Precious Metal Prices Trade Sideways After Short-Lived Rally

Via Metal Miner

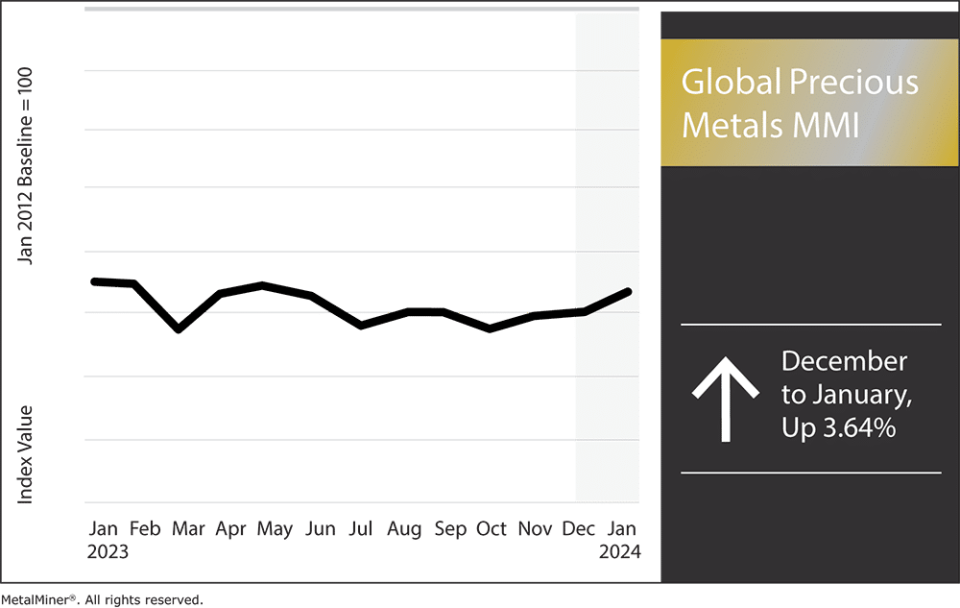

The Global Precious Metals MMI (Monthly Metals Index) ended 2023 by breaking out of its sideways trend and rising 3.64%. However, most precious metals still lack strong bullish action. All precious metals retracted in January after experiencing rallies throughout December. Currently, precious metals prices, for the most part, lack the strength needed to break out their long-term sideways or downward trends.

Precious Metals Prices: Palladium

While palladium prices jumped in late Q4, the overall long-term downtrend quickly rejected the new prices. Moreover, palladium markets spiked in December 2023. However, this bullish momentum proved too weak to breach the overall trend and reverse to the upside. Therefore, palladium prices continue to hold bearish sentiment and are currently trading near their December ‘23 low.

TD Ameritrade

Platinum Prices Retracting

Platinum prices created a short-term uptrend in late Q4 2023. However, the overall markets rejected this price action, with platinum quickly retracing back down below the $1000/oz level. Despite prices reaching historic resistance zones, they ultimately failed to push through with enough bullish momentum to establish a confirmed uptrend. Ultimately, prices retraced with bearish pressure and are currently trading toward their November ‘23 Low.

TD Ameritrade

Silver Prices Continue to Lack Strong Upward Action

Similar to gold, silver markets have also retraced back into range. This came after prices breached prior highs in Q4 2023. But unlike gold, silver has yet to form any sort of uptrend. Meanwhile, longer-term price direction continues to show indecisiveness due to the lack of bullish or bearish momentum to either side of the market.

Source: TD Ameritrade

Precious Metals Prices: Gold

Gold prices have traded in an uptrend since Q4 2023. Although prices created a bullish trend and broke previous highs in December, gold markets quickly retraced below $2100/oz and have yet to retest that limit. While prices seem bullish, investors and market participants may anticipate potential downside reversals as gold markets continue to see historically high prices. Market direction will become more apparent if gold prices break above current resistance or trade below $2000/oz, creating a new trend.

Source: TD Ameritrade

By The Metal Miner Team

More Top Reads From Oilprice.com:

Yahoo Finance

Yahoo Finance