Previewing Q3 Earnings Season After Rough Reports from Nike and Micron

We had been skeptical about extrapolating too much from FedEx’s FDX downbeat quarterly numbers as we see a big part of the problems as FedEx specific. But FedEx is hardly alone in pointing towards a cloudier horizon.

We don’t typically associate Nike NKE with management and operational missteps, but we just heard them tell us about a large inventory overhang that’s having negative implications for margins and profitability. Part of the +44% jump in Nike’s inventory is reportedly related to apparel whose movement through the company’s supply chain was impacted by ongoing logistical challenges.

We don’t know the details, but it’s fair to assume that some part of the inventory buildup is related to softening demand. After all, the U.S. Fed’s ongoing tightening cycle is directed at crimping aggregate demand as a way to bring down inflationary pressures.

Nike’s inventory problem validates what we heard from retailers in the Q2 reporting cycle. Chipmaker Micron MU is faced with a comparable issue that forced it to cut guidance and slash CapEx to bring chip supplies in alignment with market demand that has come down as a result of weakening PC, tablet and smartphone sales.

We are starting to look at these early reports from FedEx, Nike, Micron and others for their fiscal periods ending in August as giving us a preview of what likely lies ahead as the banks kick-off the Q3 reporting cycle in about two weeks. For the record, we and other data vendors count these early reports as part of the Q3 earnings season.

Through Friday, September 30th, we have seen a total of 15 S&P 500 members report results in recent days, including the aforementioned companies. We have another 4 index members on deck to report results this week, including Conagra CAG and Constellation Brands STZ.

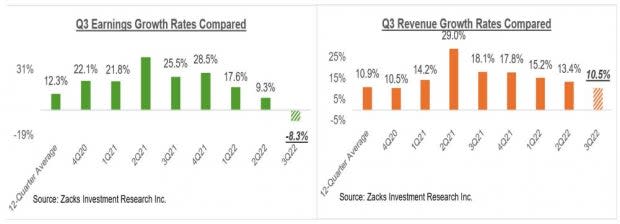

Total earnings for these 15 S&P 500 companies that have reported results are down -8.3% from the same period last year on +10.5% higher revenues, with 66.7% beating EPS estimates and 53.3% beating revenue estimates.

Here is how the 2022 Q3 earnings and revenue growth rates for these 15 companies compares across different periods.

Image Source: Zacks Investment Research

Here is how the 2022 Q3 EPS and revenue beats percentages for these 15 companies compare across different periods.

Image Source: Zacks Investment Research

We are trying hard not to draw any conclusions here given how small the sample size of Q3 results are at this stage. But it’s hard to put a gloss on the fact that these 15 index members, some of whom are true bellwethers, struggled to beat consensus estimates.

In fact, you can see above that the 2022 Q3 EPS and revenue beats percentages are tracking the 5-year lows for this group of companies. Needless to add, it is hardly a reassuring start to the Q3 reporting cycle.

The Earnings Big Picture

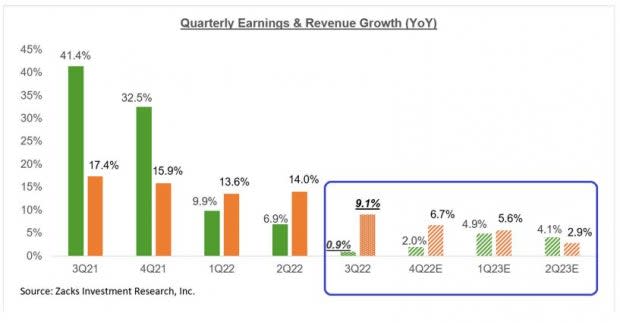

To get a sense of what is currently expected, take a look at the chart below that shows current earnings and revenue growth expectations for the S&P 500 index for 2022 Q3 and the following three quarters.

Image Source: Zacks Investment Research

As you can see here, 2022 Q3 earnings are expected to be up +0.9% on +9.1% higher revenues.

Don’t forget that it is the strong contribution from the Energy sector that is keeping the aggregate Q3 earnings growth in positive territory. Excluding the Energy sector, Q3 earnings for the rest of the S&P 500 index would be down -5.8% from the same period last year.

Analysts have been lowering their estimates since the quarter got underway, as the chart below shows.

Image Source: Zacks Investment Research

The -5.8% decline expected in Q3 on an ex-Energy basis is down from +2.1% in early July.

Third quarter estimates have come down for all sectors, except Energy and Autos, with the biggest declines within Consumer Discretionary, Basic Materials, Consumer Staples, Technology, and Construction.

In the aggregate, 2022 Q3 earnings estimates for the S&P 500 index have been cut -6.5% since mid-June. If we look at the revisions trend after excluding the Energy sector where estimates are still going up, aggregate Q3 estimates have declined by -8.5% since mid-June.

Estimates for 2022 Q4 and full-year 2024 have also been coming down.

These aren’t modest cuts to estimates, but rather towards the higher end of the historical range. The key takeaway here is that estimates have already been coming down. Yes, there may be some more cuts ahead, as we can reasonably expect will happen with estimates for Nike and Micron in the days ahead.

But to suggest that earnings estimates have to massively come down to reach a ‘fair’ level would imply that we are projecting a global financial crisis type of economic event on the horizon, which is hard to justify given current economic fundamentals. We should also keep in mind that corporate earnings and revenues are in ‘nominal’ (or not adjusted for inflation) dollars and will largely keep pace with inflationary trends.

The chart below shows the comparable picture on an annual basis.

Image Source: Zacks Investment Research

The +6.8% earnings growth expected for the index this year drops to +0.3% once the Energy sector’s contribution is excluded.

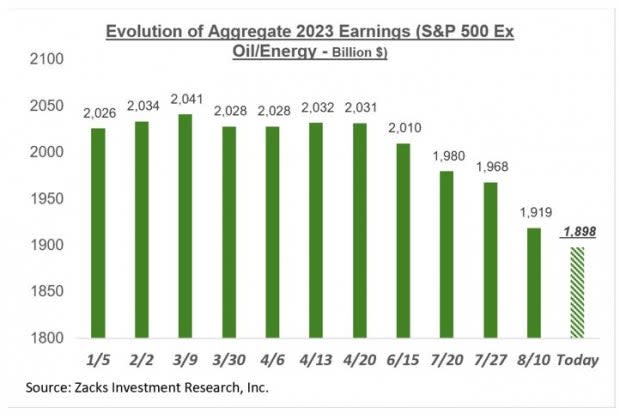

The chart below shows how the aggregate bottom-up earnings total for 2023 on an ex-Energy basis has evolved lately.

Image Source: Zacks Investment Research

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>>Are Earnings Estimates Out of Sync with the Economy?

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NIKE, Inc. (NKE) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Conagra Brands (CAG) : Free Stock Analysis Report

FedEx Corporation (FDX) : Free Stock Analysis Report

Constellation Brands Inc (STZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance