Q1 Earnings Highlights: NXP Semiconductors (NASDAQ:NXPI) Vs The Rest Of The Analog Semiconductors Stocks

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at NXP Semiconductors (NASDAQ:NXPI) and the best and worst performers in the analog semiconductors industry.

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 15 analog semiconductors stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 1.9%. while next quarter's revenue guidance was in line with consensus. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, but analog semiconductors stocks have performed well, with the share prices up 13.5% on average since the previous earnings results.

NXP Semiconductors (NASDAQ:NXPI)

Spun off from Dutch electronics giant Philips in 2006, NXP Semiconductors (NASDAQ: NXPI) is a designer and manufacturer of chips used in autos, industrial manufacturing, mobile devices, and communications infrastructure.

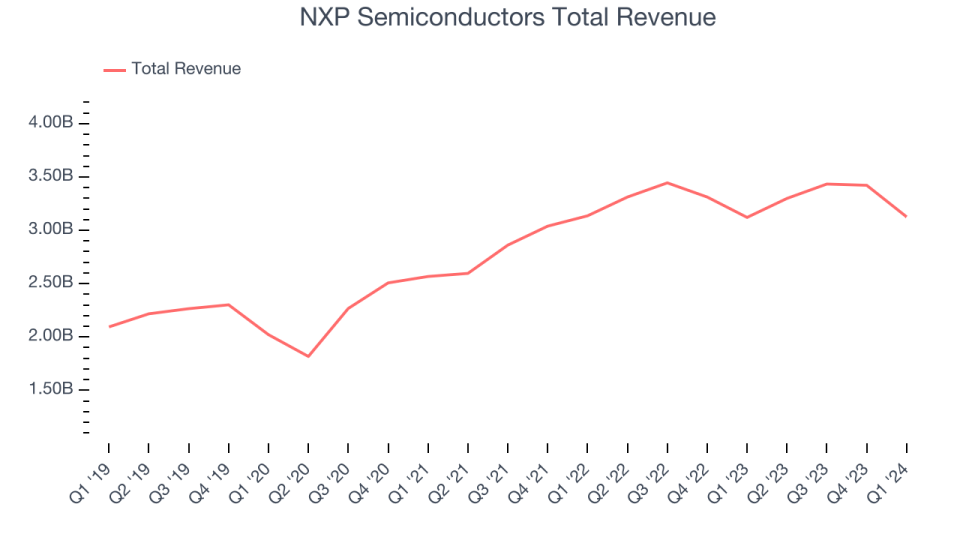

NXP Semiconductors reported revenues of $3.13 billion, flat year on year, inline with analysts' expectations. It was a weaker quarter for the company, with a miss of analysts' EPS estimates and an increase in its inventory levels.

“NXP delivered quarterly revenue of $3.13 billion, in-line with the midpoint of guidance with all our focus end-markets performing as expected. Our first-quarter results, guidance for the second quarter, and our early views into the second half of the year underpin a cautious optimism that NXP is successfully navigating through this industry-wide cyclical downturn. We continue to manage what is in our control enabling NXP to drive solid profitability and earnings in a challenging demand environment,” said Kurt Sievers, NXP President and Chief Executive Officer.

The stock is up 10.6% since the results and currently trades at $273.33.

Is now the time to buy NXP Semiconductors? Access our full analysis of the earnings results here, it's free.

Best Q1: Impinj (NASDAQ:PI)

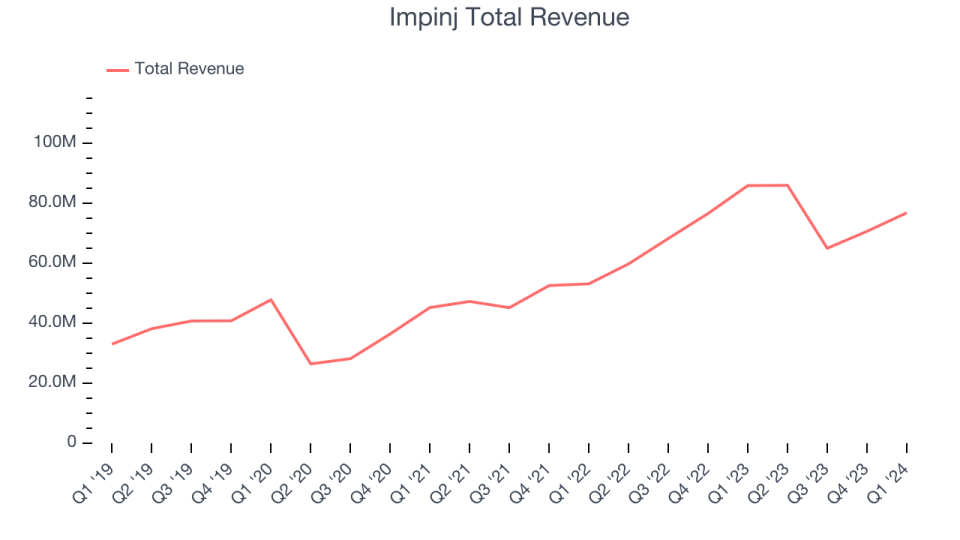

Founded by Caltech professor Carver Mead and one of his students Chris Diorio, Impinj (NASDAQ:PI) is a maker of radio-frequency identification (RFID) hardware and software.

Impinj reported revenues of $76.83 million, down 10.6% year on year, outperforming analysts' expectations by 4.4%. It was a very strong quarter for the company, with a significant improvement in its inventory levels and an impressive beat of analysts' EPS estimates.

The stock is up 29.2% since the results and currently trades at $156.

Is now the time to buy Impinj? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Microchip Technology (NASDAQ:MCHP)

Spun out from General Instrument in 1987, Microchip Technology (NASDAQ: MCHP) is a leading provider of microcontrollers and integrated circuits used mainly in the automotive world, especially in electric vehicles and their charging devices.

Microchip Technology reported revenues of $1.33 billion, down 40.6% year on year, falling short of analysts' expectations by 1.2%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter.

Microchip Technology had the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is down 2.4% since the results and currently trades at $91.5.

Read our full analysis of Microchip Technology's results here.

Himax (NASDAQ:HIMX)

Taiwan-based Himax Technologies (NASDAQ:HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops, and mobile phones.

Himax reported revenues of $207.6 million, down 15% year on year, surpassing analysts' expectations by 2%. It was a slower quarter for the company, with a decline in its operating margin.

The stock is up 47.7% since the results and currently trades at $7.7.

Read our full, actionable report on Himax here, it's free.

MACOM (NASDAQ:MTSI)

Founded in the 1950s as Microwave Associates, a communications supplier to the US Army Signal Corp, today MACOM Technology Solutions (NASDAQ: MTSI) is a provider of analog chips used in optical, wireless, and satellite networks.

MACOM reported revenues of $181.2 million, up 7% year on year, in line with analysts' expectations. It was a weaker quarter for the company, with a decline in its gross margin.

The stock is up 12.9% since the results and currently trades at $111.76.

Read our full, actionable report on MACOM here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance