Posthaste: The world's really rich are getting richer again — including Canadians

The wealth of the world’s rich is hitting record levels again, with North America leading the way, says a report out this week.

Globally the wealth of high-net-worth individuals grew 4.7 per cent last year to reach $86.8 trillion and their numbers grew 5.1 per cent to almost 23 million, according to consulting firm Capgemini’s 28th annual World Wealth Report.

That’s a big change from 2022, when both their wealth and numbers dropped.

Those 23 million include “the 1%” — the small group of people who hold 34 per cent of the world’s wealth. But it also takes in mid-tier millionaires with assets worth $5 to $30 million and “millionaires next door” whose fortunes range from just $1 million to $5 million.

Join us for a live Q&A on the Bank of Canada‘s rate decision today at noon

North America’s rich saw the biggest gains, with their wealth growing 7.2 per cent, and the population of the wealthy growing 7.1 per cent.

The United States accounted for most of that, thanks in part to the extraordinary performance of the so-called Magnificent Seven tech stocks. An economy that was in better shape than most in the world also helped.

The S&P 500 posted gains of more than 24 per cent in 2023, up 11 per cent in the fourth quarter alone, said the report.

But Canadians’ fortunes grew as well, with high-net-worth individuals gaining 3.8 per cent more wealth and the population of the wealthy increasing 3.6 per cent.

After a rough 2022, the TSX posted an 8 per cent return in 2023, led by the tech sector which soared almost 57 per cent, the report said. Yet cyclical industries were a drag on the index compared to the S&P 500, including the materials sector which dropped nearly 3 per cent.

The global wealth turnaround has led to a “significant shift” in attitudes, Capgemini’s research has found. Content in 2022 to just hang on to their money, the wealthy are now looking to grow it.

“Risk aversion is subsiding,” and in 2024 cash holdings have fallen back to norms of 25 per cent from a multi-decades high in 2022.

So where are the rich putting their money now?

Not in stocks so much. High-net-worth individuals have reduced their equity holdings to 21 per cent, a two percentage decline, despite the overall solid stock market performance, said Capgemini.

The very rich looking for very big growth are turning to high-return alternative investments such as commodities, currencies, private equity, hedge funds and digital assets. Allocations in these have risen to 15 per cent from 13 per cent in 2022.

Cryptocurrencies are popular, with half of the wealth managers Capgemini surveyed reporting a surge in client interest.

So is real estate. The wealthy increased their real estate holdings by four percentage points to almost 20 per cent allocation. Despite higher mortgage rates, the global market for luxury real estate surged towards the end of 2023, as the rich invested in secondary homes, said the report.

Dubai doubled its sales of ultra-luxury homes and London’s grew by 25 per cent.

Though not so glamorous, fixed-income portfolio allocations increased to 20 per cent in 2023, up five percentage points, as cooling inflation made these assets more attractive.

The next challenge for the wealthy, and those who advise them, is figuring how to pass all that money on.

Over the next 20 years, aging generations are estimated to transfer more than US$80 trillion.

Sign up here to get Posthaste delivered straight to your inbox.

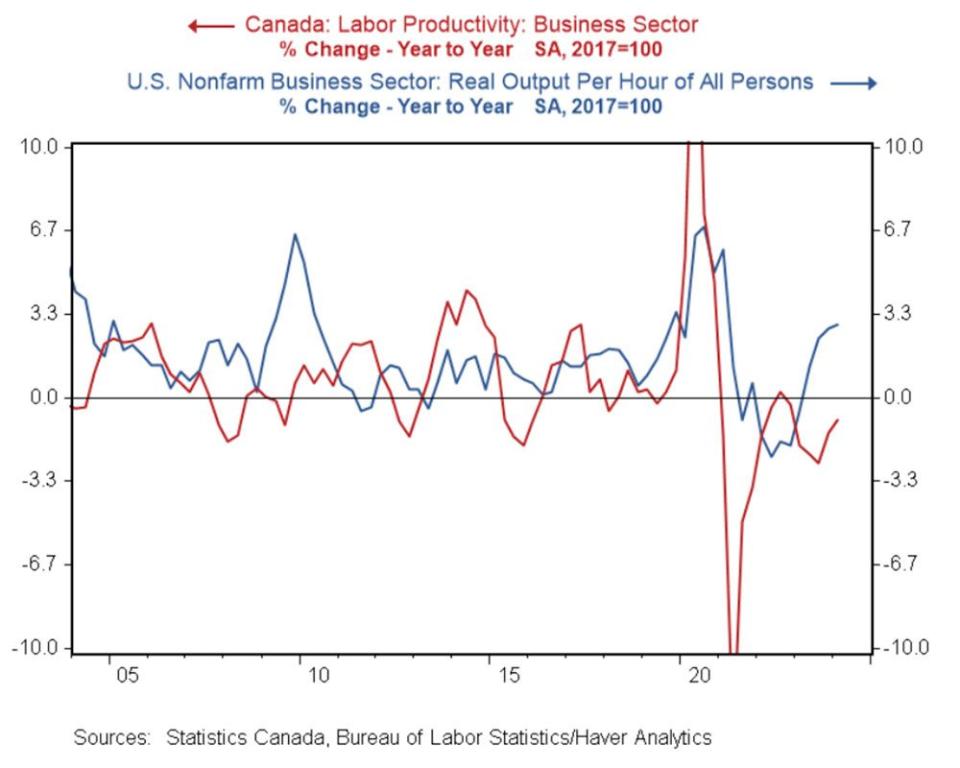

Canada’s lagging labour productivity sagged a little more in the first quarter, data showed yesterday. Labour productivity was down 0.3 per cent from the quarter before, carrying on an almost two-year decline.

Meanwhile, in the United States productivity continues to climb higher, says Bank of Canada economist Shelly Kaushik, who brings us today’s chart.

And what does higher productivity do for you? In the U.S. workers have gained higher wage growth with less inflationary pressure, meaning that Americans have more to spend, raising the odds of a soft landing for the economy, said Kaushik.

Cenovus Energy, Enbridge, Imperial Oil Limited, Shell Canada Limited, and Suncor Energy representatives appear before House of Commons committee to discuss profits and emissions reduction efforts in Canada’s oil and gas industry

The Retail Cannabis Council of Ontario holds annual general meeting and conference in Toronto.

Today’s Data: Canada international merchandise trade, United States trade balance, non-farm productivity

Earnings: Saputo Inc, The J M Smucker Co

Bank of Canada’s Tiff Macklem signals more rate cuts possible after historic shift

Bank of Canada seen cutting interest rates three more times this year

Everyone loves a comeback story, especially investors who bet on Apple Inc. in 1987, when its shares traded for a whopping 12 cents U.S. Today, they’re trading for US$190. Veteran investor Peter Hodson has seen many of these turnaround stories and looks at five recent companies that now have a new lease on life. Check them out

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line with your contact info and the gist of your problem and we’ll try to find some experts to help you out, while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers, led by Julie Cazzin, can give it a shot.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Today’s Posthaste was written by Pamela Heaven, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Yahoo Finance

Yahoo Finance