Q1 Earnings Highlights: Gibraltar (NASDAQ:ROCK) Vs The Rest Of The Home Construction Materials Stocks

As the Q1 earnings season wraps, let's dig into this quarter's best and worst performers in the home construction materials industry, including Gibraltar (NASDAQ:ROCK) and its peers.

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

The 9 home construction materials stocks we track reported an ok Q1; on average, revenues beat analyst consensus estimates by 0.7%. while next quarter's revenue guidance was 2.3% above consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and home construction materials stocks have had a rough stretch, with share prices down 14.8% on average since the previous earnings results.

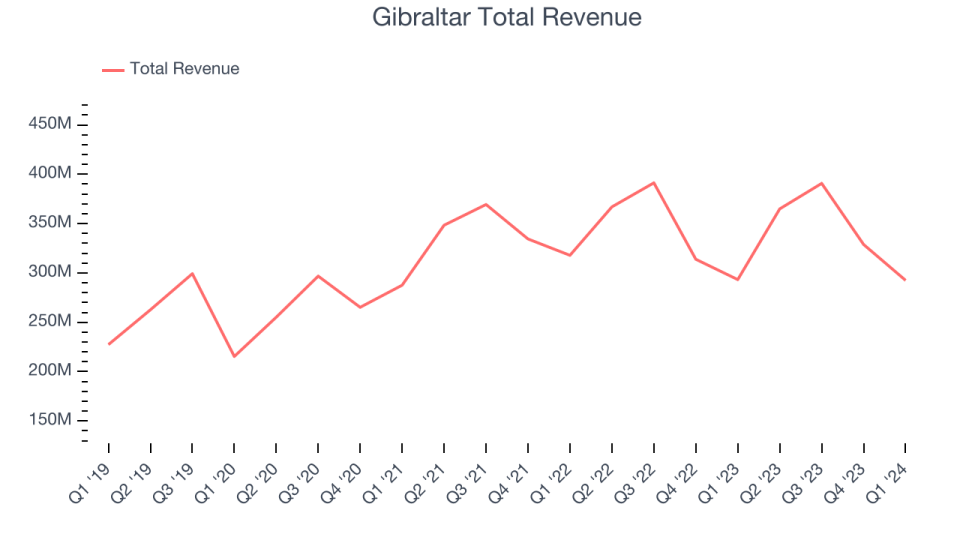

Gibraltar (NASDAQ:ROCK)

Gibraltar (NASDAQ:ROCK) makes renewable energy, agriculture technology and infrastructure products. Its mission statement is to make everyday living more sustainable.

Gibraltar reported revenues of $292.5 million, down 0.3% year on year, falling short of analysts' expectations by 1.6%. It was a mixed quarter for the company with EPS exceeding expectations.

“2024 started as we planned for the first quarter, with revenue growth in our Residential, Agtech, and Infrastructure businesses offsetting an anticipated slower start to the year in our Renewables business. Our execution and participation gains continue to leverage solid end market trends, and we continue to expect all four segments to head in the same direction in 2024, with Renewables and Agtech returning to top-line growth and driving sales growth, margin expansion and strong cash flow generation across the business,” stated Chairman and CEO Bill Bosway.

The stock is down 4.3% since the results and currently trades at $68.39.

Is now the time to buy Gibraltar? Access our full analysis of the earnings results here, it's free.

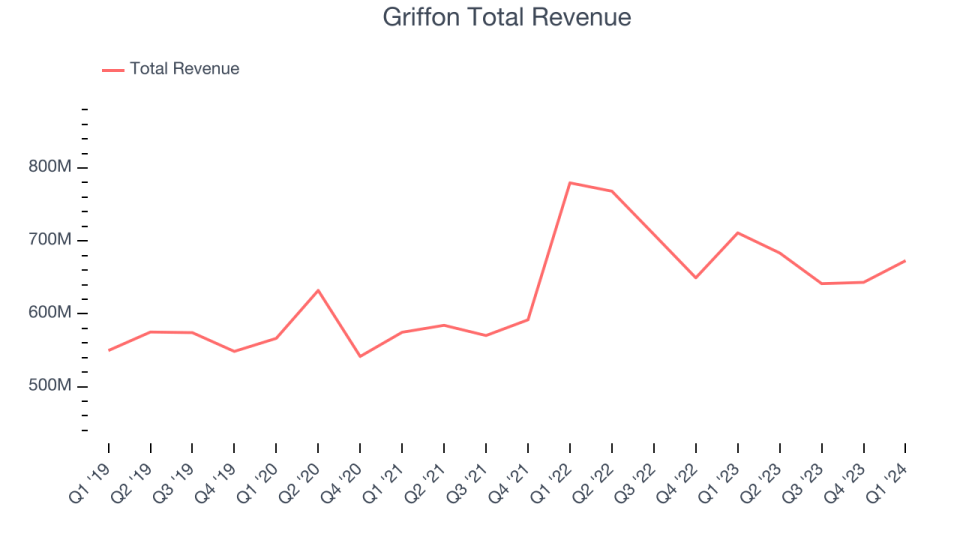

Best Q1: Griffon (NYSE:GFF)

Initially in the defense industry, Griffon (NYSE:GFF) is a now diversified company specializing in home improvement, professional equipment, and building products.

Griffon reported revenues of $672.9 million, down 5.4% year on year, outperforming analysts' expectations by 7.6%. It was an incredible quarter for the company. Griffon blew past analysts' revenue and EPS estimates.

Griffon scored the biggest analyst estimates beat among its peers. The stock is down 6.6% since the results and currently trades at $63.31.

Is now the time to buy Griffon? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Masonite (NYSE:DOOR)

A company that has specialized in making doors for an entire century, Masonite (NYSE:DOOR) designs and manufactures indoor and outdoor doors for residential and commercial markets.

Masonite reported revenues of $668.3 million, down 7.9% year on year, falling short of analysts' expectations by 6.5%. It was a weak quarter for the company, with a miss of analysts' earnings and volume estimates.

Masonite had the weakest performance against analyst estimates in the group. The stock is up 0.3% since the results and currently trades at $133.02.

Read our full analysis of Masonite's results here.

Trex (NYSE:TREX)

Addressing the demand for aesthetically-pleasing and unique outdoor living spaces, Trex Company (NYSE:TREX) makes wood-alternative decking, railing, and patio furniture.

Trex reported revenues of $373.6 million, up 56.5% year on year, surpassing analysts' expectations by 1.7%. It was a strong quarter for the company, with an impressive beat of analysts' organic revenue estimates and a solid beat of analysts' earnings estimates.

Trex pulled off the fastest revenue growth among its peers. The stock is down 24.1% since the results and currently trades at $70.94.

Read our full, actionable report on Trex here, it's free.

Builders FirstSource (NYSE:BLDR)

Headquartered in Irving, TX, Builders FirstSource (NYSE:BLDR) is a construction materials manufacturer that offers a variety of lumber and lumber-related building products.

Builders FirstSource reported revenues of $3.89 billion, flat year on year, surpassing analysts' expectations by 1.7%. It was a decent quarter for the company, with EPS exceeding analysts' estimates.

The stock is down 33.1% since the results and currently trades at $134.38.

Read our full, actionable report on Builders FirstSource here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance