Is Primeline Energy Holdings (CVE:PEH) Weighed On By Its Debt Load?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Primeline Energy Holdings Inc. (CVE:PEH) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Primeline Energy Holdings

How Much Debt Does Primeline Energy Holdings Carry?

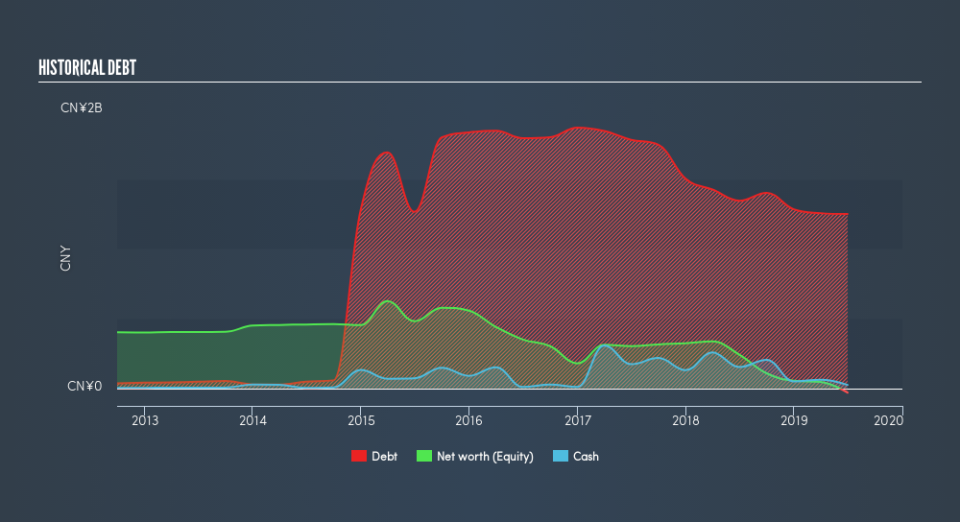

As you can see below, Primeline Energy Holdings had CN¥1.25b of debt at June 2019, down from CN¥1.34b a year prior. And it doesn't have much cash, so its net debt is about the same.

How Healthy Is Primeline Energy Holdings's Balance Sheet?

The latest balance sheet data shows that Primeline Energy Holdings had liabilities of CN¥1.44b due within a year, and liabilities of CN¥173.3m falling due after that. Offsetting these obligations, it had cash of CN¥24.6m as well as receivables valued at CN¥13.8m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥1.58b.

The deficiency here weighs heavily on the CN¥39.3m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Primeline Energy Holdings would probably need a major re-capitalization if its creditors were to demand repayment. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Primeline Energy Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Primeline Energy Holdings saw its revenue drop to CN¥305m, which is a fall of 39%. To be frank that doesn't bode well.

Caveat Emptor

Not only did Primeline Energy Holdings's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost a very considerable CN¥153m at the EBIT level. Reflecting on this and the significant total liabilities, it's hard to know what to say about the stock because of our intense dis-affinity for it. Like every long-shot we're sure it has a glossy presentation outlining its blue-sky potential. But the reality is that it is low on liquid assets relative to liabilities, and it lost CN¥283m in the last year. So we think buying this stock is risky, like walking through a minefield with a mask on. For riskier companies like Primeline Energy Holdings I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance