Professional Tools and Equipment Stocks Q1 Recap: Benchmarking Stanley Black & Decker (NYSE:SWK)

As the Q1 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers in the professional tools and equipment industry, including Stanley Black & Decker (NYSE:SWK) and its peers.

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand. Some professional tools and equipment companies also provide software to accompany measurement or automated machinery, adding a stream of recurring revenues to their businesses. On the other hand, professional tools and equipment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 9 professional tools and equipment stocks we track reported a mixed Q1; on average, revenues missed analyst consensus estimates by 0.7%. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and professional tools and equipment stocks have had a rough stretch, with share prices down 6.6% on average since the previous earnings results.

Stanley Black & Decker (NYSE:SWK)

Based in Connecticut, Stanley Black and Decker (NYSE:SWK)

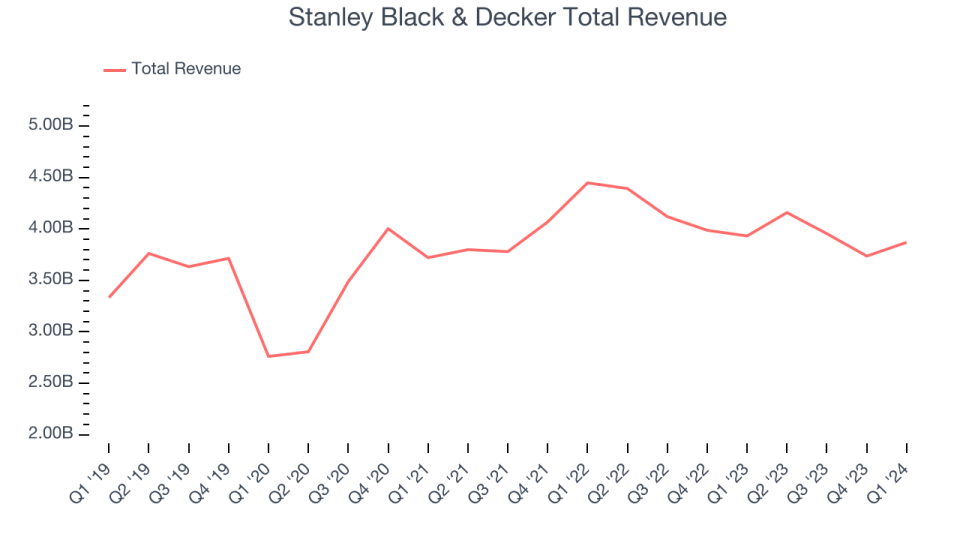

Stanley Black & Decker reported revenues of $3.87 billion, down 1.6% year on year, in line with analysts' expectations. Overall, it was a strong quarter for the company with a solid beat of analysts' organic revenue estimates and a narrow beat of analysts' earnings estimates .

Donald Allan, Jr., Stanley Black & Decker's President & CEO, commented, "Our first quarter performance was the result of consistent, solid execution and continued progress against key operational objectives. We continue to see significant value creation opportunities tied to our strategic business transformation, and we remain focused on disciplined execution of our strategy. Looking forward, we expect mixed demand trends to persist across our businesses in 2024, and we are driving supply chain cost improvements designed to expand margins, deliver earnings growth and generate strong cash flow. At the same time, the long-term growth and market share gains we are focused on achieving will be driven by introducing exciting new products within our most powerful brands designed to deliver enhanced productivity for end users. We are funding growth investments intended to further accelerate innovation and differentiated market activation to capture these compelling long-term opportunities.

The stock is down 4.4% since reporting and currently trades at $87.89.

Is now the time to buy Stanley Black & Decker? Access our full analysis of the earnings results here, it's free.

Best Q1: Hyster-Yale Materials Handling (NYSE:HY)

Playing a significant role in the development of the hydraulic lift truck, Hyster-Yale (NYSE:HY) designs, manufactures, and sells materials handling equipment to various sectors.

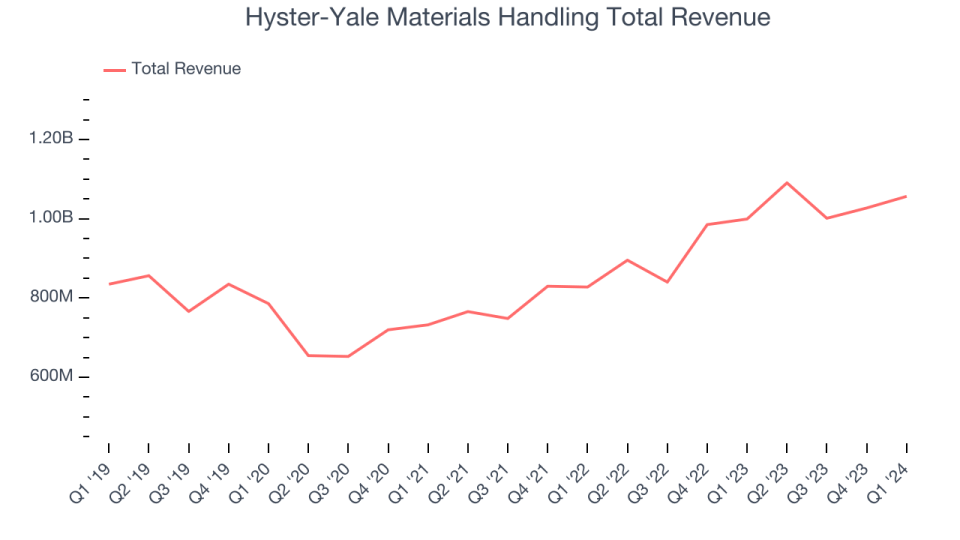

Hyster-Yale Materials Handling reported revenues of $1.06 billion, up 5.7% year on year, outperforming analysts' expectations by 2.4%. It was a stunning quarter for the company with an impressive beat of analysts' earnings estimates.

Hyster-Yale Materials Handling achieved the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 15.6% since reporting. It currently trades at $68.32.

Is now the time to buy Hyster-Yale Materials Handling? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Middleby (NASDAQ:MIDD)

Holding a Guinness World Record for creating the world’s fastest conveyor pizza oven, Middleby (NYSE:MIDD) is a food service and equipment manufacturer.

Middleby reported revenues of $926.9 million, down 8% year on year, falling short of analysts' expectations by 5.5%. It was a weak quarter for the company with a miss of analysts' earnings and organic revenue estimates.

Middleby had the slowest revenue growth in the group. As expected, the stock is down 11.7% since the results and currently trades at $125.37.

Read our full analysis of Middleby's results here.

Fortive (NYSE:FTV)

Taking its name from the Latin root 'fort' meaning strong, Fortive (NYSE:FTV) manufactures products and develops software for numerous industries.

Fortive reported revenues of $1.52 billion, up 4.4% year on year, in line with analysts' expectations. Revenue aside, it was an ok quarter for the company with a solid beat of analysts' organic revenue estimates but full-year revenue guidance missing analysts' expectations.

The stock is down 7% since reporting and currently trades at $74.95.

Read our full, actionable report on Fortive here, it's free.

Kennametal (NYSE:KMT)

Involved in manufacturing hard tips of anti-tank projectiles in World War II, Kennametal (NYSE:KMT) is a provider of industrial materials and tools for various sectors.

Kennametal reported revenues of $515.8 million, down 3.8% year on year, in line with analysts' expectations. Revenue aside, it was an ok quarter for the company with a decent beat of analysts' organic revenue estimates but a miss of analysts' earnings estimates.

The stock is down 3.2% since reporting and currently trades at $23.76.

Read our full, actionable report on Kennametal here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance