Provident Bancorp Inc (PVBC) Reports Earnings Growth Amid Market Challenges

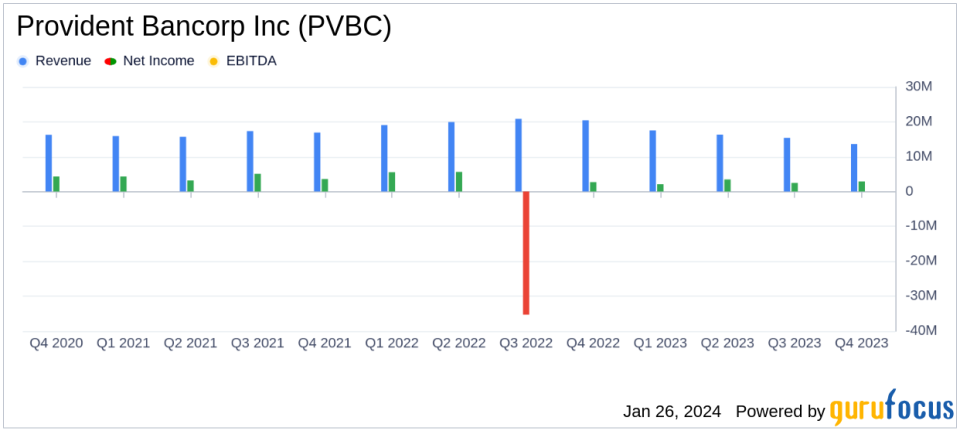

Net Income: Reported $2.9 million for Q4 2023, a sequential and year-over-year increase.

Earnings Per Share (EPS): Increased to $0.18 in Q4 2023 from $0.15 in Q3 2023 and $0.16 in Q4 2022.

Net Interest and Dividend Income: Decreased by 2.3% quarter-over-quarter and 27.6% year-over-year.

Asset Quality: Non-performing assets decreased, showcasing improved asset quality.

Balance Sheet: Total assets decreased by 7.6% quarter-over-quarter but increased by 2.1% year-over-year.

Shareholders' Equity: Increased by 2.0% from the previous quarter and 6.9% from the previous year.

On January 26, 2024, Provident Bancorp Inc (NASDAQ:PVBC) released its 8-K filing, announcing financial results for the fourth quarter and full year ended December 31, 2023. The company, a provider of banking products and services to small and medium-sized commercial customers, reported a net income of $2.9 million, or $0.18 per diluted share, for the quarter, marking an improvement from both the previous quarter and the same quarter last year. For the full year, net income stood at $11.0 million, or $0.66 per diluted share, a significant turnaround from the net loss reported in the previous year.

Joe Reilly, Co-Chief Executive Officer, commented on the results and the bank's strategic focus amidst a challenging environment characterized by rising interest rates and industry turmoil. He highlighted the bank's efforts in improving asset quality, cost discipline, and growing the core business banking base while prioritizing safe and strategic banking practices.

"Our team has made significant strides in winding down our digital asset loan portfolio, with a nearly 70% reduction year over year. I am proud of the results and profitability the team was able to achieve in 2023. Despite the economic challenges that continue to put pressure on net interest margins, I look forward to continued progress towards our strategic objectives in 2024."

The bank's net interest and dividend income for the quarter was $13.6 million, a decrease from the previous quarter and the same quarter in the prior year. This was attributed to an increase in interest expense, which was partially offset by an increase in interest and dividend income. The cost of interest-bearing deposits rose due to higher interest rates and a shift towards higher-cost savings accounts and certificates of deposit.

Noninterest income for the quarter was $1.6 million, a decrease from both the previous quarter and the same quarter last year, primarily due to a decrease in other service charges and fees. Noninterest expense for the quarter decreased to $12.5 million, reflecting cost-saving measures, including a workforce realignment.

On the balance sheet, total assets decreased by 7.6% from the previous quarter but increased by 2.1% from the previous year. The bank's efforts to manage risk and revise business practices were evident in the reduction of non-performing assets and the increase in shareholders' equity.

Provident Bancorp Inc's performance in the face of market headwinds demonstrates the bank's resilience and the effectiveness of its strategic adjustments. The bank's focus on asset quality and cost discipline, along with its commitment to core business banking, positions it well for navigating the challenges ahead.

For more detailed financial information and the full earnings report, please refer to the provided 8-K filing.

Explore the complete 8-K earnings release (here) from Provident Bancorp Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance