Posthaste: Why Bank of Canada rate hikes might really be over this time

It looks like British Columbia Premier David Eby might get his wish.

In a letter last week, the premier urged Bank of Canada governor Tiff Macklem to consider the “human impact” and halt any further interest rate hikes.

“People in B.C. are already hurting,” he wrote. “In your role as governor, I urge you to consider the full human impact of rate increases and not further increase rates at this time.”

Friday’s data on Canada’s economy may have done the job for him.

The contraction in second-quarter gross domestic product and flat estimate for July was a shock that prompted some economists to firm up their predictions for a rate pause on Sept. 6 — and others to call an end to hiking altogether.

GDP shrank 0.2 per cent in the second quarter, well below the Bank of Canada’s forecast of 1.5 per cent and economists’ estimates of 1.2 per cent. Statistics Canada also revised first-quarter growth down to 2.6 per cent.

“We had anticipated to see signs of a slowdown in Canada, but these figures were shockingly weak,” wrote Jay Zhao-Murray, an analyst at Monex Canada after the data came out.

“Virtually all remaining risk of a September hike was priced out by money markets, while the odds of a hike at any point by year-end was slashed to one in three.”

Granted, some of the economic drags were temporary. Record wildfires in Canada this season led to declines in mining, oil and gas, rail transportation and even hotel services. If activity in these areas had been unchanged GDP would have grown by 0.3 per cent, said Capital Economics’ Stephen Brown.

But even without the fire damage, the economy was slower than the bank had expected, he said. The fires would have had little effect on housing investment, for example, which dropped 8.2 per cent on a slump in both construction and renovations.

“With the August CFIB Business Barometer showing further concerning signs for domestic demand, the risks to the outlook seem tilted to the downside and there isn’t much chance of the Bank of Canada hiking interest rates again next week, or even beyond that,” Brown wrote.

Randall Bartlett, senior director of Canadian economics at Desjardins Group, said the GDP data, along with other recent economic indicators, should remove any doubt the bank will pause this week.

“Indeed, today’s data reinforces our view that the bank is done hiking for this cycle and its next move is likely to be a cut, possibly as early as the first quarter of 2024,” he wrote.

The data led CIBC economists, who had been expecting a hike tomorrow, even though they would consider it overkill, to change their minds.

“Data in the past week has tipped the scales enough that we expect the BoC to do the right thing, and opt to pause next week,” said chief economist Avery Shenfeld on Friday.

Shenfeld said he does not expect governor Macklem to declare that rates have peaked when he announces the bank’s decision.

“He’ll need to see more disinflationary momentum for that, and it could be some months before we’ll have enough labour market slack for the bank to be comfortable in stating that rates are high enough to do the job,” he wrote.

“But if they skip a hike in September, we expect that the balance of risk calculation will ultimately clarify that rates have in fact peaked for this cycle.”

We have been here before. In June after a four-month hiatus, the Bank of Canada surprised markets when it raised its rate again.

While BMO economists believe “the case for the bank to pause is now overwhelming,” they are not ready to “definitively” rule out more rate hikes because of a “few mild complications.”

The still strong U.S. economy could keep up inflation pressure and push the Federal Reserve to hike again, an option chair Jerome Powell left open when he spoke at Jackson Hole recently. That doesn’t mean the Bank of Canada would necessarily follow suit, said Porter, but it would weaken the Canadian dollar and import prices.

Canadian inflation also looms large, especially after July’s hotter-than-expected reading. Rising oil and food prices, plus base effects, could push the consumer price index higher for awhile.

“Suffice it to say, this week’s seven per cent pop in WTI to above $85/bbl is not helpful,” Porter said.

All the same, the likelihood that growth will continue to weaken in the second half of the year should eventually clear these temporary complications, he said.

“The prudent course of action for the bank would be to now move to the sidelines and let the much chillier growth backdrop work its way through the underlying inflation picture,” he wrote.

“That undoubtedly painfully slow process is a good reason to believe that the shift to rate cuts is still a long way down the line.”

__________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

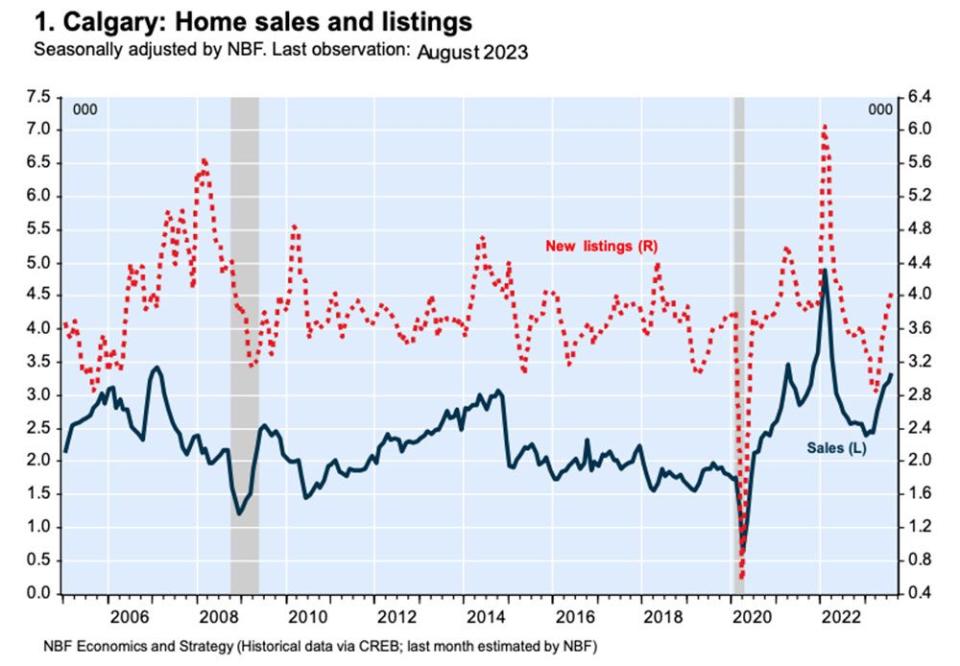

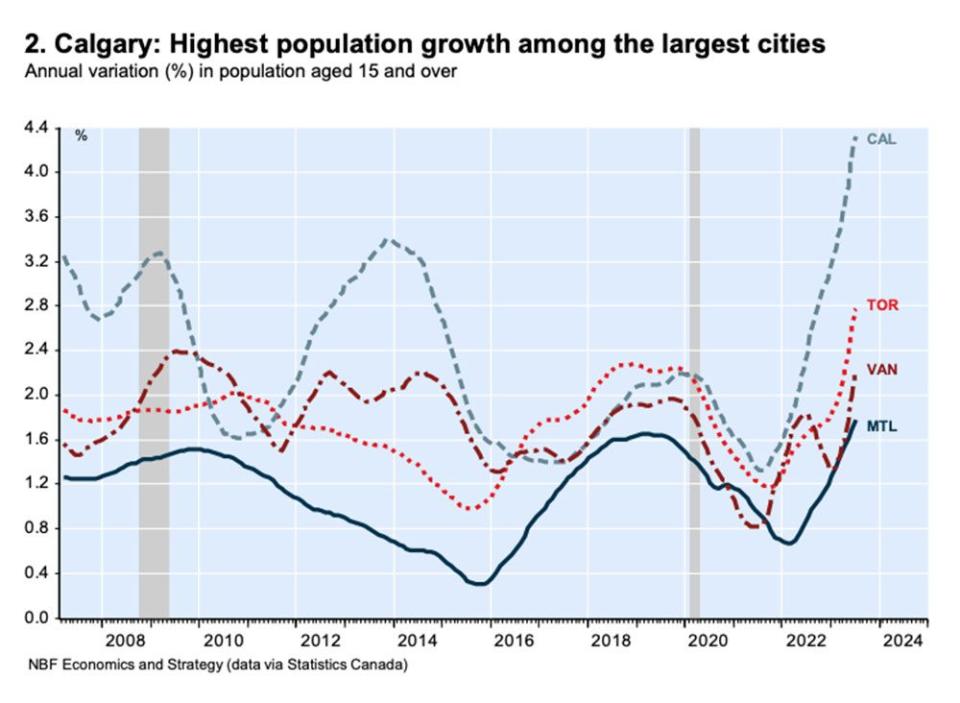

Calgary home sales continued to buck the national trend by growing for the fifth month in a row in August. Based on data from the Calgary Real Estate Board, National Bank economists estimate seasonally adjusted sales rose 4.3 per cent between July and August, exceeding pre-pandemic levels.

“The region’s economic resilience coupled with the strongest population growth among Canada’s four biggest cities and relatively favourable affordability conditions versus other major metropolitan areas remains supportive of housing demand despite the past year’s aggressive monetary tightening by the Bank of Canada,” said National economist Daren King.

This week’s main event is the Bank of Canada’s decision on interest rates Wednesday, Sept. 6, but Canadians will also get the latest on housing markets in major cities when August home sales numbers are released Tuesday for Vancouver and Wednesday for Toronto.

Friday brings the latest look at how the job market is performing when Statistics Canada posts its labour force survey for August.

Today’s data: U.S. factory sales and durable goods orders

_______________________________________________________

FP Answers: Which investment strategies work best when interest rates are high?

Shrinking economy raises odds Bank of Canada rate hikes at end

Calgary real estate hits eight-month price high amid inventory crisis

Canada’s prime rate is at 7.2 per cent, which is certainly a recent high, but not in a historical context, so there’s plenty of data to draw upon when figuring out what investments might do well in this kind of environment. Portfolio manager Amar Pandya breaks it down for us. Get the answer.

Shrinking economy raises odds Bank of Canada rate hikes at end

Bank of Canada may pause rate hikes when it sees this big data

____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Yahoo Finance

Yahoo Finance