Prepare for Takeoff With Perrigo

Perrigo Company PLC (NYSE:PRGO) is one of the world's largest pharmaceutical companies, focused on selling over-the-counter medications, infant formula and personal care products.

Investment thesis

Over the last couple of years, the company has remained highly engaged in restructuring efforts aimed at lowering its debt, improving revenue growth rates and margins, continuing a relatively aggressive merger and acquisition policy and increasing dividend payments.

In April 2022, Perrigo completed the acquisition of HRA Pharma for $1.90 billion. This has allowed it to significantly expand its product portfolio to include medicines for rare diseases, treatments for various types of scars and blisters and women's health products, including ellaOne and Hana.

We expect the acquisition to strengthen Perrigo's position in the global beauty and personal care market and enable it to reduce marketing, manufacturing and research and development costs in the long term.

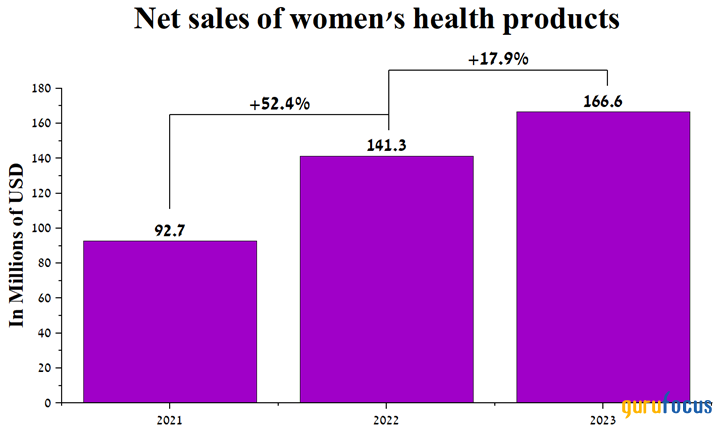

The company's fourth-quarter financial results indicate the integration of the two businesses continues to move in the right direction. Total sales of women's health products amounted to $166.60 million for 2023, an increase of 17.90% compared to the previous year.

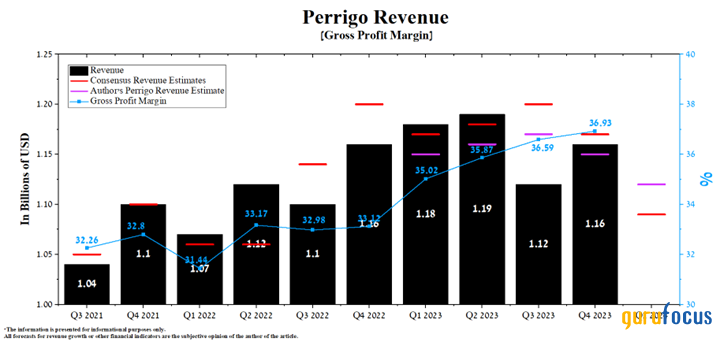

Source: Author's elaboration, based on quarterly securities reports

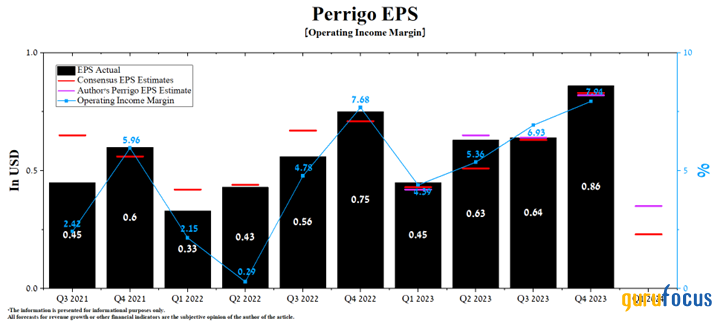

Perrigo's non-GAAP earnings per share for 2023 was $2.58, up 24.60% year over year, thanks partly to products aimed at relieving upper respiratory symptoms caused by a significant increase in flu and cold cases.

Another investment thesis is the company's product sales are through major retailers such as Walgreens Boots Alliance (NASDAQ:WBA), CVS Health (NYSE:CVS), Amazon (NASDAQ:AMZN) and Walmart (NYSE:WMT), allowing Perrigo to better adapt to the rapidly changing environment in the health care sector.

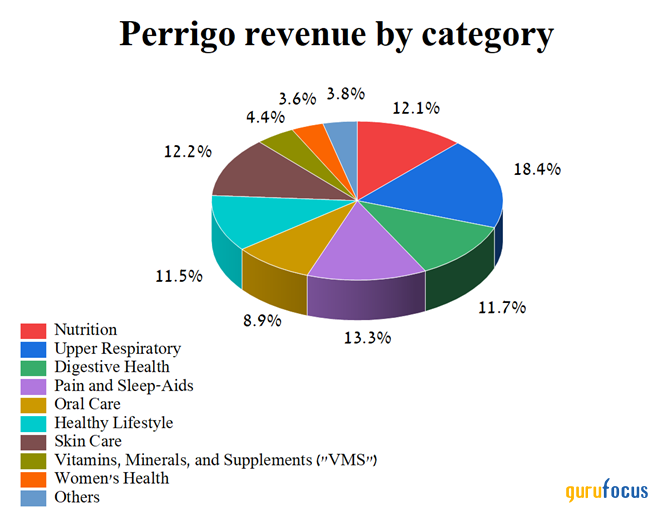

In addition, no single product category accounts for more than 20% of total revenue, making it less susceptible to falling demand for individual drugs. In 2023, the company launched Arterin, Davitamon, Abte and Acetaminophen/Ibuprofen tablets and expanded Compeed's portfolio of products outside of North America.

Source: Author's elaboration, based on quarterly securities reports.

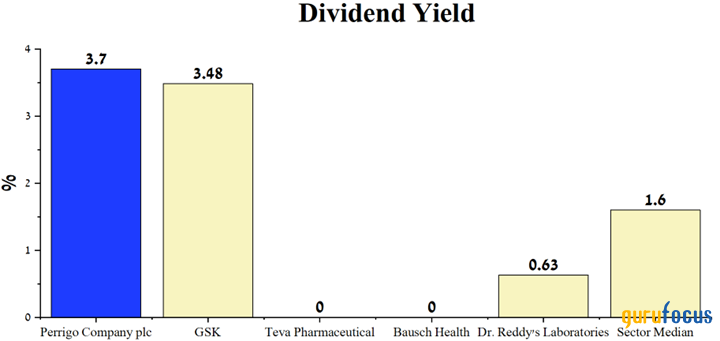

An additional investment thesis we highlight is Perrigo's dividend yield. It is about 3.70%, which is significantly higher than the average for the health care sector and also ahead of its competitors, including GSK (NYSE:GSK), Haleon (NYSE:HLN), Dr. Reddy's Laboratories (NYSE:RDY), and Teva Pharmaceutical (NYSE:TEVA).

Moreover, over the past 22 years, the company has continued to increase dividend payments. Given that its payout ratio does not exceed 50%, we expect this trend to continue.

Source: Author's elaboration, based on GuruFocus data.

We initiate our coverage of Perrigo's with an outperform rating for the next 12 months.

Fourth-quarter financial results and outlook for 2024

Perrigo's fourth-quarter 2023 revenue was about $1.16 billion, beating our expectations by about $10 million. This financial indicator remained almost unchanged compared to the prior-year quarter.

However, despite the lack of sales growth for many of its products, Perrigo's trailing 12-month price-sales ratio was 0.79, which is not only 80.55% lower than the sector median, but also 34.80% lower than the average over the past five years. As a result, we believe financial market participants remain conservative on Perrigo's prospects, given the growing revenue of its Consumer Self-Care International segment.

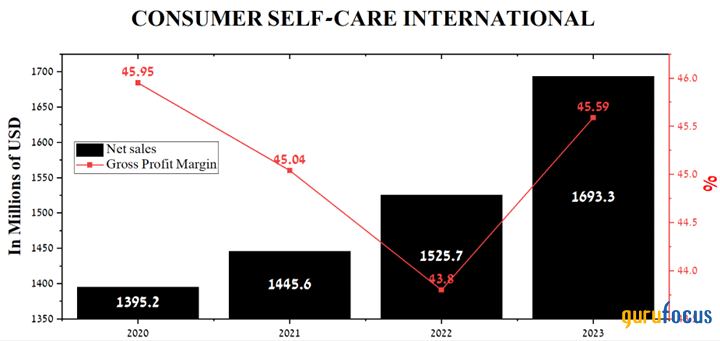

Total sales of the company's Consumer Self-Care International segment amounted to $1.69 billion for 2023, an increase of 11% compared to the previous year. Key factors contributing to the segment's improved financial position include higher prices for its medicines, higher sales within its Sebamed brand lines and increased demand for its cold and cough products, including Bronchostop, Coldrex Junior and Coldrex Max Grip.

Source: Author's elaboration, based on quarterly securities reports.

Perrigo is anticipated to publish its financial report for the first quarter on May 10. According to analyst projections, its revenue for the quarter is expected to be in the range of $1.08 billion to $1.15 billion, down about $60 million from expectations for the previous quarter.

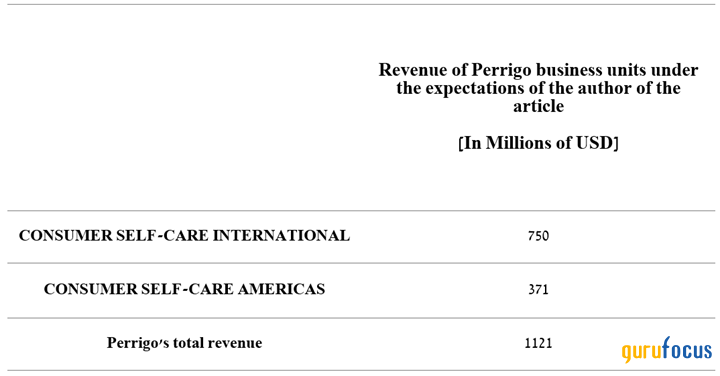

Source: Author's elaboration, based on GuruFocus data.

Simultaneously, under our model, Perrigo's total revenue will be $30 million above the median of this range and reach $1.12 billion. The higher financial metric will be driven primarily by increased demand for its women's health products, as well as double-digit growth in sales of Solpadeine, Davitamon, NorLevo and Nytol.

Source: created by Author

Perrigo's operating income margin was 7.94% for the three months ended Dec. 31, continuing to increase in the last four quarters, thanks in part to a recovery in sales of herbal medicines, vitamin supplements, pain relievers and women's health products.

According to our estimates, this financial indicator will increase to 8.20% in 2024, mainly due to the expansion of the portfolio of medicines, the weakening of the U.S. dollar relative to other currencies, lower inflation and optimization of its administrative and R&D expenses.

Source: Author's elaboration, based on GuruFocus data.

Analyst projections show Perrigo's earnings per share for the first quarter of 2024 are expected to be 23 cents. We expect its earnings to be higher, reaching 30 cents, but down 33.30% year over year.

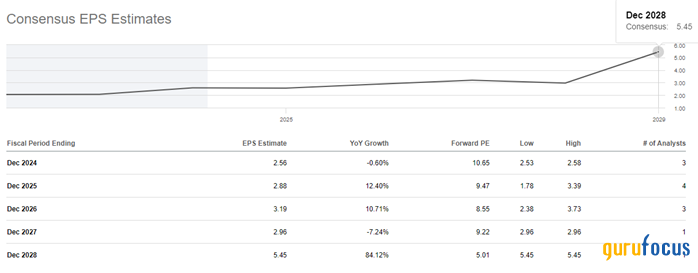

Nonetheless, the trailing 12-month non-GAAP price-earnings ratio is 10.58, which is 43.2% lower than the sector average. Taking into account the company's 2024 financial guidance, as well as our projected sales of its two segments, the forward non-GAAP price-earnings ratio will be 10.60, which is one of the factors indicating Perrigo is trading at a discount, even despite the improvement in its gross margin in recent quarters and new product launches.

More globally, Perrigo's operating income growth is expected to push its price-earnings ratio down to 5 by 2028, which we estimate is an attractive value for conservative investors.

Source: Author's elaboration, based on analyst data.

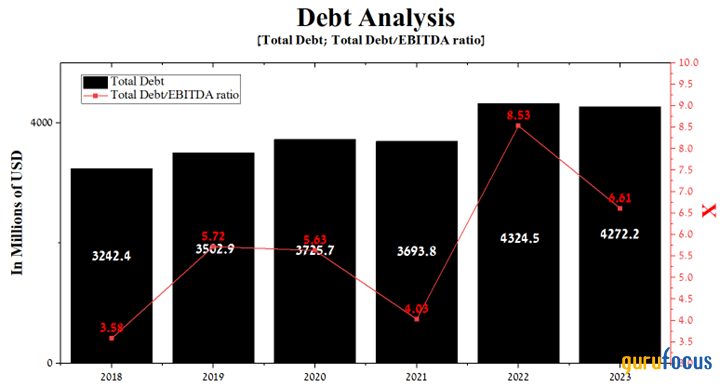

What's more, it is equally important to discuss the company's debt, which has continued to grow in recent years, including due to the acquisition of HRA Pharma for 1.80 billion euros ($1.96 billion), as well as the Nestle Gateway plant and the rights to the Good Start infant formula brand in the U.S. and Canada for a total of $170 million. So its total debt amounted to $4.28 billion at the end of 2023, down only slightly from the previous year.

On the other hand, thanks to strong demand for over-the-counter drugs and consumer self-care products, its Ebitda has continued to grow in recent quarters, ultimately reflected in a fall in its total debt/Ebitda ratio, which stood at 6.61 at the end of 2023.

Source: Author's elaboration, based on GuruFocus data.

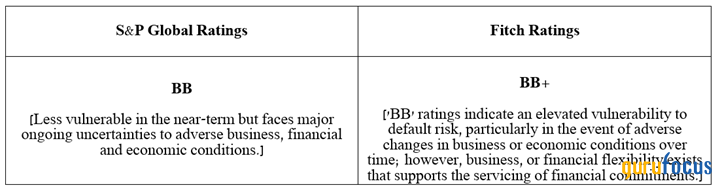

As a result, S&P Global Ratings has affirmed Perrigo's rating at "BB," while Fitch Ratings maintains its credit rating at "BB+."

Source: Author's elaboration, based on documents from credit rating agencies.

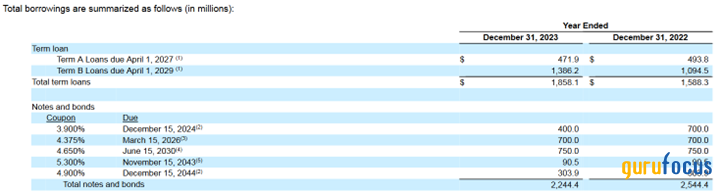

The table below shows the carrying amounts of notes and loans and their maturity dates.

Source: 10-K

Overall, we do not expect the company's management to have significant difficulty servicing its debt in the coming years, thanks to its growing free cash flow, as well as its total cash and short-term investments of approximately $744 million at the end of December 2023.

However, maintaining a company's total debt/Ebitda ratio above 5 not only negatively affects its financial flexibility, preventing its management from resorting to a share repurchase program, but may also be a factor that discourages certain categories of investors from considering Perrigo as an asset in their investment portfolio.

Conclusion

In conclusion, we want to highlight several financial risks that may negatively affect Perrigo's investment attractiveness. The first is maintaining the total debt/Ebitda ratio above 6 despite the company's improving operating income margin in recent quarters. Also, in 2024, there will be a U.S. presidential election and, as a result, some politicians may begin to speak out for stronger regulation of the pharmaceutical industry, including efforts to reduce drug prices.

However, despite these risks, management's business strategies are beginning to bear fruit, which is reflected in the improvement of its gross and operating income margins in recent quarters. As a result, the company has continued to increase its dividend payments over the past 22 years, which is an important factor that attracts long-term investors. Also, thanks to the acquisition of HRA Pharma, Perrigo significantly expanded its product range, allowing it to become one of the leaders in the global over-the-counter medicine market.

We initiate our coverage of Perrigo's with an outperform rating for the next 12 months.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance