Q1 Earnings Highlights: Hexcel (NYSE:HXL) Vs The Rest Of The Aerospace Stocks

Looking back on aerospace stocks' Q1 earnings, we examine this quarter's best and worst performers, including Hexcel (NYSE:HXL) and its peers.

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

The 15 aerospace stocks we track reported a decent Q1; on average, revenues beat analyst consensus estimates by 4%. while next quarter's revenue guidance was 1.8% above consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, but aerospace stocks have performed well, with the share prices up 11.9% on average since the previous earnings results.

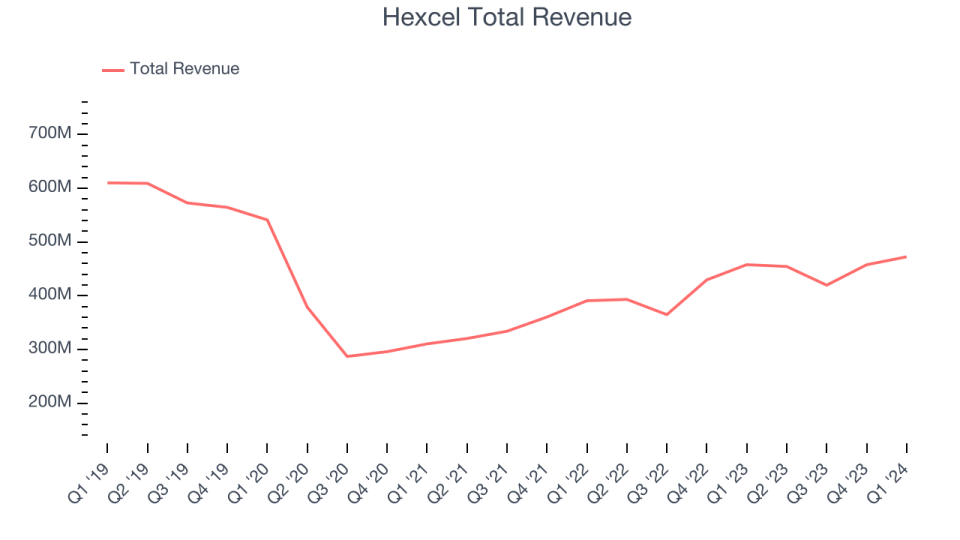

Hexcel (NYSE:HXL)

Founded shortly after World War II by a group of engineers from UC Berkley, Hexcel (NYSE:HXL) manufactures lightweight composite materials primarily for the aerospace and defense sectors.

Hexcel reported revenues of $472.3 million, up 3.2% year on year, in line with analysts' expectations. It was a decent quarter for the company with a solid beat of analysts' Commercial aerospace revenue estimates but full-year revenue guidance missing analysts' expectations.

Chairman, CEO and President Nick Stanage said, “Our commercial aerospace market continues to build momentum with our first quarter 2024 sales growing sequentially from the fourth quarter of 2023, including growth in both widebody and narrowbody programs. Volume leverage across the business drove sequential margin expansion demonstrating continued strong execution on our upward trajectory. We remain committed to delivering our full-year 2024 and our mid-term guidance as the Hexcel team focuses on growth, margin expansion and cash generation.”

The stock is up 2.5% since reporting and currently trades at $64.11.

Is now the time to buy Hexcel? Access our full analysis of the earnings results here, it's free.

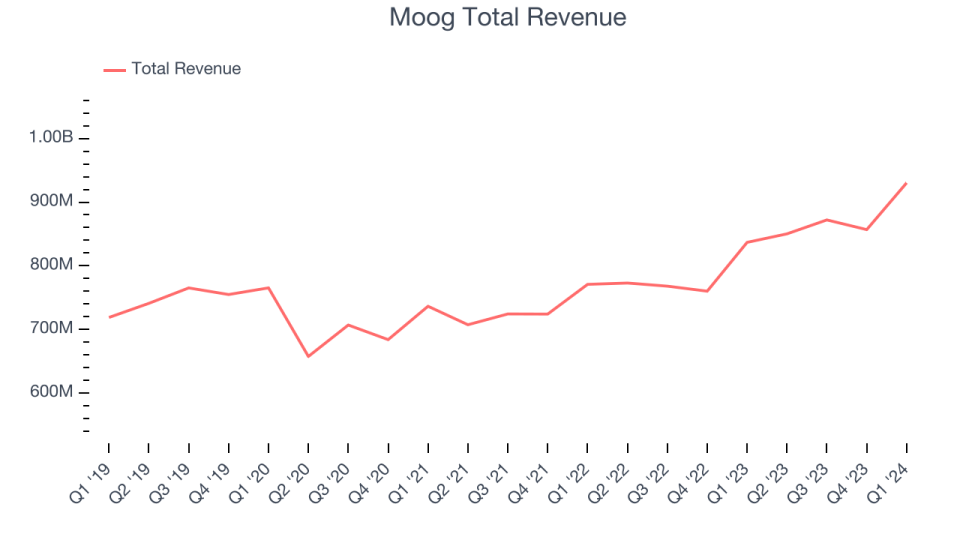

Best Q1: Moog (NYSE:MOG.A)

Responsible for the flight control actuation system integrated in the B-2 stealth bomber, Moog (NYSE:MOG.A) provides precision motion control solutions used in aerospace and defense applications.

Moog reported revenues of $930.3 million, up 11.2% year on year, outperforming analysts' expectations by 6.5%. It was an incredible quarter for the company, with an impressive beat of analysts' revenue and operating margin estimates.

The market seems happy with the results as the stock is up 8.4% since reporting. It currently trades at $170.44.

Is now the time to buy Moog? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Textron (NYSE:TXT)

Listed on the NYSE in 1947, Textron (NYSE:TXT) provides products and services in the aerospace, defense, industrial, and finance sectors.

Textron reported revenues of $3.14 billion, up 3.7% year on year, falling short of analysts' expectations by 4%. It was a weak quarter for the company with a miss of analysts' organic revenue and earnings estimates.

Textron had the weakest performance against analyst estimates in the group. As expected, the stock is down 5.4% since the results and currently trades at $88.88.

Read our full analysis of Textron's results here.

Woodward (NASDAQ:WWD)

Initially designing controls for water wheels in the early 1900s, Woodward (NASDAQ:WWD) designs, services, and manufactures energy control products and optimization solutions.

Woodward reported revenues of $835.3 million, up 16.3% year on year, surpassing analysts' expectations by 3.3%. Looking more broadly, it was a stunning quarter for the company with an impressive beat of analysts' organic revenue estimates and optimistic earnings guidance for the full year.

Woodward achieved the highest full-year guidance raise among its peers. The stock is up 14.5% since reporting and currently trades at $172.8.

Read our full, actionable report on Woodward here, it's free.

Ducommun (NYSE:DCO)

Recognized as the oldest continuously operating business in California, Ducommun (NYSE:DCO) specializes in providing essential components and systems for the aerospace and defense markets.

Ducommun reported revenues of $190.8 million, up 5.3% year on year, in line with analysts' expectations. Looking more broadly, it was a very strong quarter for the company with an impressive beat of analysts' earnings estimates.

The stock is up 3.9% since reporting and currently trades at $57.72.

Read our full, actionable report on Ducommun here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance