Puma Biotechnology Is Down 19% -- Is Its Stock a Bargain?

What happened

Despite a fairly strong third-quarter earnings release that hit the wires after the bell Thursday, mid-cap biotech Puma Biotechnology's (NASDAQ: PBYI) shares got pummeled today. Specifically, Puma's stock ended the day down 19% on almost eight times the average daily volume. While this dramatic downturn lacked a clear-cut catalyst, one possible explanation is the relatively anemic commercial outlook for the biotech's one and only Food and Drug Administration (FDA)-approved drug, Nerlynx.

Nerlynx was initially launched last July after grabbing an approval as a treatment for early stage HER2-positive breast cancer following adjuvant trastuzumab-based therapy. According to Puma's third-quarter earnings release, Nerlynx generated $6.1 million in sales for the three-month period.

Image Source: Getty Images.

So what

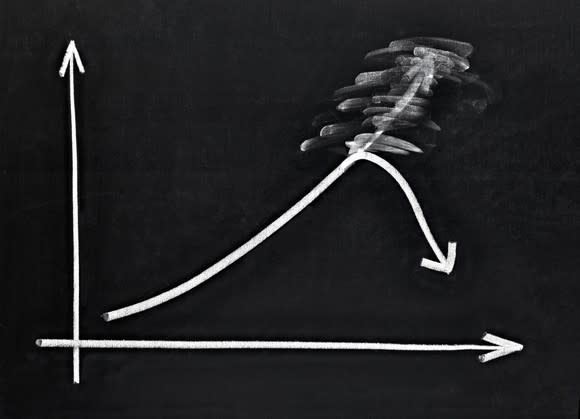

Heading into Nerlynx's regulatory decision last summer, Puma's shares rose by an astounding 208% compared to where they started the year. With Puma's market cap now over $3.8 billion, investors obviously were expecting a lot of bang for the buck, so to speak, from Nerlynx's commercial launch.

The drug's peak sales, after all, were predicted, prior to its launch, to eventually reach as high as $1.3 billion. Right now, though, this previous peak sales estimate seems rather far-fetched based on the sales figures so far.

Now what

Although the Street expects Puma's top line to rise markedly next year as Nerlynx's commercial launch progresses, this biotech stock remains on the expensive side, to put it mildly. Puma's shares, after all, are currently trading at 20 times the company's projected 2018 revenues, and that's assuming a monstrous 863% rise in sales next year.

In other words, Nerlynx's sales need to absolutely skyrocket to justify this rather rich valuation. Unfortunately, a rapid escalation of Nerlynx's commercial launch isn't guaranteed -- meaning that this red-hot biotech stock may start to retrace its steps in a big way going forward.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

George Budwell has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance