Not all provinces are equal in the COVID-19 debt crisis

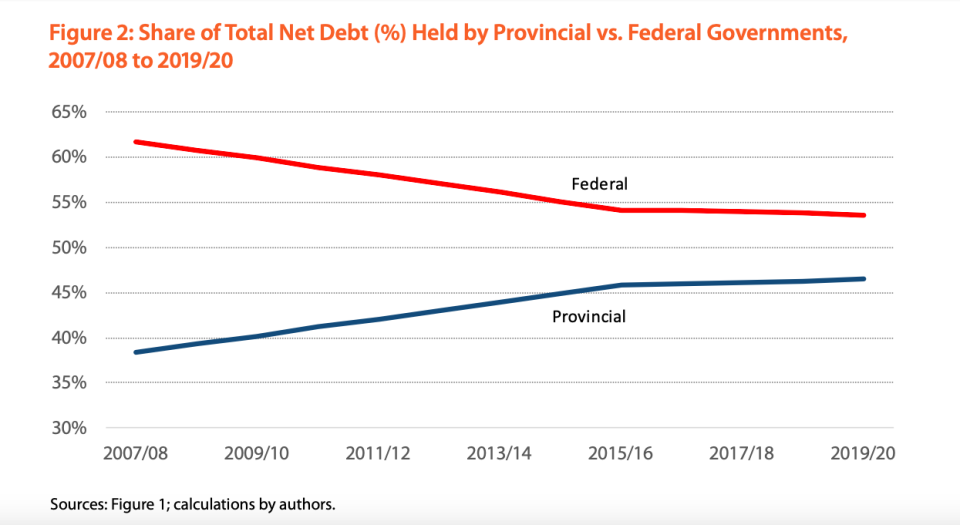

COVID-19 has exposed many weaknesses in the Canadian economy – particularly with mounting debt loads across the country. With the latest net debt percentage of 53.4 per cent, the federal government still holds the bulk of the debt load compared to the provinces.

However, a report by the Fraser Institute tracking debt data since the last recession in 2008 shows that provincial debt is beginning to catch up. Considering the impacts of COVID-19, revenues are expected to dry up and debt burdens may grow.

Not all jurisdictions are made the same: each has a distinct economy with factors determining its debt and GDP levels. Douglas Offerman, senior director at Fitch Ratings, explained: “The question really across all provinces is the experience they have in managing cycles… Provinces have the ability to run deficits fundamentally, they have the ability to cover debt and to maintain services so that they can actually work against the impact of a recession.”

Offerman walked Yahoo Finance Canada through each of the regions across the country.

Ontario

2019/2020 Net Debt: $353.7 billion

Out of all of the provinces, Ontario has the largest economy in the country - but it also has the largest debt-to-GDP ratio at 75.4 per cent, according to the Fraser Institute. Offerman explained that debt loads are related to the size of a province’s economy, but in Ontario’s case, it was still finding its footing since the last recession.

“They were a few years away from getting back to balance,” he said. “They were making slow, gradual progress, but the goal was to ensure that economic growth and revenue growth were supporting progress towards budget balance.”

The effort to recover from the recession brought their $160.0 billion net debt in 2007/08 to $353.7 billion in 2019/20 - a 121.0 per cent jump. Even with the debt, the last Fitch report, which put Ontario at a AA- rating, explained that the province would be able to “manage its own internal liquid resources or mobilize external resources as needed.”

Offerman and the Fitch report described the province as the anchor of the Canadian economy. It has substantial population growth in Toronto and an economy defined by diverse revenue streams. That said, analysts at Fitch warned that the province’s rating could be at risk if it takes on more expenditures or sees underperforming revenues. The $17 billion in financial supports it provided as COVID-19-related aid may see more expenditures, pulling the province further into the red.

British Columbia

2019/2020 Net Debt: $44.5 Billion

If Ontario’s economy was the country’s anchor, then the British Columbian economy looks more like its mirror, according to Offerman.

“The Vancouver metro region is so dynamic,” he said. “They were also in fairly good shape going into this.

“They’ve obviously run a deficit, it’s not unexpected. But they’ve been generating balanced budgets for years”.

These balanced budgets were largely fuelled by B.C.’s diverse revenues and strong goods and services sector (particularly bolstered by a robust real estate market in Vancouver).

B.C.’s initially projected surplus of $227 million through 2020/21 by RBC Economics will likely be erased by the 6 per cent revenue drop. B.C.’s $23.9 billion in net debt over 2007/08 steadily grew by 86.3 per cent to the 2019/20 debt load of $44.5 billion.

One significant risk to B.C.’s revenues is the COVID-19 impact on the tourism industry, which contributed more to the provincial GDP than any other primary resource industry in 2017, with $9 billion. This includes mining ($4.9 billion), oil and gas ($3.7 billion), forestry and logging ($1.8 billion) and agriculture and fishing ($1.5 billion).

Quebec

2019/20 Net Debt: $172.5 Billion

During the COVID-19 crisis, Quebec has become Canada’s hotzone with just over 33,400 in confirmed cases as of Tuesday. This could deepen economic impacts, though Premier François Legault announced plans for the province to come out from under lockdown. Montreal’s economy, according to Offerman, has been a story of growth for a long time with plans to maintain this narrative: “There’s an effort in… Montreal to improve transit which is of course going to build the stage for future economic growth because people will be able to move around more easily.”

Quebec’s $124.7 billion net debt in 2007/08 turned into a $172.5 billion figure in 2019/20, marking a 38.4 per cent jump. Comparing the size of the debt to the size of its economy, Quebec was one of the only provinces to reduce its net debt as a percentage of the GDP since the last recession from 40.6 per cent to 38.7 per cent.

Not only were they successful in reducing debt, they ran surpluses and had built-up ‘fiscal momentum’ leading into the crisis. “[Quebec] were running large surpluses, they were setting aside resources in this generation’s fund, and they were pulling down their debt burden, really quite fast in a relatively short span of time,” Offerman explained, “So arguably, they were a little better-placed to confront a crisis.”

Prairie Provinces

Alberta

2019/2020 Net Debt: $36.6 Billion

Saskatchewan

2019/20 Net Debt: $12.0 Billion

Manitoba

2019/20 Net Debt: $25.8 Billion

The prairie provinces may be the hardest hit, struggling with an economy that is at a standstill because of COVID-19 and the fallout from the severe oil price collapse last month.

“The resource economy - particularly oil and energy - has not yet recovered from the downturn that started a couple of years ago,” Offerman said.

He added that Saskatchewan may have an easier time in finding its footing since raising the sales tax helped bring the province back to budget. Alberta, on the other hand, hasn’t quite recovered from the last oil downturn in 2014.

“Thus far, we haven’t seen the federal government looking at targeted support for individual provinces or key sectors,” Offerman said. “This is still an unfolding crisis, so we’ll see it unfold over time.”

Alberta suffered the deepest debt plunge, moving from being the only province in a net financial asset position in 2007/08 with -$35.0 billion to $36.6 billion in net debt by 2019/20, a 204.5 per cent change. The Fraser Institute indicated that Alberta consistently overspent in provincial programs.

Saskatchewan also piled on debt to the balance sheet, going from $5.9 billion in net debt to $12.0 billion since the last recession to 2019/20. Fitch described the province’s industrial revenues as being diverse and robust.

Manitoba was also unable to balance its books prior to the coronavirus outbreak, leaving it vulnerable to taking on more debt. The growth in net debt jumped by 144.3 per cent from $10.6 billion in 2007/08 to $25.8 billion in 2019/20.

Atlantic Provinces

New Brunswick

2019/20 Net Debt: $13.8 billion

Nova Scotia

2019/20 Net Debt: $15.3 billion

Prince Edward Island

2019/20 Net Debt: $2.2 Billion

Newfoundland & Labrador

2019/20 Net Debt: $14.0 Billion

The Atlantic provinces have had their revenues challenged by COVID-19, particularly as far as the tourism and export sectors go. In Nova Scotia, lobster exports to China have halted as the overseas market grappled with the coronavirus. In Prince Edward Island, tourism accounted for three per cent of the GDP in 2014. Nova Scotia’s debt grew to $15.3 billion in 2019/20 since the last recession’s debt load of $12.1 billion - a growth of 26.1 per cent.

Prince Edward Island’s net debt load went from $1.3 billion in 2007/08 to $2.2 billion in 2019/20, a 66.6 per cent change.

Newfoundland and Labrador saw its debt grow 36.9 per cent from $10.2 billion to $14.0 billion from 2007/08 to 2019/20. It also held the highest debt-to-GDP ratio across all the provinces at 40.6 per cent, according to Fraser Institute.

New Brunswick saw the largest net debt increase in the region, with a 95.6 per cent change from $7.1 billion in 2007/08 to $13.8 billion 2019/20.

The Fraser Institute initially held New Brunswick and Newfoundland and Labrador as the only provinces along with Quebec to have a projected fall in net debt over the course of 2020. This was expected in the Atlantic region because of the expected revenues from the Atlantic Accord. The economic onslaught of COVID-19 will likely challenge this projection.

Yahoo Finance

Yahoo Finance