Posthaste: Why these economists think Canada's downturn will be worse than other advanced nations

Could Canada already be in a recession?

Some economists think so.

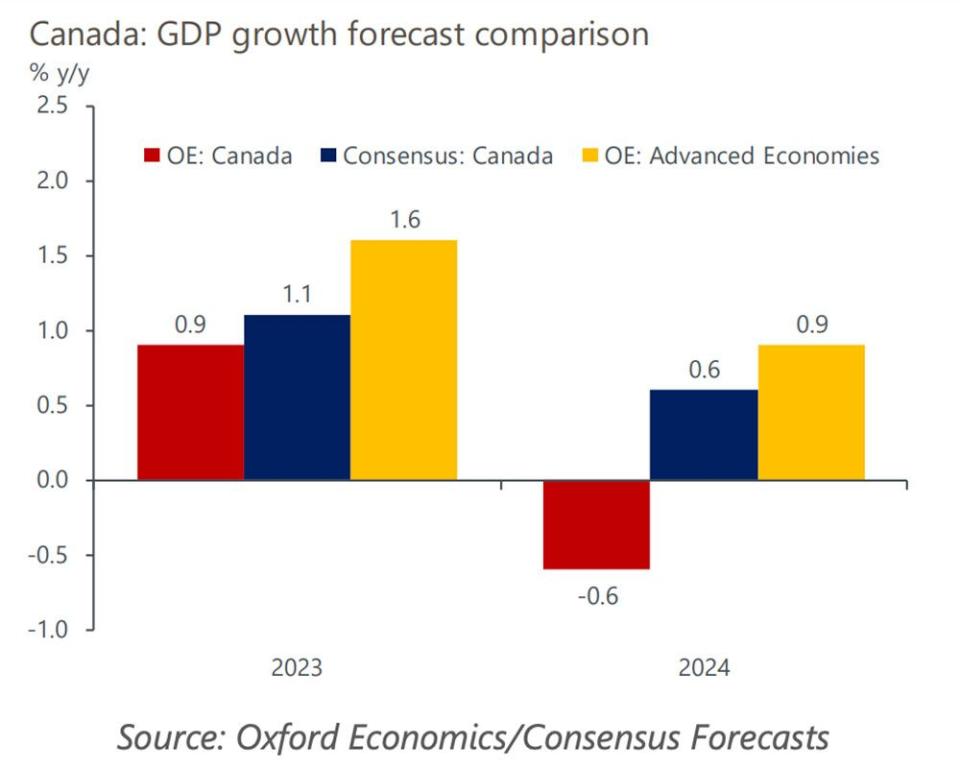

“Whereas the [Bank of Canada] BoC has underplayed the Q3 GDP contraction and still anticipates a soft landing, we believe the economy has already slipped into a recession,” said the team at Oxford Economics led by Tony Stillo.

“Four key themes will shape the economy’s performance in 2024, which we expect will be well below the consensus view and worse than other advanced economies.”

The first theme is a moderate recession followed by a muted recovery.

Oxford believes the recession started in Canada in the third quarter of 2023 and will continue until the second quarter of 2024, resulting in a 1.1 per cent peak to trough decline in gross domestic product.

Economic activity will continue to contract through the mid-year as mounting mortgage renewals push up debt service costs, forcing consumers to pull back on spending.

The housing correction, now in its fifth quarter in a row, will continue as highly indebted households are forced to deleverage. Oxford predicts another 5 to 10 per cent drop in home prices by mid 2024, bringing the overall correction to a 22 per cent decline from the peak in February 2022.

Businesses will struggle during the first half of the year as profits are hit by reduced demand and tighter credit conditions depress capital investment and hiring plans. At the same time a slowdown in the United States will hurt Canadian exports which are not expected to return to pre-recession levels until 2025, they said.

The second theme that Oxford identifies is population growth. With another 1.5 million new arrivals expected over the next two years, the labour supply will grow but the boost to actual economic activity will be gradual. Thus supply will continue to outpace job growth, driving the unemployment rate up to 7.5 per cent by the third quarter of 2024.

The third theme, and this is a big one, is the Bank of Canada. Oxford expects inflation to fall back to the 2 per cent target by the end of this year, a year earlier than the Bank’s forecast. By mid-year policy makers should see that inflation is clearly on track and will begin gradually cutting its benchmark interest rate, ending the year at 4.25 per cent, they said.

“That said, we expect the BoC will ease only gradually back to a 2.25 per cent neutral stance over several years given its concerns that inflation and inflationary expectations could get stuck well above the 2 per cent target, and its strong preference to avoid a course reversal and resume hiking rates,” Oxford said.

Lastly is fiscal policy. Unless the recession is severe, Oxford believes governments in Canada will hold back on major new spending. However, that won’t prevent budget shortfalls from growing.

Oxford expects total government revenue to decline by 1.2 per cent in 2024 amid the economic downturn. Government spending, meanwhile, is expected to rise 4.4 per cent just from higher unemployment and social assistance and debt costs.

That could push the overall government fiscal balance from a $2.2 billion surplus in 2023 to a $66 billion shortfall this year.

2024 could also include some wildcards, Oxford cautions. Wildfires, extreme weather, labour strikes and supply disruptions are all possibilities.

Globally, slowing growth in the United States and the world and a rise in tensions and conflicts all add risk and uncertainty, said the economists.

_____________________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

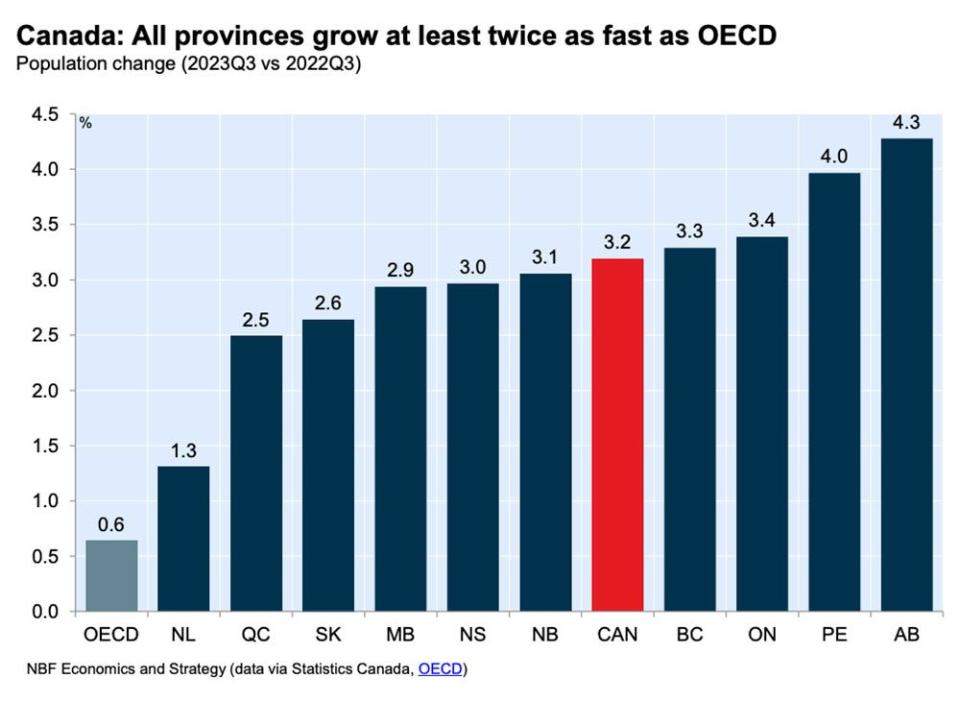

Canada’s population growth is high among its peer countries in the Organisation for Economic Co-operation and Development.

According to today’s chart from National Bank of Canada economists, Canada’s growth in 2023 was 3.2 per cent, five times the OECD average. All 10 provinces grew at least twice as fast as that average, from 1.3 per cent in Newfoundland to 4.3 per cent in Alberta.

Though immigration strengthens Canada’s prospects in the long run, National economists say recent growth may be a lot for the economy to absorb as the workforce is not aging faster than the OECD average.

Today’s Data: S&P Global U.S. manufacturing PMI and U.S. construction spending

Get all of today’s top breaking stories as they happen with the Financial Post’s live news blog, highlighting the business headlines you need to know at a glance.

Why this alternative lender’s CEO isn’t afraid of the mortgage cliff

David Rosenberg: Why the so-called soft landing is just the calm before the storm

Rate cuts are coming, but Canadian investors should also be eyeing banks and oil

Buying bonds, guaranteed investment certificates and money market funds seems like a good idea while rates are still high. But portfolio manager Emily Wheeler says it’s important to understand what fixed income represents and the role bonds may play in a portfolio versus the role of equities. Get the answer from FP Investing

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Yahoo Finance

Yahoo Finance