Posthaste: Why the case for a Bank of Canada hike may be less compelling than we think

Good Morning!

Bank of Canada forecasters haven’t had an easy time of it.

Since January 2020, overnight index swap markets have failed to predict half of the 12 rate decisions by Canada’s central bank, writes National Bank economist Taylor Schleich.

And as the July 12 decision approaches, it is shaping up to be another difficult call.

The Bank of Canada has said it would consider the data in making the decision and there has been plenty since the June meeting.

While many think the Bank will hike its rate 25 basis points to 5 per cent this month, Capital Economics says that recent data have shown spare capacity opening up in the economy.

“Overall, the data and surveys [last] week make the case for another interest rate hike in July less compelling,” said Stephen Brown, Capital’s deputy chief North America economist. “We would estimate the odds at near 50/50, similar to those currently implied by overnight index swaps.”

Key data came early last week when inflation was shown to have slowed to 3.4 per cent in May. Capital thinks inflation will average 3.6 per cent this quarter, above the Bank’s forecast of 3.4 per cent. But there are still encouraging signs, with both CPI-trim and CPI-median core measures showing the smallest monthly gains in several months.

On the other side of the argument Canada’s economy showed more momentum than expected in May, with a preliminary estimate of 0.4 per cent. This suggests that second quarter growth will be stronger than the Bank’s forecast of 1 per cent, and lays a strong base for the third quarter, said Capital. Recession calls may need to be pushed back or cancelled.

However, Capital argues that GDP growth is still below the economy’s potential and spare capacity will open up, as shown in the Bank of Canada’s Business Outlook Survey, which came out Friday. The share of businesses unable to meet demand and those suffering labour shortages are now both lower than just before the pandemic.

This was supported by another piece of data last week that showed that job openings are down 21 per cent from their peak in April.

But there is one important data point yet to come: June job numbers on Friday. The economists at RBC say even though early cracks are beginning to show in Canada’s labour market, it won’t be enough to ward off another interest rate hike.

“Though there are signs that labour markets are softening, the unemployment rate is still historically very low,” said RBC economists Nathan Janzen and Carrie Freestone.

Even if the Bank doesn’t hike rates this month the risks remain for higher rates for longer, with cuts not coming until 2024, said BMO chief economist Douglas Porter.

“We have long been of the view that central banks would begin trimming rates in early 2024 amid calmer inflation — we’re not changing that call, yet, but the risks are clearly tilting to a later start for rate cuts amid the resilient economic backdrop,” he wrote.

__________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

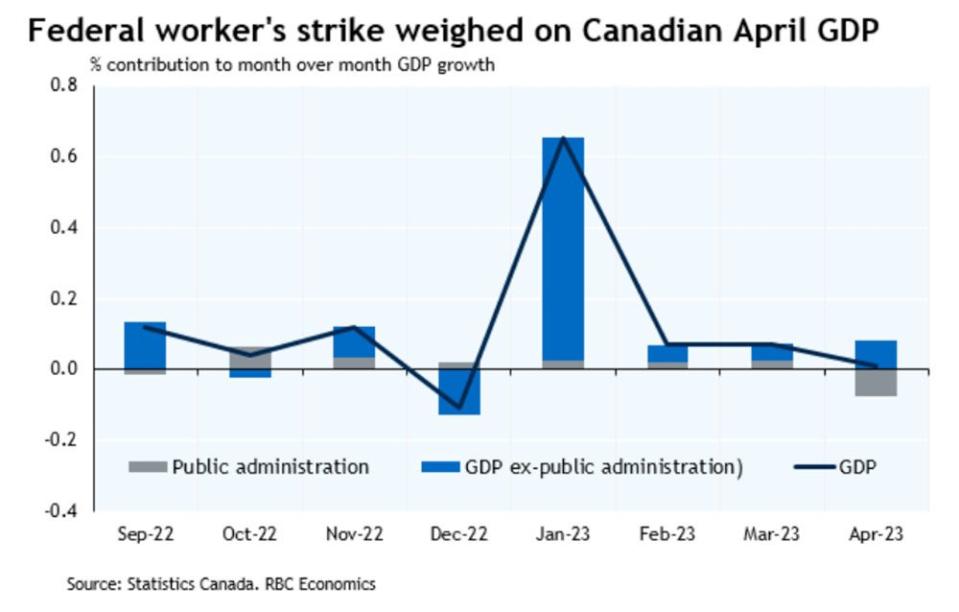

Canada’s economic growth was flat in April but only because of the strike by federal workers. Without that drag, gross domestic product would have edged up 0.1 per cent, says RBC economist Carrie Freestone, who brings us today’s chart.

Manufacturing dropped by 0.6 per cent from the month before, but that was offset by a 1.2 per cent gain in mining and oil and gas, the fourth monthly advance in a row.

Statistics Canada estimates that May brought even more activity with an advance call of 0.4 per cent growth, but Freestone cautions that “preliminary GDP estimates have also been very revision-prone.”

If the estimate is correct, Canada will not have seen a single month of GDP decline this year, even though the consensus call was for a mild recession at the beginning of 2023, said BMO chief economist Douglas Porter.

BMO is hiking its GDP forecast for the second quarter from 0.8 per cent to 1.5 per cent, and its estimate for the year from 1.3 per cent to 1.5 per cent. The Bank of Canada in April forecast 1 per cent growth in the second quarter and 1.4 per cent for the year.

U.S. stock markets closed for Independence Day

The latest home sales numbers for some of Canada’s biggest cities are expected this week. Vancouver and Calgary are to report June sales today, while Toronto is expected to report its results on Thursday.

Today’s Data: S&P Global Manufacturing PMI (June)

_______________________________________________________

Stop bashing housing investors. Canada desperately needs them

Investors should examine all the tools at their disposal, not just the ones they’re used to

Stuck in the middle: Coping with the crushing reality of the sandwich generation

Young, in love and on the hunt for a first home has one couple wondering how to save up $80,000 for a $500,000 condo. Certified financial planner Janet Gray has some tips, starting with $80,000 is a down payment of 16 per cent, while the minimum needed is five per cent and 20 per cent would eliminate the need for mortgage insurance. Get the answer

____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Yahoo Finance

Yahoo Finance