Premier Financial And Two More Top Dividend Stocks In The US

Amidst a fluctuating U.S. market where major indices like the Nasdaq Composite and S&P 500 have recently snapped their winning streaks due to declines in tech stocks, investors may find refuge in dividend stocks. These stocks offer potential stability and steady income, qualities that become particularly appealing in times when the broader market shows volatility and uncertainty about interest rate movements.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 6.69% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.46% | ★★★★★★ |

Premier Financial (NasdaqGS:PFC) | 5.65% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.01% | ★★★★★★ |

Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★☆ |

Financial Institutions (NasdaqGS:FISI) | 5.83% | ★★★★★☆ |

Marine Products (NYSE:MPX) | 5.82% | ★★★★★☆ |

Credicorp (NYSE:BAP) | 5.50% | ★★★★★☆ |

West Bancorporation (NasdaqGS:WTBA) | 5.34% | ★★★★★☆ |

Citizens & Northern (NasdaqCM:CZNC) | 6.05% | ★★★★★☆ |

Click here to see the full list of 192 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

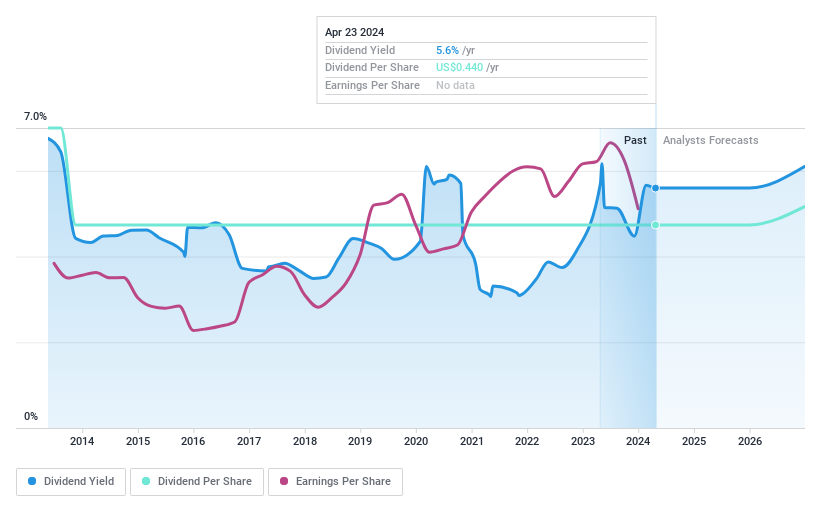

Premier Financial

Simply Wall St Dividend Rating: ★★★★★★

Overview: Premier Financial Corp., operating through its subsidiaries, offers a range of banking services and has a market capitalization of approximately $743.84 million.

Operations: Premier Financial Corp. generates its revenue primarily from financial service operations, totaling approximately $299.37 million.

Dividend Yield: 5.6%

Premier Financial, recently added to the Russell 2000 Dynamic Index, reported a slight decline in net interest income and net income for Q1 2024. Despite this, it maintains a strong dividend profile with a recent affirmation of a $0.31 per share quarterly dividend, reflecting an annual yield of 6.16%. The company's dividends are currently well-covered by earnings with a payout ratio of 40%, ensuring sustainability. Additionally, Premier has shown commitment to returning value to shareholders through significant share repurchases totaling US$66.52 million since 2019.

Sandy Spring Bancorp

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sandy Spring Bancorp, Inc., functioning as the bank holding company for Sandy Spring Bank, offers a range of services including commercial and retail banking, mortgage, private banking, and trust services in the United States, with a market capitalization of approximately $1.12 billion.

Operations: Sandy Spring Bancorp, Inc. generates its revenue through diverse financial services such as commercial and retail banking, along with offerings in mortgage, private banking, and trust services.

Dividend Yield: 5%

Sandy Spring Bancorp recently declared a quarterly dividend of US$0.34 per share, maintaining its 10-year history of stable dividends. Despite a dip in Q1 2024 earnings, with net interest income down to US$79.34 million from US$97.3 million the previous year and net income falling to US$20.37 million from US$51.25 million, the company's dividend yield remains attractive at 5.04%, above the top quartile for U.S dividend payers at 4.73%. The payout ratio stands at a reasonable 66.4%, suggesting sustainability despite current earnings pressures.

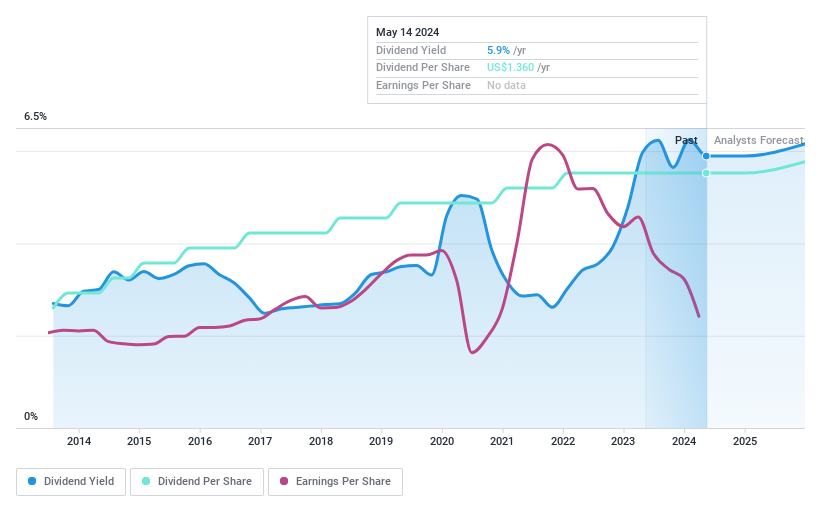

Valley National Bancorp

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Valley National Bancorp, functioning as the holding company for Valley National Bank, offers a range of services including commercial and private banking, retail banking, insurance, and wealth management with a market capitalization of approximately $3.56 billion.

Operations: Valley National Bancorp generates revenue through two primary segments: Consumer Banking, which brings in $227.76 million, and Commercial Banking with revenues of $1.46 billion.

Dividend Yield: 5.9%

Valley National Bancorp, recently added to the Russell 2000 Dynamic Index, maintains a mixed dividend track record with recent quarterly dividends declared at US$0.11 per share on common stock and higher rates for preferred stocks. Despite a leadership change with John P. Regan set to become Chief Risk Officer, and a slight dip in Q1 2024 earnings to US$96.28 million from US$146.55 million last year, the company's dividends are currently supported by earnings with a payout ratio of 51.7%. However, dividend payments have shown volatility over the past decade, challenging their reliability despite being within top U.S market yields at 5.88%.

Taking Advantage

Investigate our full lineup of 192 Top US Dividend Stocks right here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:PFC NasdaqGS:SASR and NasdaqGS:VLY.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance