PubMatic Inc (PUBM) Surpasses Analyst Revenue Forecasts Despite Narrowed Net Loss in Q1 2024

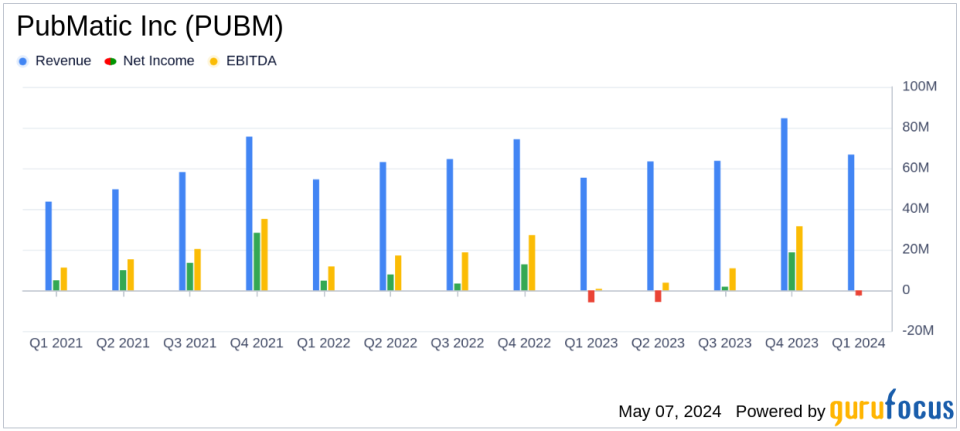

Revenue: $66.7 million, up 20% year-over-year, surpassing estimates of $61.99 million.

Net Loss: $(2.5) million, an improvement from a net loss of $(5.9) million in Q1 2023, but exceeded estimates of a $6.02 million loss.

Earnings Per Share (EPS): Reported a GAAP net loss per diluted share of $(0.05), better than the estimated loss of $(0.11) per share.

Adjusted EBITDA: $15.1 million, demonstrating a significant increase from $7.4 million in Q1 2023, with a margin expansion to 23% from 13%.

Free Cash Flow: Tripled to $16.3 million over Q1 2023, indicating strong operational efficiency and cash generation.

Operating Cash Flow: Increased by 90% to $24.3 million from $12.8 million in the same period last year.

Stock Repurchase: Utilized $20.1 million in cash to repurchase 1.1 million shares of Class A common stock from January 1, 2024, through April 30, 2024.

On May 7, 2024, PubMatic Inc (NASDAQ:PUBM) released its 8-K filing, announcing a significant revenue increase and improved financial metrics for the first quarter of 2024. The company, a leading provider of digital advertising technology, reported a 20% year-over-year increase in revenue, reaching $66.7 million, which surpassed the analyst estimates of $61.99 million. Despite this, the company experienced a net loss of $2.5 million, showing improvement from a larger loss of $5.9 million in the same quarter last year.

PubMatic's CEO, Rajeev Goel, highlighted the accelerated growth and the expanding opportunities in the digital ad supply chain, emphasizing the company's deep technology and strong customer relationships. Notably, PubMatic's strategic partnerships with major players like Instacart, Klarna, and Roblox have been pivotal, enhancing its platform's reach and capabilities.

Financial Performance Insights

The first quarter results reflect a robust performance with significant strides in revenue and operational efficiency. The Adjusted EBITDA stood at $15.1 million, a substantial increase from $7.4 million in Q1 2023, demonstrating improved profitability and operational efficiency. The company's focus on high-value ad formats and channels, such as mobile display and omnichannel video, which grew by 26%, has been a key revenue driver.

PubMatic's balance sheet remains strong with $174.1 million in cash, cash equivalents, and marketable securities, and no debt, positioning the company well for sustained growth and investment in innovation. The operational cash flow surged by 90% to $24.3 million, and free cash flow tripled to $16.3 million compared to the previous year, underscoring a solid financial foundation and effective cash management.

Strategic Developments and Market Positioning

During Q1 2024, PubMatic expanded its market influence through strategic partnerships and enhancements in Supply Path Optimization (SPO), which now represents 50% of the total platform activity. The company's innovative approaches, including a unique AI-generated cohort-based audience segment solution developed with GroupM, are set to redefine audience targeting in a privacy-focused world.

Furthermore, PubMatic's commitment to growth and efficiency is evident in its increased global headcount and infrastructure optimization, which have led to a 25% increase in impressions processed year-over-year. These efforts contribute to a lower cost of revenue per million impressions and align with the company's strategic priorities for 2024.

Outlook and Forward Guidance

Looking ahead to Q2 and the full year of 2024, PubMatic has raised its revenue and adjusted EBITDA guidance, reflecting confidence in its growth trajectory and market strategy. For Q2, revenue is expected to be between $69 million and $71 million, with an adjusted EBITDA margin of approximately 26% at the midpoint. For the full year, the company anticipates revenue between $296 million and $304 million, marking a 12% growth at the midpoint, with an impressive adjusted EBITDA margin projection of about 31%.

PubMatic's strategic positioning and robust financial health highlight its potential to continue capturing market share in the evolving digital advertising landscape. The company's focus on innovation and efficiency, combined with strong market demand and strategic partnerships, set the stage for sustained growth and profitability.

Explore the complete 8-K earnings release (here) from PubMatic Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance