Private Lenders Storm Public Bond Markets at Record-Setting Pace

(Bloomberg) -- A group of private credit funds backed by firms like Blackstone Inc. and Ares Management Corp. have found a cheap place to raise money, at a time when they already have record levels of cash: the investment-grade corporate bond market.

Most Read from Bloomberg

Wells Fargo Fires Over a Dozen for ‘Simulation of Keyboard Activity’

Apple to ‘Pay’ OpenAI for ChatGPT Through Distribution, Not Cash

Hunter Biden Was Convicted. His Dad’s Reaction Was Remarkable.

US Producer Prices Surprise With Biggest Decline Since October

Gavin Newsom Wants to Curb a Labor Law That Cost Businesses $10 Billion

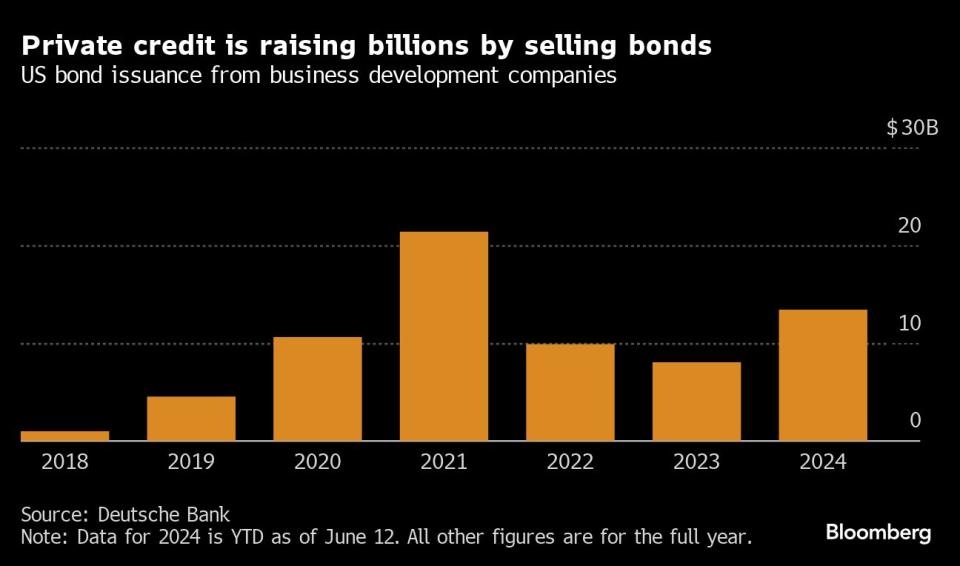

Private credit funds known as business development companies have raised over $13.4 billion in the US investment-grade bond market so far this year, according to data compiled by Deutsche Bank AG. That’s already nearly double the $8 billion raised over the entire course of 2023, and the highest since 2021, when $21.4 billion was sold.

The bond-selling spree has driven money into a market that already has plenty of liquidity. Private credit funds have a record amount of dry powder to invest — around $500 billion. And the opportunities for putting that money to work are increasingly limited, partly because the leveraged buyouts that are often financed by private credit have been drying up.

But in the investment-grade corporate bond market, investors are largely shrugging off these risks, underscoring how intense demand is for notes carrying relatively high credit ratings. BDCs are now finding cheaper financing in the unsecured corporate bond market than in the secured market, in some instances. Last month, Blackstone’s Secured Lending Fund borrowed $400 million of unsecured high-grade notes at 145 basis points over the benchmark. By contrast, most of its outstanding senior secured funding facilities have higher rates than this, a Bloomberg News analysis of regulatory filings shows.

“When you can get cheaper financing, you can also invest at cheaper rates,” said Logan Nicholson, a managing director at Blue Owl Capital Inc. “With base rates where they are, returns are still attractive. This helps us remain competitive for the deals that are out there, as spreads come in.”

Private loans have recently paid spreads of between 475 basis points and 550 basis points over US benchmarks, at or near historical lows, data compiled by Bloomberg shows. Borrowing more cheaply for their own funds is one lever private credit firms can pull to partially mitigate any negative impact on returns.

In May, Ares Strategic Income Fund — which launched in April — raised $700 million of five-year notes, while a Morgan Stanley fund borrowed $350 million and Blue Owl Credit Income raised $500 million of notes with the same maturity. Earlier this week, HPS Corporate Lending Fund — known as HLEND — became the latest BDC to take advantage of attractive borrowing costs, selling $400 million of five-year bonds.

Conducive capital markets, fewer economic worries and the record amount of dry powder have all helped fuel double-digit growth in private credit markets, according to Bloomberg Intelligence analysts David Havens and Nick Beckwith. BDCs in particular have prepared by issuing bonds, building out credit curves and boosting liquidity, they noted.

Refinancing needs are also growing for BDCs that first tapped the market a few years ago, according to Doug Conn, an investment-grade strategist at SMBC Nikko Securities America Inc. Though borrowing costs have gone up since as a result of the Federal Reserve’s aggressive rate-hikes, he predicts that BDCs will continue to issue.

Right now, BDC bond issuance is running 68% ahead of 2021’s pace, estimates Josh Warren, co-head of FIG debt capital markets North America at Deutsche Bank. “The sector is well positioned to set a new volume record,” he said.

More Flexibility

BDCs were first created in 1980 by Congress to fuel job growth and boost lending to small and mid-sized American businesses. They typically raise equity from investors in order to issue loans to the middle-market firms that banks may deem too risky to lend to. Over the last few years, they’ve also started selling corporate bonds.

A key feature of the vehicles is that they dole out most of their earnings to investors as dividends so they don’t have to pay corporate income tax. To produce the desired investor returns and stay appropriately levered, the funds need to meet inflows of equity capital with debt, according to Warren.

As the private credit market grows, issuers are becoming more familiar to investors, confidence around secondary market liquidity is rising, and it’s also becoming easier to make relative value comparisons within the sector, said Brendan Murphy, head of US investment grade syndicate at Deutsche Bank. More money has poured into private credit funds from wealthy investors, retirement plans, sovereign wealth funds, and even banks.

“Banks are falling over themselves to provide leverage to private credit funds,” said Andrew Bellis, head of private debt at Switzerland-based Partners Group. “It’s a good time to get more flexibility and lower pricing, which helps us to remain more competitive too.”

Even with private credit fundraising slowing in the first quarter, limited partners remain committed to the asset class with plans to continue allocating.

“It certainly takes a more nuanced credit approach,” said Matt Brill, head of North America investment-grade credit at Invesco Ltd., referring to BDCs. “A lot of investors got very nervous about them in 2020 and 2021 with Covid and then last year post-SVB and Credit Suisse failure.”

The debt generally trades like BB rated bonds, added Brill. While they’ve performed well in the last year, they still trade wide for their rating, according to Bill Zox, a portfolio manager at Brandywine Global Investment Management.

“In a hard landing scenario they will trade more like CCCs than BBBs and that is not zero probability,” he said.

Deals

Stifel Financial Corp. and Lord Abbett & Co. are teaming up on a joint venture for private credit

Gopher Resource, a provider of recycling services, has reached out to private credit lenders for financing as it struggles with liquidity

KKR & Co. obtained a private credit loan of about A$500 million from Blackstone Inc. and Goldman Sachs Asset Management to help finance its acquisition of Australia’s Perpetual Ltd.’s corporate trust unit

Oak Hill Advisors led and was agent to a more than $1 billion facility to refinance National Carwash Solutions existing debt

Fortress Investment Group is providing £750 million to Tabeo Ltd., which specializes in consumer healthcare financing, to approve and manage loans for dental work

Thoma Bravo has reached out to private credit lenders as it seeks to raise around $3.5 billion in fresh financing for its automated professional services provider ConnectWise

Inetum, a French IT services company owned by private equity firm Bain, has launched a sale of its software division

A group of private credit lenders provided debt financing for Bain Capital’s $5.6 billion acquisition of PowerSchool Holdings Inc., beating out banks that had also competed to finance the deal

Blackstone Inc. is in talks with private credit lenders to raise as much as $2.8 billion in financing for its audio-visual and event-services company Encore Group USA LLC to address its upcoming maturities

Hayfin Capital Management, the private-credit specialist that began exploring a sale last year, has put those plans on ice in favor of a management buyout

Team Global Express, an Australia transport and logistics company, has lined up a A$190m loan from CBA and a number of funds to electrify its truck fleet

Oxley Holdings Ltd, a cash-strapped property developer in Singapore, is seeking a private credit loan of $100 million to $120 million partly to help repay a Singapore dollar bond due next month

Fundraising

Investment firm North Wall Capital has announced the final close of its second flagship fund, raising €640 million to invest in opportunistic private credit

Private credit lender Monroe Capital is looking to forge long-term partnerships with investors in the Middle East with its new office in Abu Dhabi

Legal & General Group Plc’s Chief Executive Officer António Simões has set out a new strategy for the UK insurer that would merge its asset management units and scale up private-market and higher fee-paying assets

Indian money manager Neo Asset Management raised 25.75 billion rupees ($308 million) in its maiden private credit fund, as one of Asia’s fastest growing markets for such lending expands

Asset manager Kartesia raised €1.8 billion for its second fund dedicated to a senior debt strategy

Australian money manager Tanarra Capital Pty Ltd. is planning a A$1 billion private credit fund for lending to local companies, tapping the country’s fast-expanding pension savings pool

Job Moves

Asset management firm Fiera Capital has appointed Shawn Shi as senior vice president, with a focus on Australia and New Zealand private credit

On Bloomberg TV

Blue Owl Not Seeing Uptick in Defaults, Lipschultz Says

Koenig: Mid-East Among Fastest Growing Pvt Credit Mkts

JPMorgan’s Kelly: Diversify in Public, Private Markets

KKR: Private Markets Will Continue to Outperform

Did You Miss?

BlackRock Scouts for Insurance Partnerships in Private-Debt Push

Banks, Private Credit Need to Team Up for Sake of New Economy

Non-Bank Risk Buildup Needs Regulating, Swiss Watchdog Warns

Private Credit Defaults Will Purge ‘Tourist Investors,’ BCI Says

Private Credit’s Valued Privacy Set to Be Eroded by New EU Rules

High Rates Pit Private Equity Firms Against Direct Lenders

Private Credit Accelerates Rise in Italian M&A, Says DC Advisory

--With assistance from John Sage.

Most Read from Bloomberg Businessweek

Israeli Scientists Are Shunned by Universities Over the Gaza War

Grieving Families Blame Panera’s Charged Lemonade for Leaving a Deadly Legacy

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance