Research? Access our full analysis of the earnings results here, it's free.

Kulicke and Soffa (NASDAQ:KLIC)

Headquartered in Singapore, Kulicke & Soffa (NASDAQ: KLIC) is a provider of production equipment and tools used to assemble semiconductor devices

Kulicke and Soffa reported revenues of $172.1 million, down 0.5% year on year, falling short of analysts' expectations by 1.2%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in its operating margin.

The stock is up 3.9% since the results and currently trades at $46.

Read our full analysis of Kulicke and Soffa's results here.

FormFactor (NASDAQ:FORM)

With customers across the foundry and fabless markets, FormFactor (NASDAQ:FORM) is a US-based provider of test and measurement technologies for semiconductors.

FormFactor reported revenues of $168.7 million, flat year on year, surpassing analysts' expectations by 1.7%. It was a decent quarter for the company, with optimistic revenue guidance for the next quarter but a miss of analysts' EPS estimates.

The stock is up 33.2% since the results and currently trades at $58.6.

Read our full, actionable report on FormFactor here, it's free.

Teradyne (NASDAQ:TER)

Sporting most major chip manufacturers as its customers, Teradyne (NASDAQ:TER) is a US-based supplier of automated test equipment for semiconductors as well as other technologies and devices.

Teradyne reported revenues of $599.8 million, down 2.9% year on year, surpassing analysts' expectations by 5.2%. It was a solid quarter for the company, with an impressive beat of analysts' EPS estimates and optimistic revenue guidance for the next quarter.

The stock is up 44% since the results and currently trades at $145.

Read our full, actionable report on Teradyne here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance