How To Profit From Europe’s $800 Billion Energy Crisis

Europe is weathering its second winter since it cut itself off from Russian natural gas, but beyond that, without its own sufficient supplies, the continent remains vulnerable to the whims of a volatile global market.

That vulnerability is now beginning to resurface, as the Biden administration presses pause on all new LNG export projects, sending waves of concern throughout Europe, which has traded dependence on Russian gas for dependence on American LNG.

In the short term, this meant significantly higher energy prices throughout Europe, with energy costs rising by 40.8% annually within the EU as of September 2022. It got so bad, in fact, that Europe shelled out $800 billion to protect consumers and businesses from the spiralling costs.

The regulatory atmosphere has changed dramatically since Russia’s invasion of Ukraine. Germany has pleaded that the Bloc “work together with countries that have the capacity to develop new gas fields, as part of the Paris Climate Agreement commitments.”

That’s exactly what MCF Energy (TSXV:MCF; OTC:MCFNF) plans to do in Germany—the EU’s biggest economy—and Austria.

The company recently started drilling in Austria, with the Company disclosing that the drill is set to take around 40 days to complete, and then immediately following this the rig will be moved to Germany, where a second drill will re-enter a previously producing well initially drilled by Mobil.

Through four prospects, MCF Energy has over 100 BCF of proven reserves with previously producing wells and two previous discoveries.

If they hit, especially in Germany, they are potentially looking at a flare-out with multiple development locations from this drill.

Confirmed Gas Plays in Germany and Austria

MCF Energy’s prospects in Germany include the Lech concession where Mobil (before it was Exxon) drilled a wildcat well back in the ‘80s. That well came in at 24 million cubic feet of natural gas per day, with 700 barrels of condensate, with a second well drilled to a deeper zone flowing almost 200 barrels of oil per day. A third well drilled found the oil – water contact and did not produce. After the third well Mobil went in and shot 120 square kilometers of seismic, which proved to be a treasure trove for MCF’s explorers.

Back then, the German government did not require companies to share their data at all. But last year, due to Germany’s scramble to ensure more domestic production, this historical data was made available to the public. MCF took the opportunity and ran the 3D data by its AI specialist, which pinpointed multiple drilling locations on both Lech and Lech East with identical or very similar character to the big discovery well drilled in the 80’s on Lech that MCF will soon re-enter.

Now, the company isn’t hoping simply to replicate, but to improve on the results that Mobil had decades ago across the region. Back then, technology was limited to vertical wells. When MCF drills its first well in Germany in March, new AI and Machine learning technology as well as the improvements in drilling technologies could change this game.

“What happens if we put a horizontal well into that thing? We’re going to go in and recreate the Mobil well and stimulate the zone with new techniques developed over the last 40 years. We know where the hydrocarbons are. We’ve got cores through it,” MCF Energy CEO James Hill told Oilprice.com in a recent interview.

5 Prospects Secured, Drilling Launched

As a result of MCF Energy’s (TSXV:MCF; OTC:MCFNF) 100% acquisition of Germany’s Genexco last year, the company now has five licenses secured for four large-scale project areas in Germany and one in Austria, with drilling soon to be underway.

The first drill, which will spud next week and set to be completed in March, is in Austria, at MCF’s Welchau prospect near the Austrian Alps. Welchau appears analogous to large anticline structures discovered in the Kurdistan Region of Iraq and the Italian Apennines, and is adjacent and up-dip from a discovery, drilled in the 80’s that intersected a gas column of at least 400 meters, testing condensate rich with pipeline quality gas.

A national gas pipeline network is only 18 kilometers away, making for what could be a short, cheap tie-in option for getting products to domestic markets.

MCF will earn a 25% interest for exploration drill costs estimated at 2.55 million euros, which represents MCF’s 50% share in drilling costs.

Germany, which houses four of the concessions, is where MCF Energy is playing a bigger game.

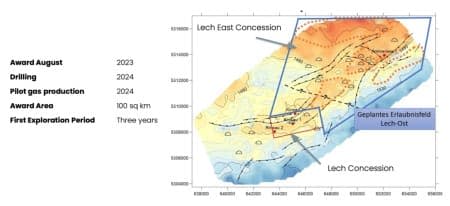

The company’s Lech (10 square kilometers) and Lech East (100 square kilometers) concessions hold natural resources riches that have already seen two discoveries and three previous wells drilled.

As soon as the Austria drill is completed in March, the rig will be moved to Lech, where MCF Energy will re-enter Mobil’s former Kinsau #1 well, adapting new drilling and completion technology and eventually horizontal wells to stimulate what they already know is there.

Within the first fault block at Lech, MCF’s Hill believes there is around 20 BCF recoverable, with associated condensate.

“The Lech assets are proven producers,” says Hill, noting the existence of two wells here that have produced gas, condensate and oil, which upon successful re-entry would translate into quick cash flow for MCF Energy. Furthermore, all the wells had few problems during drilling, which means lows costs for drilling, coupled with nearby pipelines—the closest only 2 kilometers away—to get to market quickly and cheaply. “The exploration possibilities are there. You've got the fractured carbonates, and even sandstone reservoirs that have produced in the area. So, now, it really comes down to the fact that there are also new exploration techniques, in addition to seismic, that I think will reduce the risk,” Hill told Oilprice.com.

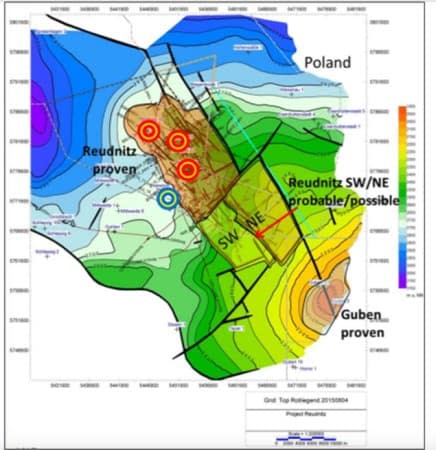

Also in Germany, MCF Energy now has the Reudnitz Gas field concession, a large-scale natural gas prospect initially discovered in 1964.

An independent assessment by Gaffney, Cline & Associates suggests 118.7 billion cubic feet of natural gas for extraction, noting that the resources, as with the other fields in Northern Germany contain low-caloric gas rich in nitrogen, potentially diluting the hydrocarbons’ concentration. In addition to methane, the gas at Reudnitz contains, best estimate (P50), 1.06 BCF of helium and an upper zone containing 4.4 million barrels of oil.

Pilot test production will start in 2024 and development using established cryogenic technology for targeted helium and methane recovery will follow. Development of the shallower oil zone will also begin when the sweet spots are identified.

The fifth concession in Germany is Erlenwiese, for which 2D seismic has been acquired and is being reprocessed, with 3D on the way, along with AI analysis. This project contains two, well documented prospects which will be risk reduced with machine learning.

Beyond this, MCF’s Genexco acquisition gives it a proprietary database for 10 additional project areas, including geological, seismic and well data, which is being used for the bases of further acquisitions. The acquisition also makes MCF an established operator with active concessions and a local german speaking technical team that has been active with the government agencies.

What Does Europe Do Next?

And the timing is significant: Europe has underinvested in natural gas as it strives to lower carbon emissions, but natural gas is turning out to be the accepted bridge fuel for the world’s energy transition. Nowhere is this more poignant than in Europe, where energy security and climate change must work hand-in-hand.

MCF (TSXV:MCF; OTC:MCFNF) is doing something unique on the natural gas playing field: It’s aiming to gain exposure to European natural gas for the first time since Russia invaded Ukraine and Western sanctions disrupted global markets.

The company is hoping to offer Germany, and the wider European region, a domestic pathway to improved energy security, without full dependence on Norway’s piped gas or more expensive LNG.

They will very soon be drilling in Austria, and are planning to launch drilling in Germany in March, making this one of the most exciting new plays that the supermajors have left behind since they moved to bigger venues offshore.

The coming weeks will give us the first glimpse into potential new gas for Austria, and in just two months, we’ll know more about the re-opening of Germany’s domestic gas resources—with the potential for oil, too.

Other energy companies to keep an eye on as geopolitical tensions heat up:

Chevron Corporation (NYSE:CVX), one of the world’s leading energy companies, is making significant strides in the realm of natural gas, aligning its operations with the global shift towards cleaner energy sources. By heavily investing in exploration, production, and distribution, Chevron is solidifying its presence in major LNG projects across Australia and Africa, demonstrating its ambition to lead in this sector.

Parallel to its natural gas endeavors, Chevron continues to fortify its foundational oil operations. The company leverages vast reserves and a robust downstream presence, committing to efficient and sustainable oil production. This commitment is evident through Chevron's investment in innovative technologies and practices aimed at minimizing environmental impact and enhancing the efficiency of oil extraction and refining processes.

For investors, Chevron represents a unique opportunity to engage with a global powerhouse actively diversifying its energy portfolio. Its substantial investments in natural gas, paired with a steadfast commitment to sustainable oil production, position Chevron as a key player in the evolving energy landscape, offering both growth potential and stability.

Exxon Mobil Corporation (NYSE:XOM), a titan in the global energy market, is assertively expanding its footprint in the natural gas sector, leveraging strategic investments in LNG projects and shale gas explorations to cement its position as an industry leader. This strategic pivot reflects Exxon Mobil's adaptation to the shifting energy consumption patterns, emphasizing cleaner energy sources.

Despite the growing emphasis on natural gas, oil remains a pivotal aspect of Exxon Mobil's operations, driving a significant share of its revenues. The company's global operations are marked by continuous efforts to enhance extraction efficiencies and refining capabilities, underscoring its commitment to maintaining its stature as a premier oil company.

Exxon Mobil presents investors with a harmonious blend of tradition and innovation. The company's aggressive expansion into natural gas is paired with robust oil operations, suggesting a well-rounded vision for the future. For those seeking investment opportunities in the energy sector, Exxon Mobil offers both steady returns and growth potential, anchored by its legacy and forward-looking strategies.

ConocoPhillips (NYSE:COP), with its extensive global footprint, exhibits a balanced approach to energy, harmonizing its oil exploration and production endeavors with strategic investments in natural gas and LNG operations, particularly in North America and Asia. This dual focus reflects the company's adaptability to the world's evolving energy consumption patterns and its ambition to lead in both domains.

Oil exploration and production remain critical pillars of ConocoPhillips' strategy, with operations spanning across continents. The company's emphasis on sustainable production methods highlights its commitment to environmental stewardship and operational excellence.

Investors looking at ConocoPhillips are presented with a company that offers both stability in oil and growth potential in natural gas. The company's strategic investments and global operations make it a compelling choice for those interested in a diversified and sustainable energy portfolio.

Talos Energy Inc. (NYSE:TALO) distinguishes itself in the exploration and production sector, focusing on oil and natural gas in the strategically significant regions of the United States Gulf of Mexico and offshore Mexico. As a relatively young entity, Talos Energy has rapidly established a reputation for strategic acquisitions and an unwavering focus on exploration, demonstrating an agile approach to its operations.

The company's commitment to environmental stewardship and sustainability is a cornerstone of its strategy, underpinned by continuous efforts to leverage innovative technologies to minimize its ecological footprint. This commitment, coupled with a strategic vision for growth balanced with environmental responsibility, positions Talos Energy as an attractive investment opportunity for those keen on supporting a company with a sustainable outlook on energy production.

Cheniere Energy, Inc. (NYSE:LNG), pioneers the liquefied natural gas (LNG) sector in the United States, operating the country's first LNG export facilities. With a business model that encompasses the entire LNG value chain, Cheniere is well-placed to capitalize on the increasing global demand for natural gas. The company's Sabine Pass and Corpus Christi facilities are central to its strategy, responding to the growing international demand for cleaner energy sources.

Cheniere's commitment to sustainability is integral to its operations, aiming to improve the environmental performance of its activities. The company's focus on safety, environmental stewardship, and community engagement positions it as a responsible energy provider, setting a benchmark in the LNG market.

Investors considering Cheniere Energy are offered a unique vantage point into a company with a pioneering status in the LNG sector, bolstered by a commitment to expansion and operational excellence. Cheniere's strategic position in the energy transition era presents a compelling case for growth and profitability, anchored by its contribution to the global shift towards cleaner energy sources.

Enerplus Corporation (TSX:ERF) is making significant strides as a diversified North American energy producer, with a keen focus on organic production growth within its principal regions. By emphasizing operational efficiency and cost management, Enerplus is able to navigate the complexities of the energy market, particularly highlighting its prowess in the Bakken/Three Forks formations in North Dakota. These areas, known for their high-quality light oil assets, significantly contribute to the company's production volume and revenue.

Enerplus's commitment to sustainability and responsible resource development is evident through its investment in technologies and practices designed to minimize environmental impact. This approach not only enhances the safety and efficiency of its operations but also aligns with the growing global emphasis on environmental responsibility within the energy sector.

Looking ahead, Enerplus is poised for continued growth and operational excellence. With a solid financial foundation and a strategic focus on its core operational areas, Enerplus is well-equipped to thrive in the dynamic energy market. The company's dedication to value-driven growth and sustainability positions it as an attractive investment opportunity for those looking to engage with a company at the forefront of the energy transition.

Vermilion Energy Inc. (TSX:VET) stands out for its global reach and diversified asset portfolio across North America, Europe, and Australia. The company's ability to tap into various markets and optimize its production mix allows it to leverage global pricing dynamics effectively. Vermilion's commitment to strong operational and financial performance is supported by strategic acquisitions and efficient resource management.

The company places a significant emphasis on environmental stewardship and community engagement. By focusing on minimizing its environmental impact and investing in the communities it operates in, Vermilion not only supports sustainable development but also enhances its corporate reputation and strengthens stakeholder relationships.

Vermilion Energy is focused on sustaining its production and cash flow through disciplined capital investment and efficient operations. The diversified nature of its asset base provides a resilient platform for growth, making Vermilion an appealing option for investors seeking exposure to the global energy sector, with a particular emphasis on sustainability and community partnership.

Suncor Energy (TSX:SU), one of Canada’s leading integrated energy companies, has made notable inroads into the natural gas sector, tapping into the vast reserves of Western Canada. This move reflects Suncor’s strategy to diversify its energy portfolio and respond to North America's increasing demand for cleaner energy sources.

However, the cornerstone of Suncor’s operations lies in the oil sands, where it ranks among the world’s largest operators. Suncor's commitment to innovation and sustainability in oil sands extraction and processing showcases its dedication to efficient and environmentally responsible energy production.

For investors, Suncor presents a compelling blend of steady revenues from its entrenched oil sands operations and the potential for growth offered by its ventures into natural gas. This combination underscores Suncor's adaptability and strategic positioning in a market that is increasingly leaning towards diversification and sustainability.

Tourmaline Oil Corp. (TSX:TOU), Canada's largest natural gas producer, exemplifies strategic expansion and operational efficiency. Through targeted acquisitions and exploration, Tourmaline has not only expanded its operational footprint but has also underscored its commitment to sustainability and environmental stewardship. The company’s efforts to minimize its environmental impact, particularly through water conservation technologies, align with the broader industry's move towards more sustainable energy production practices.

The company's strategic acquisitions and emphasis on low-cost operations have bolstered its resilience and operational efficiency, establishing Tourmaline as a benchmark for sustainable growth in the sector. For investors, Tourmaline represents a promising opportunity to engage with a company that is not only focused on enhancing its operational base but is also committed to environmental stewardship and sustainability in the energy sector.

Brookfield Renewable Partners (TSX: BEPC) is at the forefront of capitalizing on the growing demand for renewable energy, supported by strategic acquisitions and organic growth initiatives. The company's aim to increase its funds from operations (FFO) by over 10% this year is indicative of its robust growth trajectory, with projections of sustained double-digit earnings growth into the foreseeable future.

The advent of Artificial Intelligence (AI) as a new growth catalyst for Brookfield Renewable highlights the company's innovative approach to embracing technological advancements. AI's significant power consumption presents an unparalleled opportunity for Brookfield Renewable to meet the surging electricity demands driven by AI expansion.

Strategically positioned to benefit from this AI-driven increase in power demand, Brookfield Renewable has developed strong partnerships with leading global technology firms. These collaborations position the company as a primary source of green power for tech giants, potentially matching the current energy consumption levels of countries like the UK. This unique positioning underscores Brookfield Renewable's pivotal role in supporting the energy needs of the future, making it an attractive investment for those interested in the intersection of technology and renewable energy.

TC Energy (TSX:TRP), primarily known for its pipeline operations, plays a pivotal role in North America's energy infrastructure. Their natural gas pipelines span thousands of kilometers, ensuring efficient distribution across the continent. This vast network highlights TC Energy's strategic intent to be at the heart of North America's gas distribution.

While they're more infrastructure-oriented, their involvement in oil cannot be ignored. Their oil pipelines play a crucial role in connecting major oil sands regions to refineries and markets, ensuring steady flow and distribution.

For investors, TC Energy offers a unique proposition. Their dominance in natural gas and oil infrastructure presents both stability and a continuous growth trajectory in line with North America's energy demands.

Canadian Natural Resources (TSX:CNQ) boasts a diverse and robust portfolio. Their ventures in the natural gas sector, especially in the Montney and Duvernay regions, reflect a comprehensive strategy to harness Canada's gas potential.

Oil, however, remains a significant contributor to CNRL's success. With assets ranging from oil sands to heavy crude, they've showcased their prowess in managing diverse operations. Their emphasis on sustainable practices and cost efficiencies sets them apart in the industry.

Investors eyeing CNRL are looking at a powerhouse. The combination of their extensive natural gas projects with a solid foundation in oil makes them a top contender in the energy sector.

By. Josh Owens

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that large oil and gas companies will continue to focus on offshore natural gas resources; that domestic onshore natural gas assets in Europe will provide a more affordable energy source than offshore resources; that demand for natural gas will continue to increase in Europe and Germany; that Russia will not supply the majority of natural gas in Germany and Europe; that natural gas will continue to be utilized as a main energy source in Germany and other European countries and demand for natural gas, and in particular domestic natural gas, will continue and increase in the future; that MCF Energy Ltd. (the “Company”) can replicate the previous success of its key investors and management in developing and selling valuable energy assets; that the natural gas projects of the Company will be successfully tested and developed; that the Company can develop and supply a safe, domestic source of energy to European countries; that natural gas will be reclassified as sustainable energy which will support the development of the Company’s assets; that imports of liquified natural gas will not be sustainable for Europe and that European countries will need to rely on domestic sources of natural gas; that the Company expects to obtain significant attention due to its upcoming drilling plans combined with Europe desperate for domestic natural gas supply; that the upcoming drilling on the Company’s projects will be successful; that the Company’s projects will contain commercial amounts of natural gas; that the Company can finance ongoing operations and development; that the Company can achieve its business plans and objectives as anticipated. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that large oil and gas companies will start focusing on the development of domestic natural gas resources; that the natural gas resources of competitors will be more successful or obtain a greater share of market supply; that offshore liquified natural gas assets will be favored over domestic resources for various reasons; that alternative technologies will replace natural gas as a mainstream energy source in Europe and elsewhere; that demand for natural gas will not continue to increase as expected for various reasons, including climate change and emerging technologies; that political changes will result in Russia or other countries providing natural gas supplies in future; that the Company may fail to replicate the previous success of its key investors and management in developing and selling valuable energy assets; that the natural gas projects of the Company may fail to be successfully tested and developed; that the Company’s projects may not contain commercial amounts of natural gas; that the Company may be unable to develop and supply a safe, domestic source of energy to European countries; that natural gas may not be reclassified as sustainable energy or may be replaced by other energy sources; that the upcoming drilling on the Company’s projects may be unsuccessful or may be less positive than expected; that the Company’s projects may not contain commercial amounts of natural gas; that the Company may be unable to finance its ongoing operations and development; that the Company can achieve its business plans and objectives as anticipated; that the Company may be unable to finance its ongoing operations and development; that the business of the Company may be unsuccessful for various reasons. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated by MCF Energy Ltd. for this article. While the opinions expressed in this article are based on information believed to be accurate and reliable, such information in our communications and on our website has not been independently verified and is not guaranteed to be correct. The content of this article is based solely on our opinions which are based on very limited analysis and we are not professional analysts or advisors.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of MCF Energy Ltd. and therefore has an incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of MCF Energy Ltd. in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. Accordingly, our views and opinions in this article are subject to bias, and we stress that you should conduct your own extensive due diligence regarding the Company as well as seek the advice of your professional financial advisor or a registered broker-dealer before you consider investing in any securities of the Company or otherwise.

NOT AN INVESTMENT ADVISOR. Oilprice.com is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. You should not treat any opinion expressed herein as an inducement to make a particular investment or to follow a particular strategy, but only as an expression of opinion. The opinions expressed herein do not take into account the suitability of any investment with your particular objectives or risk tolerance. Investments or strategies mentioned in this article and on our website may not be suitable for you and are not intended as recommendations.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making any investment. This communication should not be used as a basis for making any investment in any securities. Past performance is not indicative of future results.

RISK OF INVESTING. Investing is inherently risky. Do not trade with money you cannot afford to lose. There is a real risk of loss (including total loss of investment) in following any strategy or investment discussed in this article or on our website. This is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote in any jurisdiction. No representation is being made as to the future price of securities mentioned herein, or that any stock acquisition will or is likely to achieve profits.

Yahoo Finance

Yahoo Finance