Q1 Earnings Highs And Lows: D.R. Horton (NYSE:DHI) Vs The Rest Of The Home Builders Stocks

As the Q1 earnings season wraps, let's dig into this quarter's best and worst performers in the home builders industry, including D.R. Horton (NYSE:DHI) and its peers.

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

The 12 home builders stocks we track reported a decent Q1; on average, revenues beat analyst consensus estimates by 3.8%. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, and home builders stocks have had a rough stretch, with share prices down 6.9% on average since the previous earnings results.

D.R. Horton (NYSE:DHI)

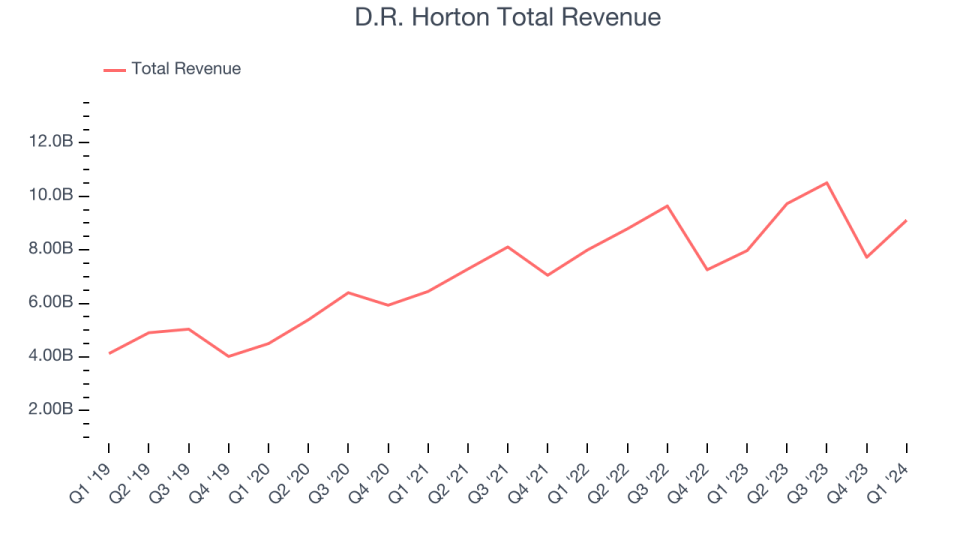

One of the largest homebuilding companies in the US, DR Horton (NYSE:DHI) builds a variety of new construction homes across multiple markets.

D.R. Horton reported revenues of $9.11 billion, up 14.2% year on year, exceeding analysts' expectations by 10.6%. Overall, it was an ok quarter for the company with a solid beat of analysts' earnings estimates but a miss of analysts' backlog sales estimates.

The stock is down 6.6% since reporting and currently trades at $136.07.

Is now the time to buy D.R. Horton? Access our full analysis of the earnings results here, it's free.

Best Q1: Tri Pointe Homes (NYSE:TPH)

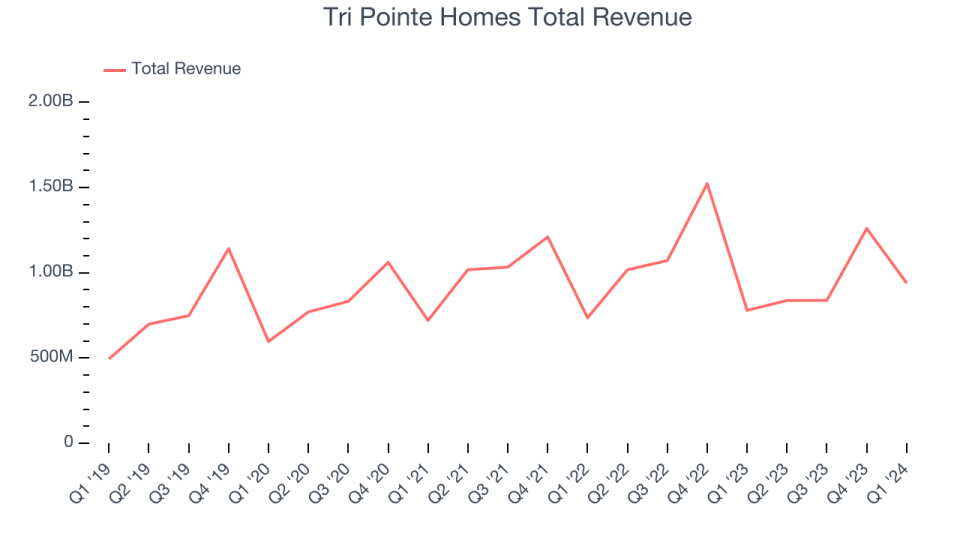

Established in 2009 in California, Tri Pointe Homes (NYSE:TPH) is a United States homebuilder recognized for its innovative and sustainable approach to creating premium, life-enhancing homes.

Tri Pointe Homes reported revenues of $939.4 million, up 20.5% year on year, outperforming analysts' expectations by 8.8%. It was a stunning quarter for the company with an impressive beat of analysts' earnings estimates and a solid beat of analysts' backlog sales estimates.

Tri Pointe Homes pulled off the fastest revenue growth among its peers. The market seems content with the results as the stock is up 1.4% since reporting. It currently trades at $36.65.

Is now the time to buy Tri Pointe Homes? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Skyline Champion (NYSE:SKY)

Founded in 1951, Skyline Champion (NYSE:SKY) is a manufacturer of modular homes and buildings in North America.

Skyline Champion reported revenues of $536.4 million, up 9.1% year on year, falling short of analysts' expectations by 4.4%. It was a weak quarter for the company with a miss of analysts' earnings and volume estimates.

Skyline Champion posted the weakest performance against analyst estimates in the group. As expected, the stock is down 12.3% since the results and currently trades at $68.12.

Read our full analysis of Skyline Champion's results here.

Meritage Homes (NYSE:MTH)

Originally founded in 1985 in Arizona as Monterey Homes, Meritage Homes (NYSE:MTH) is a homebuilder specializing in designing and constructing energy-efficient and single-family homes in the US.

Meritage Homes reported revenues of $1.47 billion, up 14.8% year on year, surpassing analysts' expectations by 15.5%. Looking more broadly, it was a decent quarter for the company with an impressive beat of analysts' earnings estimates but a miss of analysts' backlog sales estimates.

Meritage Homes scored the biggest analyst estimates beat among its peers. The stock is flat since reporting and currently trades at $154.23.

Read our full, actionable report on Meritage Homes here, it's free.

KB Home (NYSE:KBH)

The first homebuilder to be listed on the NYSE, KB Home (NYSE:KB) is a homebuilding company targeting the first-time home buyer and move-up buyer markets.

KB Home reported revenues of $1.71 billion, down 3.1% year on year, surpassing analysts' expectations by 3.4%. Looking more broadly, it was a very strong quarter for the company with a solid beat of analysts' earnings estimates.

The stock is down 1.6% since reporting and currently trades at $66.98.

Read our full, actionable report on KB Home here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance